|

|

|

|

|

|

|

|

|

|

|

| Jan 21 11 |

78.50 |

STO 10 Naked Puts Feb $75 @ .55 |

0.73 |

|

|

19.50 |

|

|

530.50 |

7284.75 |

| Jan 21 11 |

78.80 |

BTC 10 Naked Puts Feb $70 @ .14 |

(0.20) |

|

|

19.50 |

|

|

(159.50) |

7125.25 |

| Jan 25 11 |

78.30 |

BTC 10 Naked Puts Feb $75 @ .15 |

(0.20) |

|

|

19.50 |

|

|

(169.50) |

6955.75 |

|

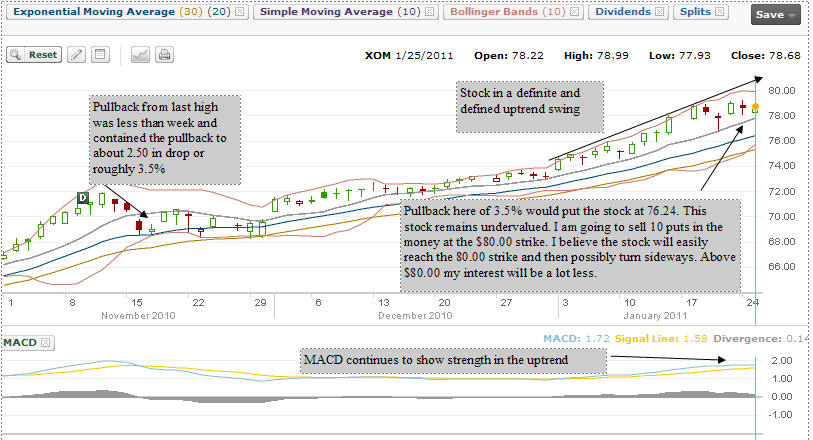

JAN 25 2011: Each roll higher has met with success. It may

seems like luck, but actually there is real strength in the

stock's uptrend. The last pullback in November saw a drop of

about 3.5%. Since then the stock has been in a strong

uptrend. I believe weeks ago I could have sold in the money

naked puts and watched the stock move above my strikes. It

is obvious to me that this stock has strong support and will

easily push above $80.00. If not by Feb expiry then

certainly into March. The strategy of selling out of the

money naked puts is no longer as worthwhile as the strikes

available for options are $5.00 apart and premiums therefore

are best At The Money rather than out of the money. I am

becoming less interested in the stock at these levels

because of that. I will take one last leap and close my Feb

75 naked puts and move to Feb 80 and sell in the money for a

much better return. From here though I may end up closing

this trade and moving to another stock. My reasons are

obvious. The stock has had a terrific move higher and at

these lofty levels, the option premiums are not worthwhile

unless I can continue to sell in the money puts. But I am

not interested in being assigned shares at this level should

the stock pullback.

|

| Jan 25 11 |

78.05 |

STO 10 Naked Puts Feb $80 @ $2.55 |

3.1% |

|

|

19.50 |

|

|

2530.50 |

9486.25 |

| Feb 2 11 |

83.70 |

BTC 10 Naked Puts Feb $80 @ .30 |

(0.375) |

|

|

19.50 |

|

|

(319.50) |

9166.75 |

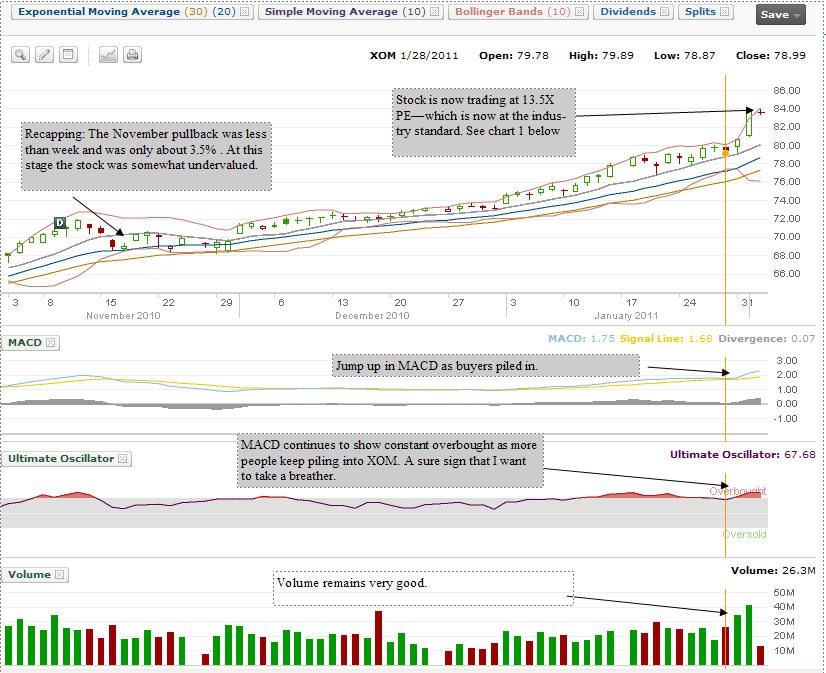

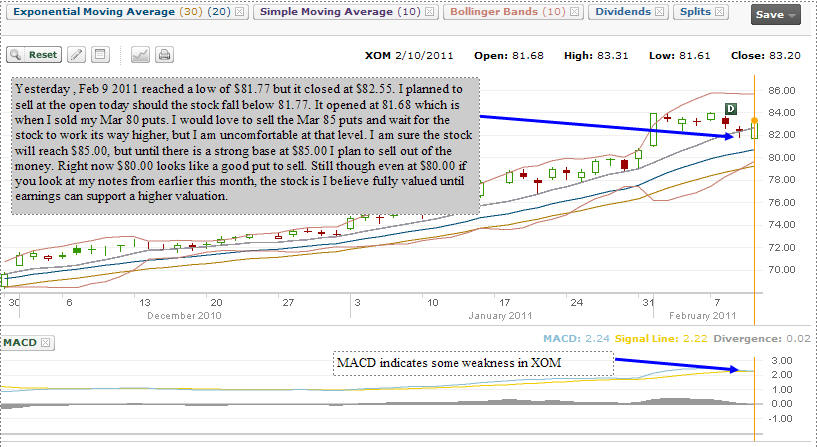

FEB 2 2011:

TAKING A BREATHER IN XOM.

There are enough warning signs for me to close my naked puts

on XOM and pull my capital out of the stock at this stage.

It has been another dramatic rise for XOM and I am sure

there is still more upside left, but with MACD flashing

OVERBOUGHT every day, and more and more people piling into

XOM, it is time for me to close my naked puts and get out. I

will wait at the sidelines to see if the stock can pullback

to the $80.00 mark before marching higher again. Below is

today's chart. We have not had much of a breather in the

rise since November's small 3.5% pullback. On Friday with

the plunge in the overall market, MACD turned down, but it

is right back up in the last two sessions as more buyers

keep getting into the stock. Volume shows all the buyers

flocking to XOM. That's another warning sign telling me that

a pullback could take the stock lower than 3.5%.

Here are the stats on XOM and part of the reason why I think

a break to the sidelines for me, is in order. When I was

first interested in XOM last year, the stats were much

better. XOM was trading BELOW all the industry standards and

the PE was trailing by a wide margin. Today XOM has

recovered to the rest of the industry. It still has lots of

room to grow, but my interest is a lot less with these type

of "normal" stats.

Do you recall the 3 year chart when I first was interested

in XOM? Here is the chart from 3 years back and now at

$83.00 the rallying is maturing. Therefore option premiums

are also declining and with option strikes at $5.00

increments, it makes selling out of the money for half a

percent return, not worthwhile. Getting half a percent a

month is fine, but not when I am sitting with a stock that

could fall from $83.00 to $75.00 overnight. So now the

strategy changes.

Here are the options for today Feb 2 2011. The STOCK is

trading at $83.65 at the time of my generating these

options. These are MARCH puts that expire in a little over a

month. The $80.00 put is now generating about 1%. Is it

worth selling for a 45 day exposure at these levels for

$80.00? No. BUT the strategy changes to one of watching for

opportunities:

1) Should the stock fall to $80.00 or lower, than I would

sell the $80.00 for larger premiums as I believe the stock

will recover to $80.00 easily.

2) Should volatility pick up, then premiums could again make

it worthwhile to sell short term puts, one month out.

3) On a pullback it is best to sell smaller quantities of

put contracts AT SPECIFIC STRIKES as the stock reaches that

strike. For example, if XOM falls to $79.50 - then I would

sell 5 contracts at $80.00. If XOM falls to $75.00 then I

would sell 5 contracts at $75.00.

4) With strike increments being at $5.00 a piece, it is

better to stay on the sidelines and wait for opportunities.

Meanwhile I can deploy some of the capital I had set aside

for XOM, on different trades and possibly just keep back

enough for 3 to 5 naked puts.

|

|

Feb 10 11 |

81.68 |

STO 10 Naked Puts Mar 80 @ 1.78 |

2.35% |

|

|

19.50 |

|

|

1760.50 |

10927.25 |

|

Feb 10

2011: Back into XOM. The weakness this morning was

perfect for my naked puts for March at the $80.00

strike.

|

|

Mar 14 11 |

82.35 |

BTC 10 Naked Puts Mar 80 @ .65 |

(0.8%) |

|

|

19.50 |

|

|

(669.50) |

10257.75 |

|

March 14

2011: The past three days have flashed a warning

that XOM is under pressure and will probably fall

further. You can see on my chart that the stock each

day is going further through the lower bollinger and

yesterday the stock broke through the 50 day EMA.

With just a few days to expiry and the stock on a

bounce up today, I bought and closed my March 80

puts. I will wait a few days to see if the stock

falls further and then sell into April.

|

|

Mar 16 11 |

78.90 |

STO 5 Naked Puts Apr $75.00 @ 1.18

COMMENTS: I sold just 5 Naked Puts and held the rest

back in case XOM should fall further allowing me to

sell naked puts below $75.00 |

1.5% |

|

|

13.25 |

|

|

576.75 |

10834.50 |

|

Apr 15 11 |

84.29 |

Expiry: 5 Naked Puts Apr 75 expired |

|

|

|

|

|

|

|

|

|

April 15

2011: Just yesterday April 14, the stock closed at

83.44 but hit an intraday low of $82.38. The stock

is sitting on the lower bollinger and the 10 day

Simple Moving Average is pushing down. I see no

point in selling the $82.50. It is still better to

stay at $80 or below.

|

|

Apr 15 11 |

83.50 |

STO 5 Naked Puts May $80 @ .88 |

1.06 |

|

|

13.25 |

|

40013.25 |

426.75 |

11261.25 |

|

May 20 11 |

81.57 |

Expiry: 5 Naked Puts May $80 expired |

|

|

|

|

|

|

|

|

|

May 20

2011:

Exxon is a

bright spot in my trades as it has pulled back 10%

from its most recent high and allowed me to stay

with the 77.50 and 80.00 strikes. If you recall from

my XOM trade comments back in Feb, I expressed

concern with the stock above 83.00, but back at

80.00 I believe the stock has good opportunity to

recover to 80.00 should the stock fall lower.

Therefore I can continue to put additional capital

into my Exxon trade which will assist those trades

that are not generating enough income. Back on Jan

31 the stock moved above $80.00 and has only briefly

pulled below it. Looking at my chart below, anywhere

below $79.50 will suffice for my trades. Therefore

on any pullback next week I will sell up to 10 put

contracts.

Examining

the 6 month chart below, I can see that support for the

stock is not really at $80 or 79.50, but lower,

around the 70.00 strike. Any move down to that level

would make a compelling case for buying the stock or

selling in the money puts.

To understand this trade

fully you may wish to

read the MAY OPTIONS REVIEW

to understand how I

am deploying all of my capital in my US Portfolio.

|

|

May 23 11 |

80.28 |

STO 5 Naked Puts 18JUN11 $77.50 @ .86 |

1.07 |

|

|

13.25 |

|

38763.25 |

416.75 |

11,678.00 |

|

May 23 11 |

80.27 |

STO 5 Naked Puts 16JUL11 $75.00 @ 1.00 |

|

|

|

13.25 |

|

37513.25 |

486.75 |

12164.75 |

|

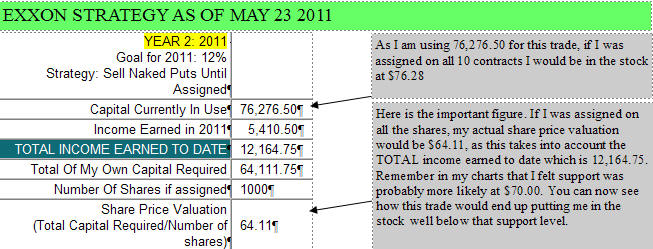

May 23

2011:

One trading session later and the market is selling

off as it worries about a climbing US dollar. I took

full advantage and sold the Jun 77.50 and the Jul 75

puts.

Now let us take a moment

to reflect on the strategy as it now applies to

EXXON. To date I have made $12164.75. If EXXON

should pull back dramatically and I do not have the

advantage of rolling further out for more income, I

could be assigned on all 10 contracts.

That would put me

in the stock at 76.28.

However taking

into account my TOTAL INCOME EARNED TO DATE, my cost

basis in the stock would be just $64.11. That is

well below where I believe support is for the stock

- namely $70.00.

|

|

Jun 17 11 |

79.02 |

Expiration: 5 Naked Puts 18 JUN11 $77.50 expired |

|

|

|

|

|

|

|

|

|

JUNE 19 11

Patience is a strategy many investors ignore. Exxon

Mobil is a terrific oil company. My naked puts for

June expired releasing $38,750. Now the question is

do I reinvest immediately through selling more puts

or hold and wait to see a clearer direction in the

stock. It is times like these that patience is the

correct strategy to use, My comments and chart are

too long to place with this trade.

They can be read in a separate article here.

. |

|

Jun 29 11 |

79.90 |

Sold 5 Naked Puts 20AUG11 $75.00 @ .92 |

|

|

|

13.25 |

|

37513.25 |

446.75 |

12611.50 |

|

Jun 30 11 |

80.85 |

Bought to close 5 Naked Puts 16JUL11 $75.00 @ .12 |

|

|

|

13.25 |

|

|

(73.25) |

12538.25 |

|

Jul 29 11 |

79.76 |

Sold 5 Naked Puts 17SEP11 $75.00 at $1.19 |

|

|

|

13.25 |

|

37513.25 |

581.75 |

13120.00 |

|

Aug 5 11 |

72.25 |

Sold 5 Naked Puts 22OCT11 $60 at $1.00 |

|

|

|

13.25 |

|

30013.25 |

486.75 |

13606.75 |

|

Aug 5 11 |

74.70 |

Bought to Close 5 Puts 20AUG11 $75 @ 2.29 |

|

|

|

13.25 |

|

|

(1158.25) |

12448.50 |

|

Aug 8 11 |

72.90 |

Bought to close 5 puts 17SEP11 $75.00 at 3.85 |

|

|

|

13.25 |

|

|

(1938.25) |

10510.25 |

|

Aug 9 2011

Exxon Mobil fell hard yesterday as the price of oil

continued to decline. I believe I am too high at

$75.00 for September. I already have 5 puts for

October $60.00. I decided to take a loss today and

close my September $75.00 puts.

Today the stock pulled

back hard in the mid-afternoon and I sold the

September $60.00 puts. I sold 7 puts despite closing

5 Sept $75 puts yesterday. It still does not cover

the loss of my buying back the September $75 puts,

but I am quite comfortable staying at the $60.00

strike.

.

|

|

Aug 9 11 |

67.70 |

Sold 7 Puts 17SEP11 $60.00 $1.51 |

|

|

|

15.75 |

|

42015.75 |

1041.25 |

11551.50 |

|

Sep 6 11 |

70.00 |

Sold 5 Puts 22OCT11 $55.00 @ .54 |

0.93 |

|

|

13.25 |

|

27513.25 |

256.75 |

11808.25 |

|

Sep 16 11 |

74.25 |

Expiry: 7 Puts 17SEP11 $60 expired |

|

|

|

|

|

|

|

|

|

Oct 21 11 |

80.13 |

Expiry: 5 Oct $60 puts expired. 5 Oct $55 puts

expired. |

|

|

|

|

|

|

|

|

|

Nov 1 11 |

75.88 |

Sold 5 Puts 17DEC11 $70 @ 1.38 |

1.9 |

|

|

13.25 |

|

35013.25 |

676.75 |

12485.00 |

|

Nov 1 11 |

75.88 |

Sold 10 Puts 19NOV11 $70 @ .71 |

1% |

|

|

19.50 |

|

70019.50 |

671.00 |

13156.00 |

|

Nov 9 11 |

77.55 |

Sold 10 PUTS 19NOV11 $70 @ .23 |

0.32% |

|

|

19.50 |

|

70019.50 |

210.50 |

13366.50 |

|

Nov 21 11 |

76.15 |

Sold 10 PUTS 17DEC11 $65 @ .31 |

0.49% |

|

|

19.50 |

|

65019.50 |

290.50 |

13657.00 |

|

Nov 25 11 |

74.25 |

Sold 5 PUTS 19DEC $70 @ .55 |

0.78% |

|

|

13.25 |

|

35013.25 |

261.75 |

13918.75 |

|

Dec 16 11 |

80.16 |

Expiry: 10 Naked Puts $65 and 10 Naked Puts $70

expired |

|

|

|

|

|

|

|

|

|

Dec 19 11 |

79.55 |

Sold 10 Puts 21JAN12 $72.50 @ .65 |

0.86% |

|

|

19.50 |

|

72519.50 |

630.50 |

14549.25 |