|

|

|

|

|

|

|

|

|

|

|

| Jan 6 2011 |

28.78 |

STO 25 Naked Puts Jan 28 @ .18 |

0.6 |

0.00 |

|

38.25 |

|

|

411.75 |

411.75 |

JAN 6 2011: I closed

my

position in MERCK and transferred the 70,000 to AT&T for the

next two weeks. The $28 strike has reasonable support for

this two week period. Today T paid it's dividend and the

stock pulled back hard pushing to the lower bollinger and

creating a great opportunity to sell the $28 strike for two

weeks of a little more than 1/2 a percent return. Add this

to the Merck trade and the return is better than 1% for a

couple of weeks work.

Looking at the 1 year chart AT&T has a lot of support at the

$26.00 strike and fair support at $28.00. 2010 looks like a

rather lackluster year for AT&T but it would have been a

good year for naked put sellers. A nice sideways stock could

have provided decent monthly returns.

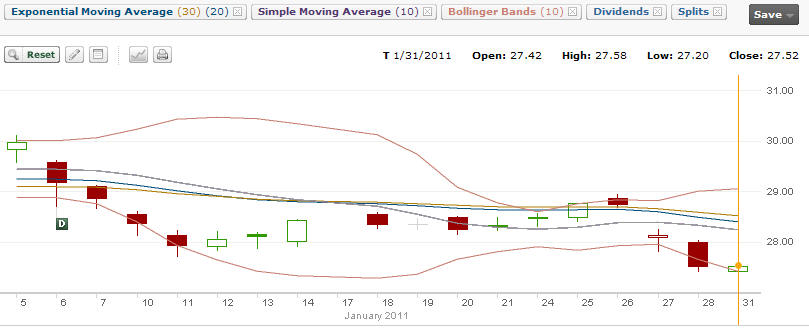

Here is the 3 month chart and the support at $28.00 is more

obvious. Today's pullback pushed the stock to the lower

bollinger band and turned MACD to the downside. While this

could mark a downside trend, my strategy is to sell the $28

strike for 2 weeks, or less if the premium vanishes from the

$28 strike, or should the stock end up below $28.00 then I

will buy to close my naked puts and roll them out to Feb.

With good support at 27.50, I think $28.00 is a good choice

for two weeks exposure to AT&T.

|

| Jan 21 11 |

28.33 |

Expiry 25 Naked Puts Jan 28 expired |

|

|

|

|

|

|

|

|

| Jan 31 11 |

27.30 |

STO 20 Naked Puts Feb 27 @ .72 |

2.6% |

|

|

32.00 |

|

|

1408.00 |

1819.75 |

|

Jan 31 2011: The stock has a nice sell

off yesterday and today it is now bouncing just below my

support point of $27.50. I have taken advantage of the move

lower and sold the Feb $27.00. I do not plan to hold this to

expiry unless necessary.

|

| Feb 11 11 |

28.44 |

BTC 20 Naked Puts Feb 27 @ .09 |

|

|

|

32.00 |

|

|

(212.00) |

1607.75 |

| Feb 24 11 |

27.70 |

STO 20 Naked Puts Mar 27 @ .38 |

|

|

|

32.00 |

|

|

728.00 |

2335.75 |

|

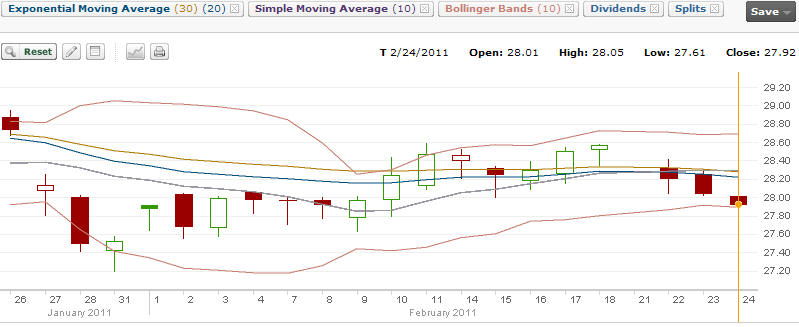

Feb 24 2011: The stock has moved back

towards my support level of $27.50 and is now touching the

lower bollinger. I could wait until tomorrow but with the

move lower today premiums moved up and I captured more than

1%. Again I do not plan to hold these puts until

expiry.

|

| Mar 7 11 |

28.00 |

BTC 20 Mar 27 Naked Puts @ .08 |

|

|

|

32.00 |

|

|

(192.00) |

2143.75 |

| |

|

Trade on hold as I believe the stock

is overvalued. I will wait for the stock to pull back to the

$28.00 range again. |

|

|

|

|

|

|

|

|

| Aug 31 11 |

28.20 |

Sold 10 Naked Puts Sep 27 @ .34 |

1.1 |

|

|

19.50 |

|

27019.50 |

320.50 |

2464.25 |

|

Aug 31 2011 & Sep 1 2011 : The news by the US Justice

Department's move to block AT&T's planned acusition of

T-Mobile USA operations has hammered the stock and provided

an excellent put selling opportunity.

In this article I discuss the decision to sell two sets

of puts and why it is never worth chasing stocks that become

over valued.

Read the article.

|

| Sep 1 11 |

28.30 |

Sold 10 Naked Puts Oct 26 @ .50 |

1.8 |

|

|

19.50 |

|

26019.50 |

480.50 |

2944.75 |

| Sep 16 11 |

28.94 |

Expiry: 10 Naked Puts Sep $27 expired |

|

|

|

|

|

|

|

|

| Sep 19 11 |

28.37 |

Sold 10 Naked Puts Oct 26 @ .30 |

1.1 |

|

|

19.50 |

|

26019.50 |

280.50 |

3225.25 |

| Oct 21 11 |

29.13 |

Options Expiry: 20 Oct $26 put options

expired |

|

|

|

|

|

|

|

|

| Nov 9 11 |

28.93 |

Sold 10 Naked Puts 17DEC11 $26 @ .18 |

0.69 |

|

|

19.50 |

|

26019.50 |

160.50 |

3385.75 |

| Dec 16 11 |

28.85 |

Expiry 10 Naked Puts 17DEC11 expired |

|

|

|

|

|

|

|

|

| Dec 16 11 |

28.85 |

Sold 10 Naked Puts 21 Jan 12 $27 @ .24 |

0.90 |

|

|

19.50 |

|

27019.50 |

220.50 |

3606.25 |