|

|

|

|

|

|

|

|

|

|

|

| |

|

Balance Carried

Forward from 2010 |

|

|

|

|

|

|

|

9262.75 |

| Jan 4 11 |

65.40 |

BTC 5 NP JAN 60.50 @ .08 |

|

|

13.25 |

|

|

(53.25) |

|

9209.50 |

| Jan 4 11 |

65.40 |

STO 5 Puts Jan 62.50 @ .28 |

|

|

13.25 |

|

31263.25 |

126.75 |

0.40 |

9336.25 |

|

Jan 4 2011: Today

I closed the 5 Puts Jan 60. as Pepsi stock has remained

steady and the put premiums have evaporated again. At this

point I am going to sell the 5 Puts for Jan at $62.50

for an extra .28 cents as the stock technically looks like

it will hold above 65 for the next three weeks. I wouldn't

recommend this trade but as I have already some Puts

at 62.50 and built up 9200.00 in capital, I would roll my

Puts should the stock pull back in the next 3 weeks. .

|

| Jan 21 11 |

65.87 |

Expiry 9 Puts Jan 62.50 expired |

|

|

|

|

|

|

|

|

|

Jan 26 2011: Since

expiry PepsiCo stock has pulled back. This is getting to be

pretty common with so many of my stocks. They run up the day

before options expiry and then sell off. The 10 day is

showing a possible downward move for Pepsi stock prices. Momentum is just

turning negative but MACD is showing a widening negative

divergence which could indicate more selling to come. I will

watch for a few more days as I really would prefer to stay

at the $62.5 strike for my Puts. If I sell now the

premium is around three quarters of a percent but if I

wait and the stock pulls back to below 64.00 the 62.50

should be worth over 1%. .

|

| Jan 31 11 |

64.25 |

STO 4 Puts Feb $62.50 @ .44 |

|

|

12.00 |

|

25012.00 |

164.00 |

0.65 |

9500.25 |

|

Jan 31 2011: The

stock has had the pullback but since this is Pepsi I am sure

it will take a couple of weeks to get much lower and much

meaning to $63.00. Pepsi is a very strong stock so the

chance of a major pullback is not high. I sold just 4 Puts today and will keep waiting but the premiums are less

than three quarters of a percent for Feb at the 62.50

strike. .

|

| Feb 7 11 |

63.35 |

STO 5 Puts Mar $62.50 @ .89

COMMENTS: Finally the stock is down and I have sold out to

March for 1.4% - when added to the 0.70% I am pretty close

to 1% a month for Feb and March. |

|

|

13.25 |

|

31263.25 |

431.75 |

1.38 |

9932.00 |

| Feb 18 11 |

63.41 |

Expiry: 4 Puts Feb $62.50

expired |

|

|

|

|

|

|

|

|

| Feb 22 11 |

62.60 |

STO 6 Puts Apr $62.50 @ 1.62

expired |

|

|

14.50 |

|

37514.50 |

958.75 |

2.5 |

10890.75 |

|

Feb 22 2011: What

a great pullback. Hard to believe the stock hit $62.50

today. I had my sell in right away and did 6 Puts for

April as I think PepsiCo stock will recover by then and I wanted

to lock in some decent premiums. Meanwhile I still am

holding March 62.50 puts which I sold for .89 cents. Once

they expire next month perhaps the stock will still be

depressed. I kind of doubt that as even the 10 day is

already turning flat. Pepsi is a great stock to own so at

this level there are lots of buyers. .

|

| Mar 18 11 |

63.24 |

5 Puts Mar 62.50 expired |

|

|

|

|

|

|

|

10890.75 |

|

Mar 18 2011: Two

sessions ago the stock fell below $62.50 for the second time

in a month. I should have bought shares or sold more puts or

done something. Today I could see that my Puts were

going to expire so I decided to step up and buy 300 shares

at $63.10. I am going to hold for a few days and I will

close in a week or so. I am still holding April 62.50 Puts. The 10 day SMA has crossed over the 20 day EMA which

would indicate the stock is going to recover. Time will

tell. .

|

| Mar 18 11 |

63.24 |

Bought 300 shares @ 63.10 |

300 |

63.12 |

7.00 |

(18937.00) |

(18937.00) |

|

|

10890.75 |

|

Apr 5 2011: With

just a couple of weeks and a big move up again today I sold

near the close. There may be more upside but this was just a

short term trade and I want to lock in my profit on the 300

shares. This frees up my capital and meanwhile I also sold

into May at $62.50 for .44 cents. .

|

| Apr 5 11 |

65.50 |

Sold 300 shares @ 65.50 |

0 |

|

7.00 |

19643.00 |

0 |

706.00 |

3.7 |

11596.75 |

| Apr 5 11 |

65.50 |

STO 5 Puts May $62.50 @ .44 |

|

|

13.25 |

|

31263.25 |

206.75 |

0.66 |

11803.50 |

| Apr 15 11 |

67.11 |

Expiry: 6 Puts Apr 62.50 expired |

|

|

|

|

|

|

|

|

| May 20 11 |

71.30 |

May Options Expiry: 5 Naked Puts May

$62.50 expired |

|

|

|

|

|

|

|

|

|

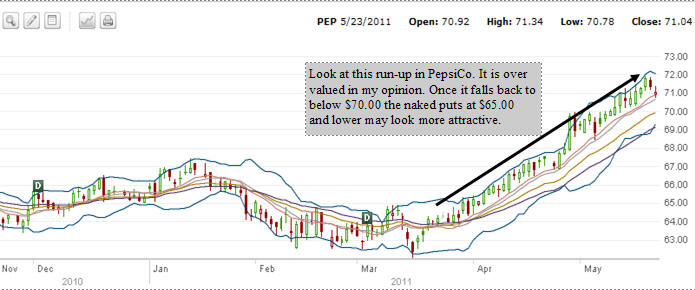

May 20 2011: With

my May options expiring, I really believe PepsiCo is way

over valued. Coke is doing better than Pepsi and yet it is

trading at just 13 X

earnings whereas Pepsi is at 19X earnings. I have no

interest in owning PepsiCo at such over valued levels. I

will not be placing any further naked put trades until it

falls back and can push up naked put premiums on the strikes

no higher than $65.00. .

|

| Jul 21 11 |

65.00 |

Bought 500 shares at $65.00 |

|

|

7.00 |

(32507.00) |

|

|

|

|

|

Jul 21 2011: After

waiting 2 months I am finally back into PepsiCo.

You can read about

today' s trade and my outlook on PepsiCo Stock here.

Below is today's movement. From the outset the stock fell

and only climbed in the last hour of trading. The is the

type of opportunity I look forward to..

|

| Jul 21 11 |

64.90 |

Sold 5 Puts 20AUG11 $65 at 1.00

(Assigned) |

|

|

13.25 |

|

32513.25 |

486.75 |

1.49 |

12290.25 |

| Jul 21 11 |

64.85 |

Sold 5 Puts 17SEP11 $62.50 at .70 |

|

|

13.25 |

|

31236.75 |

336.75 |

1.07 |

12627.00 |

| Jul 21 11 |

66.10 |

Sold 500 shares at $66.10 |

|

|

7.00 |

33043.00 |

|

536.00 |

1.64 |

13163.00 |

|

Jul 25 2011:

Pepsi Stock continues to sell off and with the overall

weakness in the market, the stock is bound to fall further.

I am holding puts now at the 65.00, 62.50 and 60.00 level

(with today's sell of Oct) and I am stretched out from

August to October. As each month progresses, I will roll and

keep rolling. Pepsi Stock is pretty strong and I am

confident in the stock. It could though easily reach $62.50

is the selling intensifies in the overall market. At that

point I would buy back both my $65 and $62.60 puts and roll

further out and if possible down a strike each or split the

puts into small groups.. |

| Jul 25 11 |

64.30 |

Sold 5 Puts 22OCT11 $60.00 at .82 |

|

|

13.25 |

|

30013.25 |

396.75 |

1.32 |

14009.75 |

| Aug 19 11 |

62.07 |

Expiry: 5 PUTS 20AUG11 $65.00 Assigned

Comments: I was away for much of the day so these shares

were assigned. I much prefer to have the shares as I would

like to pick up the dividend on August 31 and sell deep in

the money covered calls against these shares. |

500 |

|

20.00 |

$32520.00 |

32520.00 |

|

|

|

| Aug 31 11 |

64.50 |

Sold 5 Covered Calls 17SEP11 $62.50

for 2.95

return is the total capital invested less being exercised at

$62.50 for a profit of $171.75 / 32520.00 |

500 |

|

13.25 |

|

|

1461.75 |

0.52% |

15471.50 |

| Aug 31 11 |

64.50 |

Dividend 500 shares X .515 |

|

|

|

|

|

257.50 |

|

15729.00 |

| Sep 16 11 |

62.75 |

Expiry: BTC 5 17SEP11 $62.50 puts at

.35

PepsiCo ended the day at $62.05 |

|

|

13.25 |

|

|

(188.25) |

|

15540.75 |

| Sep 16 11 |

62.05 |

Expiry: 5 Covered Calls 17SEP11 $62.50

expired |

|

|

|

|

|

|

|

|

| Sep 21 11 |

61.90 |

Sold 5 Covered Calls 22OCT11 $57.50 at

$4.79

return is the total capital invested less income from the

two groups of covered calls sold (Sep which expired and now

Oct) and being exercised at $57.50 for a profit of $53.50 /

32520.00 |

500 |

|

13.25 |

|

|

2381.75 |

0.16% |

17922.50 |

| Sep 22 11 |

60.10 |

Sold 5 PUTS 22OCT11 $55.00 at .56 |

|

|

13.25 |

|

27513.25 |

266.75 |

0.96% |

18189.25 |

| Oct 21 11 |

62.28 |

Expiry: 5 Covered calls exercised at

$57.50

This is an in the money covered call and as such I have

reflected the loss of capital in the appropriate column. The

entire trade made $311.00 |

|

|

20.00 |

|

(28730.00) |

(3790.00) |

|

14399.25 |

| Dec 19 11 |

64.37 |

Sold 5 Naked Puts 18FEB12 $60 @ .61 |

|

|

13.25 |

|

30013.25 |

305.00 |

1% |

14704.25 |