|

|

|

|

|

|

|

|

|

|

|

|

Carry Forward from 2010 - $16105.50 |

|

Jan 3 11 |

70.00 |

STO 2 NP FEB $62.50 @ .65 |

1.0 |

|

|

9.50 |

|

|

120.50 |

16226.00 |

|

Jan 19 11 |

69.26 |

BTC 5 NP JAN $65 @ .04 |

(0.01) |

|

|

13.25 |

|

|

(33.25) |

16192.75 |

|

Jan 19 11 |

69.26 |

STO 5 NP FEB $65.00 @ .85 |

1.3 |

|

|

13.25 |

|

|

411.75 |

16604.50 |

|

JAN

19 2011: A steady decline culminating into lots

of selling today as the debit transaction fees are

back in the news again. The stock could test the

$66.50 range so I will stay at the $65.00 range and

start by selling just 5 naked puts at $65.00. I

closed my Jan 65 naked puts just to be safe. At 4 cents

it's not worth holding on as I want to take

advantage of today's 3% decline in the stock and

stay at that $65.00 level.

|

|

Jan 20 11 |

67.80 |

STO 5 Naked Puts Feb 65 @ 1.20 |

1.8% |

|

|

13.25 |

|

|

586.75 |

17191.25 |

|

Feb 18 11 |

$75.83 |

Expiry - 5 Feb $62.50 / 10 Feb $65.00 naked puts

expired |

|

|

|

|

|

|

|

|

|

Feb 22 11 |

73.20 |

STO 5 Naked Puts Apr 70 @ 1.82 |

2.4% |

|

|

13.25 |

|

|

896.75 |

18088.00 |

|

Feb 22 11 |

73.20 |

STO 5 Naked Puts Apr 67.50 @ 1.19 |

1.7% |

|

|

13.25 |

|

|

581.75 |

18669.75 |

|

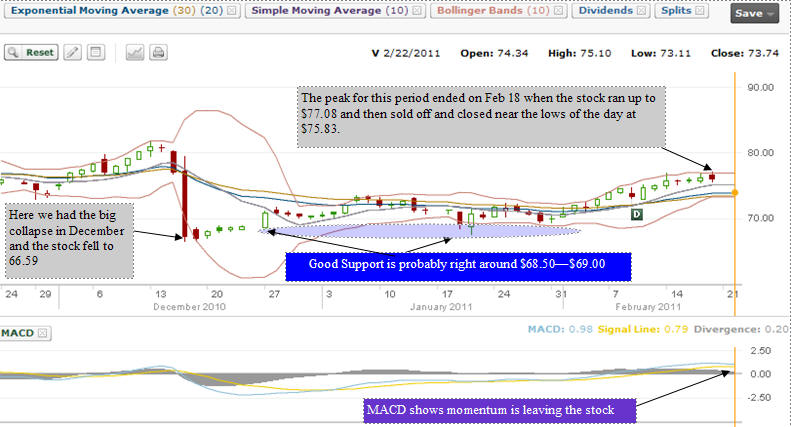

Feb

22 2011:

Back in December the stock broke it's uptrend with a

strong collapse that saw the stock plummet to a low

of $66.59. The stock then quickly climbed back up to

its support zone of around $68.50 to $69.00. There

would appear to be strong support in that range.

Looking back throughout the past 12 months, the

chart continues to show good support in that

valuation. Therefore the "sweet spot" for me as I

want to eventually own shares, is at the $70.00

level. This should put my puts in and out of the

stock at various times over the next few cycles.

This means very good premiums. Meanwhile to augment

that position I will continue to sell the $67.50

naked put as it is below support and I have a good

chance of it always expiring out of the money.

You

can see on the chart below that the latest run up

ended on Friday with Options Expiry. It is obvious

since the stock took a run to $77.08 and then sold

off to close down near the lows of the day. This

normally signals that more selling is coming into

the stock. The stock probably has a good chance to

test back to the $72.00 to even the $70.00 range. At

this level I would expect traders to load up on the

stock and then push it back up to $75.00 and then

they will probably start to sell again.

Today

I sold 5 naked puts for Apr $70 and 5 for Apr

$67.50. This leaves me with 5 contracts that I can

place should I see the stock take a larger tumble

then I would expect affording me the opportunity to

sell additional naked puts below $67.50. Meanwhile I

am still holding my March $70.00 naked puts which I

sold for $6.00. I will hold a little longer before

considering whether to buy them back early or not.

If I didn't want to own shares I would definitely be

buying them back with such a large profit already

made in the puts. At the same time if I did not want

the shares I would always be selling below the

$68.00 level on weakness like we saw today. I would

expect the weakness to continue for a few days, as

traders will want the stock to remain depressed as

they load up on it before pushing it higher.

|

|

Mar 18 11 |

71.42 |

Expiry 5 Naked Puts Mar 70 expired |

|

|

|

|

|

|

|

18669.75 |

|

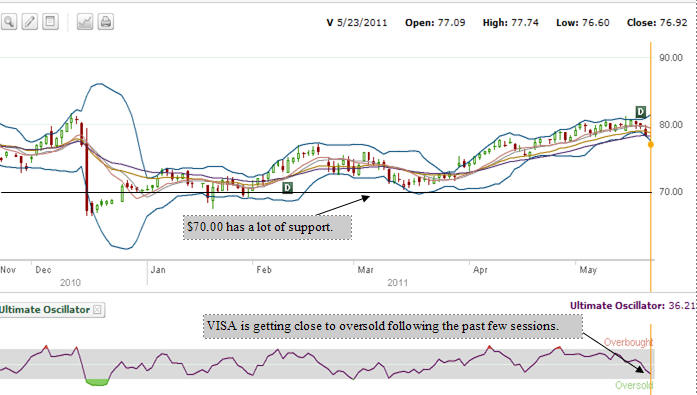

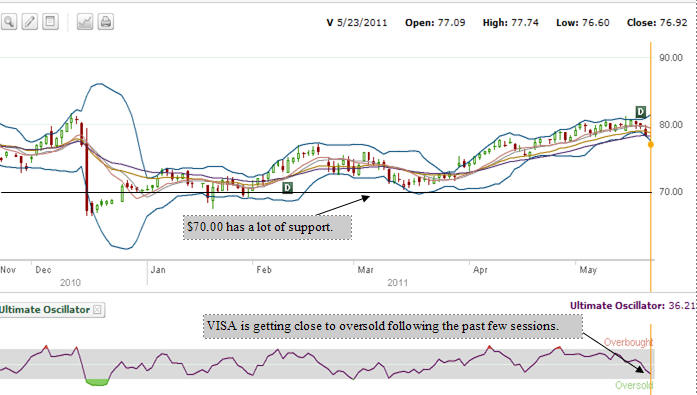

Apr 15 2011:

My April naked puts all expired. Time to look back

at the past year on Visa. $70 marks a lot of

support. If I sell the May $72.50 which is just

above support, for 1.10 this returns 1.5%. Since

that will bring in 1.5% I will wait until next week

to see if the stock falls a bit further and then sell

the 70 strike with my remaining 5 contracts..

|

|

Apr 15 11 |

76.47 |

Expiry 5 Naked Puts Apr 70 expired

5 Naked Puts Apr 67.50

expired |

|

|

|

|

|

|

|

18669.75 |

|

Apr 15 11 |

76.25 |

STO 5 Naked Puts May $72.50 @ 1.10 |

1.48% |

|

|

13.25 |

|

36263.25 |

536.75 |

19206.50 |

|

May 20 11 |

78.23 |

May Options Expiry 5 Naked Puts May $72.50 expired |

|

|

|

|

|

|

|

|

|

MAY 23 2011: I have

been waiting for a chance to sell puts again on Visa

and today with the pullback I was able to sell 8

naked puts on Visa at the $72.50 strike for better

than 1% return. The $70 zone has a lot of support in

the stock. I feel quite comfortable selling the

stock at $72.50 and I was actually quite surprised

when this opportunity presented such good premiums.

|

|

May 23 11 |

76.77 |

STO 8 Naked Puts JUN $72.50 @ .79 |

1.06% |

|

|

17.00 |

|

58017.00 |

615.00 |

19821.50 |

|

JUNE 8 2011: VISA

STOCK was perfect today for selling a short term

put. I jumped on the opportunity and sold the

18JUN11 $72.50 Put for .82. Visa has been weak for

the past few sessions, along with most of the

market. However VISA is a special case as congress

continues to try to decide what to do about debit

fees. Today's trade is decent as the stock pulled

back to almost where it was on May 23. Selling

another 5 put contracts at the $70.00 strike is an

easy choice for 7 more trading sessions before

expiry.

|

|

Jun 8 11 |

76.90 |

Sold 5 Naked Puts 18JUN11 $72.50 @ .82 |

1.1% |

|

|

13.25 |

|

36263.25 |

396.75 |

20218.25 |

|

Jun 17 11 |

74.43 |

Expiry: 13 Naked Puts Jun $72.50 expired |

|

|

|

|

|

|

|

|

|

JUNE 17 2011: Visa is

down 8% from its recent high. The technicals look

poor on VISA which leads me to think the stock could

easily fall lower. The market turmoil has created

higher put premiums, but I do not want to be

assigned at a high strike only to watch the stock

collapse, leaving me deep in the money. Here is the

strategy I use to determine what put strikes to sell

in an effort to minimize the chance of assignment

while at the same time earning enough put premium to

warrant risking my capital during a period of market

uncertainty. It is important to get the risk I am

willing to accept, balanced against the reward I

want to earn. To read how I came up with $65 as my

put strike to sell,

you can read about the strategy I use, here. |

|

Jun 17 11 |

74.40 |

Sold 5 Naked Puts Sep $65 @ 1.50 |

2.3% |

|

|

13.25 |

|

32513.25 |

736.75 |

20955.00 |

|

JUNE 24 2011: VISA

STOCK continued weak with more selling today. I have

been watching the weeklies on VISA and today I had

to jump in and sell some 1JUL11 $67.50. Even with

the weakness in the stock I feel pretty comfortable

at $67.50 for 1 week. I believe the stock while

under pressure has a lot of support at $65.00.

Therefore if assigned at $67.50 I will sell covered

calls until the stock recovers.

|

|

Jun 24 11 |

74.00 |

Sold 5 Naked Puts 1JUL11 $67.50 @ .50 |

0.70% |

|

|

13.25 |

|

33,763.25 |

236.75 |

21191.75 |

|

Jun 24 11 |

73.90 |

Sold 5 Naked Puts 1JUL11 $67.50 @ .53 |

0.74% |

|

|

13.25 |

|

33,763.25 |

251.75 |

21443.50 |

|

Jun 24 11 |

73.77 |

Sold 5 Naked Puts 1JUL11 $67.50 @ .60 |

0.84% |

|

|

13.25 |

|

33,763.25 |

286.75 |

21730.25 |

|

Jul 1 11 |

87.97 |

Expiry: 15 Naked Puts Jul $67.50 expired |

|

|

|

|

|

|

|

|

|

Jul 8 11 |

88.50 |

Bought To Close 5 Naked Puts Sep 65 @ .20 |

(0.30) |

|

|

13.25 |

|

|

(113.25) |

21617.00 |

|

JUL 25 2011: VISA

STOCK roared up after the government pretty well

backtracked on its decision to change the debit fees

companies like VISA levy. The stock ran up to a

little over $90.00 in just the last few weeks. On

Wednesday of this week VISA will announce its

earnings. Everyone is expecting terrific earnings,

including myself. I sold the weeklies for today and

I also sold out into August. |

|

Jul 25 11 |

88.35 |

Sold 10 Puts 20AUG11 $82.50 @ .92 |

1.09 |

|

|

19.50 |

|

82519.50 |

900.50 |

22517.50 |

|

Jul 25 11 |

88.30 |

Sold 5 Puts 29JUL11 $85 @ .40 |

0.43 |

|

|

13.25 |

|

42513.25 |

186.75 |

22704.25 |

|

JUL 28 2011: VISA

announced excellent earnings yesterday. The stock

did not sell off as much as I had anticipated.

Therefore in keeping with my strategy of the

cautious bull, I closed the 29JUL11 puts 1 day

early. There is no reason to risk this capital

further when for pennies I can close this trade and

release the capital for further investments. |

|

Jul 28 11 |

87.22 |

Bought to close 5 PUTS 29JUL11 $85 @ .08 |

0.13 |

|

|

13.25 |

|

|

(53.25) |

22651.00 |

|

Jul 29 11 |

84.21 |

Sold 5 20AUG11 PUTS $77.50 at .80 |

1.00 |

|

|

13.25 |

|

38763.25 |

386.75 |

23037.75 |

|

Aug 9 11 |

78.80 |

Sold 10 Puts 17SEP11 $70.00 at .75 |

1.00 |

|

|

19.50 |

|

70019.50 |

730.50 |

23768.25 |

|

Aug 19 11 |

79.60 |

Expiry: 10 Puts 20AUG11 $82.50 assigned |

|

1000 |

|

20.00 |

82520.00 |

82520.00 |

|

|

|

Aug 19 11 |

79.60 |

Expiry: 5 Puts 20AUG11 $77.50 expired |

|

|

|

|

|

|

|

|

|

Aug 19 11 |

79.60 |

Sold 5 Puts 17SEP11 $67.50 @ .72 |

1.02 |

|

|

13.25 |

|

33763.25 |

346.75 |

24,115.00 |

|

AUG 19 2011: With options expiry today, I had to

decide whether or not to accept assignment on 1000

shares of VISA. I had decided back in July that I

would take the shares. The other options expired and

I took advantage to sell some more put options at

$67.50. |

|

Aug 25 11 |

84.11 |

Sold 5 Puts 17SEP11 $67.50 @ .45 |

0.62 |

|

|

13.25 |

|

33763.25 |

211.75 |

24,326.75 |

|

AUG 29 2011: It is obvious that it was the right

choice to accept shares in VISA stock rather than

buy back my August $82.50 puts and roll down. But

how do I decide when to accept shares in a stock

versus buying back the puts and rolling down?

This article on Visa Stock explains my strategy

and how I apply it.. |

|

Aug 29 11 |

87.50 |

Sold 1000 shares at $87.50 |

6.00 |

|

|

7.00 |

-87493.00 |

0.00 |

4973.00 |

29,299.75 |

|

Sep 16 11 |

90.50 |

Expiry: 10 Puts 17SEP11 $67.50 expired |

|

|

|

|

|

|

|

|

|

Sep 22 11 |

86.55 |

Sold 10 Naked Puts 22OCT11 $70 @ .72 |

1.0 |

|

|

19.50 |

|

70019.50 |

700.50 |

30,000.25 |

|

Oct 3 11 |

84.35 |

Sold 5 Naked Puts 22OCT11 $70 @ .63 |

0.86 |

|

|

13.25 |

|

35013.25 |

301.75 |

30,302.00 |

|

Oct 21 11 |

93.43 |

Expiry: 15 Naked Puts Oct $70 expired |

|

|

|

|

|

|

|

|

|

Oct 25 11 |

90.77 |

Sold 10 Naked Puts 28Oct11 $82.50 for .28 |

0.31 |

|

|

19.50 |

|

82519.50 |

260.50 |

30,562.50 |

|

Nov 21 11 |

89.25 |

Sold 5 Naked Puts 17DEC11 $75 @ .35 |

0.43 |

|

|

13.25 |

|

37513.25 |

161.75 |

30,724.25 |

|

Nov 21 11 |

89.35 |

Sold 5 Naked Puts 17DEC11 $75 @ .30 |

0.36 |

|

|

13.25 |

|

37513.25 |

136.75 |

30,861.00 |

|

Nov 25 11 |

89.00 |

Sold 10 Naked Puts 21JAN12 $85 @ 2.25 |

2.6 |

|

|

19.50 |

|

85019.50 |

2230.50 |

33,091.50 |

|

Dec 16 11 |

97.44 |

Expiry 10 Naked Puts 17DEC $75 expired |

|

|

|

|

|

|

|

|

|

Dec 16 11 |

96.80 |

STO 5 Naked Puts 21JAN12 87.50 @ .58 |

0.63 |

|

|

19.50 |

|

43,763.25 |

276.75 |

33,368.25 |

|

Dec 28 11 |

102.00 |

STO 10 Naked Puts 21JAN12 92.50 @ .55 |

0.57 |

|

|

19.50 |

|

92519.50 |

530.50 |

33,898.75 |

|

Dec 28 11 |

102.00 |

BTC 10 Naked Puts 21JAN11 $85 @ .14 |

(0.02) |

|

|

19.50 |

|

|

(159.50) |

33739.25 |

|

Dec 30 11 |

101.65 |

Sold 7 Naked Puts 18FEB12 $87.50 @ .95 |

0.75 |

|

|

15.75 |

|

61265.75 |

461.75 |

34201.00 |