|

|

|

|

|

|

|

|

|

|

|

| |

|

Running Total From 2010 |

|

|

|

|

|

|

|

$9061.00 |

|

Jan 19 11 |

28.55 |

BTC 8 put options Jan 29 @ .57 |

|

|

17.00 |

|

|

(473.00) |

(2.04) |

8588.00 |

|

Jan 19 11 |

28.35 |

STO 6 put options Jul 27 @ .95

COMMENTS See the rolldown below |

|

|

14.50 |

|

16214.50 |

555.50 |

5.1 |

9143.50 |

Jan

19 2011:

THE ROLL DOWN

The Oscillator has been flashing overbought

for a while now. Today with the stock at 28.55 I

bought back my 8 Jan 29 puts and rolled 6 out to

July at 27.00.What an exceptional trade this way.

This frees up another 5800.00 of capital for writing

more put options at lower strikes and reduces the

number of puts I have at this higher strike level.

Originally this was 10 contracts and through several

rolls I have reduced my exposure and my strike level

all the while still getting a credit on each

subsequent roll. It is important to stay focused and

remain with a strategy that has worked and not step

away from that strategy. In this case I spotted the

opportunity to roll a couple of days early and to

roll less contracts and move lower. It is the

consistency with having the plan always in focus and

taking advantage of opportunities as they present

themselves, that makes the strategy successful.

Rolling naked puts in this manner has worked for me

for many years.

|

|

Jan 21 11 |

28.02 |

Expiry: 3 Naked Puts Jan 26 expired |

|

|

|

|

|

|

|

|

|

Jan

21 2011:

Expiry: My Jan 26 put options expired. This

leaves me with 6 July $27 put options and 8 Feb 25

put options. I have a lot of freed up capital to put

back into puts, but looking at the technicals

Microsoft looks like there could be a little bit of

a bounce and then selling should come into this

stock. The real warning is from MACD which since Jan

10 has been negative and despite the stock hanging

in at these levels, it is widening indicating that

selling is picking up in Microsoft. I will wait a

bit before selling more put options.

|

|

Jan 28 11 |

27.55 |

STO 3 Naked Puts Mar 25 @ .38 |

|

|

10.75 |

|

7510.75 |

103.25 |

1.37 |

9246.75 |

|

Jan

28 2011:

It took a few days longer than I thought but

today there was good selling and I sold just a few

puts into March at 25.00. Why 25.00? Because I think

that is where Microsoft is heading over the next

month or so. There is good support at 25.00. I am

already holding Feb 25 naked puts so I see no reason

to load up on more. I can take my time and do a few

here and there to take advantage of big down days.

|

|

Feb 18 11 |

27.06 |

Expiry: 8 put options Feb 25 expired |

|

|

|

|

|

|

|

|

|

Feb

18 2011:

EXPIRY: Today my 8 naked puts for Feb 25

expired. This now leaves me with 3 March 25 naked

puts and 6 July 27 naked puts. I will be placing

lots more as we move lower. I still believe the $25

strike is the point we are heading toward.

|

|

Mar 1 11 |

26.25 |

STO 5 put options Apr 25 @ .58 |

|

|

13.25 |

|

12513.25 |

276.75 |

2.21 |

9523.50 |

|

Mar 1

2011: Microsoft is moving getting closer to the $25 level.

Today I sold another 5 put options for April 25. I am

just doing 5 as I think we will hit 25.00 and I want

to get the best premium I can as we come falling

down. Meanwhile though we are heading into oversold

territory and while Momentum looks like it is

picking up, MACD is actually showing buyers starting

to arrive. I believe there will be more buying as we

fall into that $25 range. If I am wrong and we keep

falling, then I am going to end up holding a lot of

25 put options. (ha ha).

|

|

Mar 16 11 |

24.70 |

STO 10 put options April 25 @ 1.23 |

|

|

19.50 |

|

25019.50 |

1210.50 |

4.84 |

10734.00 |

|

Mar

16 2011:

Microsoft has reached $25.00 and closed below it. I

sold more puts today.

|

|

Mar 18 11 |

25.10 |

Expiry: BTC 3 put options March 25 @ .22 |

|

|

10.75 |

|

|

(76.75) |

(1.02) |

10657.25 |

|

Mar 18 11 |

24.80 |

Expiry: Stock closed at 24.80

STO 5 put options April $24 @ .33

Comments: At today's close, I bought to close 3 Mar

25 naked puts and sold 5 for April at 24. |

|

|

13.25 |

|

12013.25 |

151.75 |

1.26 |

10993.25 |

|

Mar 21 11 |

25.25 |

STO 3 Naked Puts 18Jun11 $24 @ .74 |

|

|

10.75 |

|

7210.75 |

211.25 |

3.14 |

11204.50 |

|

Mar 21 11 |

25.25 |

STO 3 Naked Puts 16Jul11 $23 @ .59 |

|

|

10.75 |

|

6910.75 |

166.25 |

2.41 |

11370.75 |

|

Mar 21 11 |

25.25 |

STO 3 Naked Puts 22Oct11 $21 @ .60 |

|

|

10.75 |

|

6310.75 |

169.25 |

2.68 |

11540.00 |

|

Mar

21 2011:

BACK TO REVERSE NAKED PUTS LADDER:

With

the recent pullback of Microsoft I have spread 9

naked puts out over 3 different durations from June

to October. Each set of 3 naked puts is at a lower

strike. This is my return to reverse ladder naked

puts. Microsoft has continued to perform well and

stayed right within an acceptable trading range. I

could continue to sell put options at the money month

after month but it makes a lot of sense to now

spread out the risk at lower strikes and reap the

income. As my at the money naked put for April will

probably expire out of the money, when those put

options expire I will then take some of that capital

and sell lower strikes further out and keep the

ladder rolling month after month. Basically when the

nearest month expires, it is then rolled out 3

months or so and at lower strikes. In this manner I

will probably keep around 50,000 tied to Microsoft

in lots of 3 contracts each and basically stay far

out of the money. As the puts lose their value I

will keep closing them early whenever profitable and

sell those 3 contracts further out in time. In this

way as Microsoft meanders around, I should be able

to stay consistently out of the money.

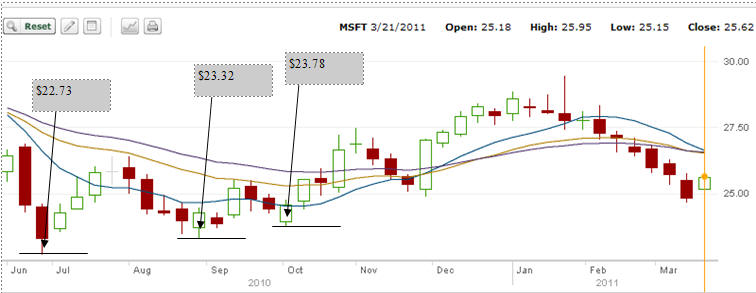

Deciding on the strikes to sell is simple. Looking

at the past year on Microsoft, the low was $22.73

and from there the stock made successively higher

lows. My goal will be to stay around those levels

and then have 3 contracts that I continue to sell as

close to the money, monthly whenever the chart tells

me trading that close to at the money has a good

chance of not being assigned. Meanwhile I will

continue to roll down the remaining 6 July $27 naked

put contracts until they are at the money and then I

will roll them forward and their capital will become

that capital I use for AT THE MONEY trades.

Effectively then the capital in play will be reduced

over the course of the year and the put contracts

will be spread out over a wide variety of strikes. I

have successfully used this strategy many times in

the past including on Microsoft. With the stock now

back into the mid $20 range, the reverse naked put

ladder strategy should work well.

Microsoft

has a lot going for it and it continues to generate

significant cash earnings through everything from

Windows7, Office 2010 to its Kinect products and

cloud computing, let alone the increasing share of

search powered by Bing. Microsoft will be around for

a long time but hopefully the stock will just keep

trudging along which is perfect for the reverse

naked ladder strategy.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April 9 2011:

MICROSOFT - THE ULTIMATE UTILITY STOCK

More

than a decade ago Microsoft was a tech stock, but

over the last 10 years, truly it is more a UTILITY

stock than a tech stock.

Read this report on the past 8 years of selling

Microsoft stock options

MICROSOFT

IS BETTER THAN GOLD:

In April

2003 gold was trading at around $325 US an ounce.

Today (April 6) it is around 1455.00 - This is a

347% return. If I had invested $10,000 in gold at

$325.00 US an ounce and cashed out today I would

have a total of $44,028.30 which includes the return

of my initial $10,000.00. Annualized this is a 20%

gain.

However through

selling Microsoft put options I have generated 33%

annualized and a total return of 925%.

Read the article.

|

|

Apr 15

11 |

25.38 |

Expiry: 15 Naked Puts April 25 expired

5 Naked Puts

April 24 expired |

|

|

|

|

|

|

|

|

|

Apr

15 2011:

Microsoft is back under pressure again. Yet looking

at the one year chart 24.00 looks like a great

strike. I already have a rever naked put ladder in

play, so I am basically just adding to my gains by

selling another 5 put options for May at $24.

Meanwhile I had 20 put options expire in April

freeing up $49500.00 for additional put options. By

selling the 5 May 24 I have used jusy 12,000 of that

capital. This gives me lots more room for upcoming

weeks should the opportunities arise.

|

|

Apr 15 11 |

25.20 |

Sold 5 put options May 24 @ .30 |

|

|

13.25 |

|

12013.25 |

136.75 |

1.13 |

11676.75 |

|

Apr 19 11 |

24.94 |

Sold 15 put

options May 24 @ .39

COMMENTS:

Just a

few days ago I wrote how Microsoft was better than

Gold for investment returns. Obviously few analysts

agree with me because today it's down again. Well I

love this stock and with so much free capital I

jumped in and sold another 15 put options. I have

been in and out of Microsoft over the past few years

but just about every month I have some put options

either being rolled or expiring. What a great stock

it has been. Thank you Microsoft for making my

returns so great. Keep doing what you are best at -

simply going nowhere! |

|

|

25.75 |

|

36,025.75 |

559.25 |

1.55 |

12,236.00 |

|

Apr 19 11 |

24.94 |

STO 10 put options 21May 25 @ .61 |

|

|

19.50 |

|

25013.25 |

590.50 |

2.36 |

12826.50 |

|

Apr

29 2011:

WOW is about all I can say. Third Quarter Earnings

came out after hours yesterday and today the stock

fell more than 4% at one point. What a great day to

be in Microsoft stock for those of us who sell

options. In the morning I bought and closed my May

$25 and $24 strike puts and in the afternoon I was

back selling them again. Double dipping (selling

options in the same month) is so very good for my

portfolio. The

market over reacted a bit on the Microsoft earnings.

The earnings were very good but the very notion that

Microsoft's core flagship product, Windows could be

seeing a slowing of sales worldwide, shook investor

confidence.

My

thoughts and opinions on the direction of Microsoft

are here.

My Microsoft stock

options have been a terrific strategy since the day

I started. Double digit returns every year and I

still see Microsoft as a very strong stock for my

put selling strategy. The

Microsoft Stock History charts I uploaded

show me that the trend for selling put options should

continue. Those investors who are buying the stock

and plan to "buy and hold" might want to reconsider

Microsoft stock. My charts do not show any real

value for buy and hold on Microsoft. I believe my

Microsoft Stock Price History

charts do NOT indicate any value holding the stock

over the long term. Ten years ago the stock was

trading basically where it is today. |

|

Apr 29 11 |

26.28 |

BTC 10 put options 21May $25 @ .09 |

|

|

19.50 |

|

|

(109.50) |

(0.43) |

12717.00 |

|

Apr 29 11 |

26.28 |

BTC 20 put options 21May $24 @ .03 |

|

|

32.00 |

|

|

(92.00) |

(0.19) |

12625.00 |

|

Apr 29 11 |

25.38 |

STO 10 put options 21May $25 @ .32 |

|

|

19.50 |

|

25019.50 |

300.50 |

1.20 |

12925.50 |

|

Apr 29 11 |

25.59 |

STO 10 put options 21May $25 @ .27 |

|

|

19.50 |

|

25019.50 |

250.50 |

1.0 |

13176.00 |

|

May 20 11 |

24.80 |

BTC 20 put options 21May $25 @ .23 |

|

|

32.00 |

|

|

(492.00) |

(0.94) |

12,684.00 |

|

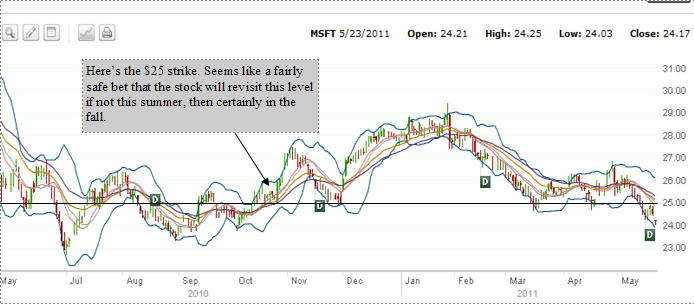

MAY 23 2011The

news that Microsoft bought SKYPE is depressing the

stock. It's the same old issue for investors - fear of the

unknown. The stock is having a lot of trouble, but

on Friday I closed my May 25 puts early in the day

and then today sold the same strike. I think $25.00

is good value in Microsoft and looking at the past

year, Microsoft has revisited this level many times.

I believe if the stock doesn't recover during the

summer it will in the fall. I don't plan on putting

any more capital into Microsoft, but instead I will

roll the puts forward if they end up in the money.

If I was very worried

about Microsoft I would not be selling puts but

would be waiting to see if the stock falls further

or can hold and gradually move back up. If I wanted

to sell puts but was not too worried I probably

would be selling at the 23 strike. I have a reverse

naked put ladder on Microsoft right now which you

can read about here.. .

|

|

May 23 11 |

24.10 |

STO 10 put options 18JUN $25 @ 1.05 |

|

|

19.50 |

|

25019.50 |

1030.50 |

4.1 |

13,714.50 |

|

JUNE 17 2011I did quite a

number of trades with Microsoft today. To explain

them fully,

you can read this article which explains the

continued reverse naked put ladder.. |

|

Jun 17 11 |

24.25 |

Buy To Close 10 put options 18JUN11 $25 @ .79 |

|

|

19.50 |

|

|

(809.50) |

(3.2) |

12,905.00 |

|

Jun 17 11 |

24.25 |

Buy To Close 6 put options16JUL11 $27 @ 2.83 |

|

|

14.50 |

|

|

(1712.50) |

(10.56) |

11,192.50 |

|

Jun 17 11 |

24.13 |

Sold 6 naked puts 21JAN12 $26 @ 3.00 |

|

|

14.50 |

|

15614.50 |

1785.50 |

11.43 |

12,978.00 |

|

Jun 17 11 |

24.13 |

Buy To Close 3 Naked Puts 17JUN11 $24 @ .02 |

|

|

10.75 |

|

|

(16.75) |

(0.10) |

12,961.25 |

|

Jun 17 11 |

24.13 |

Sell To Open 3 Naked Puts 20AUG11 $23 @ .58 |

|

|

10.75 |

|

6910.75 |

163.25 |

2.3 |

13,124.50 |

|

Jun 17 11 |

24.13 |

Sell To Open 3 Naked Puts 20AUG11 $22 @ .36 |

|

|

10.75 |

|

6610.75 |

97.25 |

1.4 |

13,221.75 |

|

Jul 5 11 |

25.99 |

Sell to Open 10 Naked Puts 20Aug11 $24 @ .25 |

|

|

19.50 |

|

24019.50 |

230.50 |

0.95 |

13,452.25 |

|

Jul 5 11 |

25.99 |

Sell To Open 5 Naked Puts 17SEP11 $24 @ .47 |

|

|

13.25 |

|

11,986.75 |

221.75 |

1.8 |

13,674.00 |

|

JUL

5 2011: Today I entered into a stock purchase as

well as put selling on Microsoft stock. On July 7 I

sold the stock for a 3.1% gain.

In this

article I explain the importance of a plan, goal and

objective PRIOR to commencing the trade, in

attaining success when it comes to trading. This

trading anatomy can be used on any stock trade. I

hope you enjoy the article. |

|

Jul 5 11 |

25.99 |

Bought 1000 shares at $25.99 |

|

|

7.00 |

|

25,997.00 |

|

|

|

|

Jul 7 11 |

26.81 |

Sold 1000 shares at $26.81 |

|

|

7.00 |

|

26,803.00 |

806.00 |

3.1 |

14,480.00 |

|

Jul 11 11 |

26.66 |

Bought to close 3 Naked Puts Aug 22 @ .05 |

|

|

10.75 |

|

|

(25.75) |

(0.38) |

14,454.25 |

|

Jul 11 11 |

26.66 |

Bought to close 3 Naked Puts July 23 @ .01 |

|

|

10.75 |

|

|

(13.75) |

|

14,440.50 |

|

JUL

12 2011:

To understand this new In The Money Covered Call

Trade, read this article. |

|

Jul 12 11 |

26.42 |

Bought 2000 shares at $26.42

COMMENTS: I

bought these shares for a new in the money covered

call trade |

|

|

7.00 |

|

(52,840.00) |

|

|

|

|

Jul 13 11 |

26.89 |

Sold 10 Covered Calls August 25 @ 2.12 |

|

|

19.50 |

|

|

2100.50 |

2.6 |

16,541.00 |

|

Jul 13 11 |

26.90 |

Sold 10 Covered Calls August 26 @ 1.34 |

|

|

19.50 |

|

|

1320.50 |

3.4 |

17,861.50 |

|

Jul 18 11 |

26.44 |

Bought to close 3 Naked Puts 20AUG11 $23 @ .08 |

|

|

10.75 |

|

|

(34.75) |

(0.50) |

17826.75 |

|

Aug 4 2011: Just like the

Intel Stock

trade Microsoft too could not withstand the

selling today. It fell 3.64% and now sits at the 200

day moving average. I did a lot of trades today to

free up capital and prepare for any further selling.

The stock could see a bounce up over the next few

days but then I think the stock could be heading to

at least $24.00 in any bear market. I

unwound my covered call trade even though I believe

the better thing would be to sell 1000 shares and

and close the $25 covered call but hold the

remaining shares and retain the $26 covered call,

but after looking at my position I think I prefer to

hold the Jan $26 puts which basically if assigned

will cost me nothing as I have earned more than the

cost of the 600 shares. That doesn't mean I am just

going to let them be assigned. I plan to keep

rolling them as we get nearer to January.

|

|

Aug 4 11 |

26.70 |

Bought to close 3 naked puts Oct 21 at .23 |

|

|

10.75 |

|

|

(79.75) |

(1.2) |

17747.00 |

|

Aug 4 11 |

26.65 |

Sold 2000 shares at $26.65 |

|

|

7.00 |

|

53293.00 |

453.00 |

|

18200.00 |

|

Aug 4 11 |

26.65 |

Bought to close 15 Naked Puts Aug 24 at .10 |

|

|

25.75 |

|

|

(175.75) |

|

18024.25 |

|

Aug 4 11 |

26.00 |

Bought to close 10 Covered Calls Aug 26 at .68 |

|

|

19.50 |

|

|

(699.50) |

|

17324.75 |

|

Aug 4 11 |

26.00 |

Bought to close10 Covered Calls Aug 25 at 1.31 |

|

|

19.50 |

|

|

(1329.50) |

|

15995.25 |

|

Sep 6 11 |

25.20 |

Sold 10 Puts 17SEP11 $23 at .22 |

|

|

19.50 |

|

23019.50 |

200.50 |

0.87 |

16195.75 |

|

Sep 6 11 |

25.22 |

Sold 10 Puts 22OCT11 $22 at .31 |

|

|

19.50 |

|

22019.50 |

290.50 |

1.3 |

16486.25 |

|

Sep 16 11 |

27.12 |

Expiry: 10 Puts 17SEP11 $23 expired |

|

|

|

|

|

|

|

|

|

Oct 21 11 |

27.16 |

Expiiry: 10 Naked Puts Oct $22 expired |

|

|

|

|

|

|

|

|

|

Nov 9 11 |

26.13 |

Sold 5 Naked Puts 17DEC11 $24 at .33 |

|

|

13.25 |

|

12013.25 |

151.75 |

1.2 |

16638.00 |

|

Nov 21 11 |

24.95 |

Sold 5 Naked Puts 17DEC11 $23 @ 20 |

|

|

13.25 |

|

11513.25 |

86.75 |

0.75 |

16724.75 |

|

Nov 25 11 |

24.30 |

Sold 5 Naked Puts 17DEC11 $23 @ .23 |

|

|

13.25 |

|

11513.25 |

101.75 |

0.88 |

16826.50 |

|

Dec 16 11 |

26.00 |

Expiry: 10 17DEC11 $23 puts expired / 5 17DEC11 $24

puts expired |

|

|

|

|

|

|

|

|

|

Dec 19 11 |

25.55 |

Sold 10 18FEB11 $23 puts @ .35 |

|

|

19.50 |

|

23019.50 |

330.50 |

1.4% |

17157.00 |