|

|

|

|

|

|

|

|

|

|

|

Capital

Committed |

|

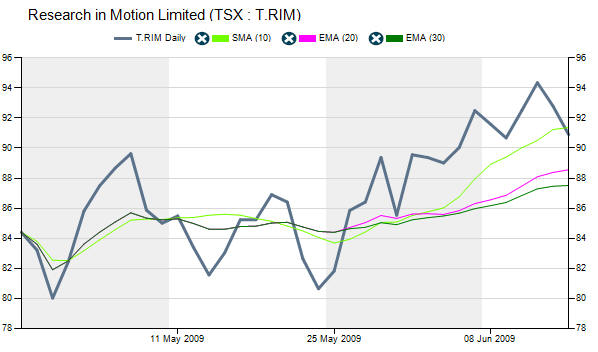

JUNE 2 2009:

The 10 day SMA has crossed the 30 day and now the 20 day

EMA. I have sold

5 naked puts Jun 80 for $1.50.

|

| Jun 2 09 |

89.37 |

STO Sold 5 Naked Puts

Jun 80 @ 1.50 |

1.87 |

0 |

|

13.25 |

0 |

0 |

736.75 |

736.75 |

40,000.00 |

|

JUNE 11 2009: The stock has hit over 94.00 during

the day. My Put is at .45 big .51 ask. I bought back my put for .51

cents. Why cover here you may ask. The gain is over

60% in just a few days. Look at the chart below.

|

|

|

|

JUNE 11 2009: Here is RIM from Jan 2 2008 until Jun

11 2009. This stock is extremely volatile. During the rush

to get into stocks it was pushed beyond normal valuation as

were most stocks. There is reasonable support for the stock

at just above 80.00, but resistance is anywhere above 90.00.

I have many friends who bought into this stock at and above

100.00. They are waiting to get out. The concept here for me

is to make a profit. A gain of more than 60% in a few days

is great for my needs.

|

| Jun 11 09 |

94.24 |

BTC Bought back 5 Naked Puts Jun 80 @ .51 |

(.64) |

0 |

|

13.25 |

0 |

0 |

(268.25) |

468.50 |

0.00 |

|

JUNE 15 2009: Even though the stock has pulled back

in the last few days, the 10 day SMA is far above the 20 and

30 day EMA. I am however going to sell 5 Jun 100 naked

Calls @ 1.91. There is just 4 days left to

expiration.

|

| Jun 15 09 |

90.90 |

STO Sold 5 Naked Calls Jun 100 @ 1.91 |

1.9 |

|

|

13.25 |

|

|

941.75 |

1410.25 |

50,000 |

| Jun 19 09 |

84.10 |

Expiration Day Jun 100 Calls Expired |

|

|

|

|

|

|

|

|

0.00 |

|

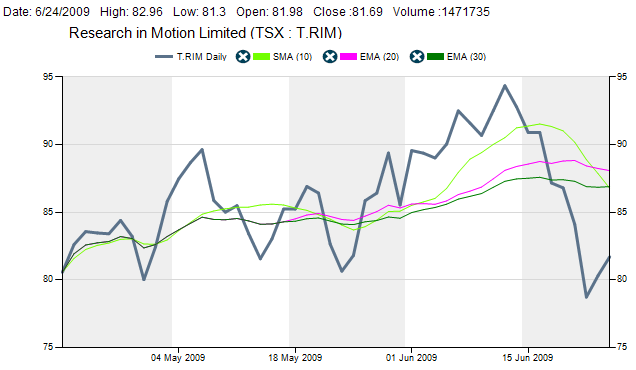

JUNE 24 2009: The 10 day has crossed the 20 day and

is touching the 30 day EMA. The stock has bounced up a

little in the last couple of days. A good day to do nothing.

|

|

|

|

JUL 6 2009: The 10 day is starting to flatten out.

The 20 day EMA has cross the 30 day EMA. Still doing

nothing, but getting ready to sell Naked Puts or possibly

buy Calls.

|

|

|

|

JUL 9 2009: The 10 day EMA has slowed its descent

while the 20 day EMA is falling toward the 80 dollar mark.

The 30 day has only moved a dollar or so. Still doing

nothing.

|

|

|

|

JUL 14 2009: Good thing I waited for confirmation.

Stock is now lower and the 30 day EMA is moving lower. The

20 day EMA is down to 80.00 and now the 10 day EMA is below

80.00. Still doing nothing. Should have bought some puts

back on Jul 6. If you look at the chart above you can see

that the 10-20-30 rule indicated this stock was moving

lower. I though prefer shorting the options rather than

buying them.

|

|

|

|

JUL 20 2009: If you are a bit of a risk taker you

could consider buying a call or selling a put, but there is

no confirmation yet but everything is turning back up. I am

waiting though.

|

|

|

|

JUL 23 2009: 10 day almost touching the 20 day and

still moving higher. Stock is trending sideways though

trying to find a direction.

|

|

|

|

JUL 28 2009: 10 day SMA has crossed 20 and 30 DAY

EMA confirming an uptrend. Could consider buying a call. But I sold 5 Naked Puts Aug 76 @

.84 instead. Note I am always staying OTM both on

the put and call side. Yes the premiums are higher

for ATM or closer OTM but this is a volatile stock.

I want to turn a profit and not have to worry about

owning or buying shares.

|

| Jul 28 09 |

83.55 |

STO Sold 5 Naked Puts Aug 76 @ .84 |

1.10 |

0 |

|

13.25 |

0 |

0 |

406.75 |

1817.00 |

38,000.00 |

|

JUL 31 2009: The 10 day SMA is flattening out. Was

it a wrong call. The stock is trending sideways. Perhaps

there will not be a breakout. My put has gone no where. I

will wait a bit longer. As I sold August, each day means a

bit more evaporation of the premium in my favor.

|

|

|

|

AUG 4 2009: The stock is moving higher. 10 day is

starting to turn higher as well.

|

|

|

|

AUG 11 2009: Uh Oh are we in for more selling? The

10 day SMA is turning down. To get out of the Naked Put - Aug 76 - will cost me .84

cents. I think I will hang on. If I get assigned

I don't mind $76.00. It's on the low side of the

stock price.

|

|

|

|

AUG 14 2009:

The 10 day SMA

has crossed the 20 day SMA and the 30 day EMA is moving

lower. The stock though has a bit of a bounce. Is it time to

get out? My Aug 76 Put is at .41.

The 30 day EMA though is not moving lower as is the

20 day EMA. Just 1 week to go. Let's see if I get

assigned.

|

|

|

|

AUG 17 2009: Stock at $78.10. 10 day SMA still

turning lower as is the stock but the 10 day has still not

crossed the 30 day EMA. The 30 day EMA is also not falling

lower. Just 2 days left.

|

|

|

AUG 19 2009:

The 10 Day SMA

has crossed the 20 and 30 day EMA. This is expiration day.

My Aug $76.00 puts expired.

I sold Naked Calls. 5 Contracts Sep 90 @ 1.27

|

| Aug 19 09 |

80.33 |

Expiration Day Aug 76 Puts Expired |

|

|

|

|

|

|

|

|

0.00 |

| Aug 19 09 |

80.45 |

STO Sold 5 Naked Calls Sep 90 @ 1.27 |

1.41 |

|

|

13.25 |

|

|

621.75 |

2438.75 |

45,000.00 |

|

AUG 21 2009: The stock has moved higher and the 10

day SMA has turned flat. What do you think? Sell some Naked

Puts and buy back my call? I think I will wait a bit longer.

|

|

|

|

AUG 26 2009: The 10 day is moving up and the 30 day

EMA has crossed the 20 day EMA. The stock though appears

flat. Still holding my Naked Calls. Remember they are Sep

$90.00

|

|

|

|

AUG 31 2009: Here we are at the end of Aug and the

10 day has just crossed the 20 day, but the stock is still

flat. My Sep 90.00 Calls are trading at .46 cents to buy

them back. I'll wait.

|

|

|

|

SEP 3 2009: The stock is up, but the 10 day SMA has

just finally touched the 30 day but not crossed it. The 20

day EMA is turning up.

|

|

|

|

SEP 4 2009: 10 day SMA refuses to cross the 30 day

EMA and the 20 day EMA is flattening out. Stock is up

slightly.

|

|

|

|

SEP 8 2009: I

finally got my confirmation. Time to sell 5 Naked Puts and buy back my

Sep 90 Call for .50.

The problem is there is no premium left in September

for OTM worth the risk. I will wait a day or so.

(Next day - Sep 9 - I sell 5 Oct 76 @ 1.99)

|

| Sep 08 09 |

85.60 |

BTC Bought back 5 Naked Calls Sep 90 @ .50 |

(.55) |

|

|

13.25 |

|

|

(263.25) |

2175.50 |

0.00 |

| Sep 09 09 |

84.35 |

STO Sold 5 Naked Puts Oct 76 @ 1.99 |

2.61 |

|

|

13.25 |

|

|

981.75 |

3157.25 |

38,000.00 |

|

SEP 11 2009: 20 day EMA crosses the 30 day EMA.

Stock continues its climb.

|

|

|

|

SEP 15 2009: Stock continues climbing as does the 10

day SMA and 20 day EMA. Now the 30 day EMA is moving higher.

|

|

|

|

SEP 23 2009: Wow - we are up to a high of 94 during

the day. So here we are again. All the indicators point up

and up and the 30 day EMA is getting up to 85.00. My Oct 76

put is trading for

.50 cents. I buy the puts to close the trade.

What a great trade this has been. The Oct Call

$105.00 is at 1.26 bid. I might wait a day or so and

sell that call. I doubt we see 100.00 on the stock.

|

| Sep 23 09 |

94.00 |

BTC Bought back 5 Naked Puts Oct 76 @ .50 |

(.65) |

|

|

13.25 |

|

|

(263.25) |

2894.00 |

0.00 |

|

SEP 24 2009:

The stock fell

$4.00 today. I really think the chance of this stock getting

to 105.00 is limited. Not to out think the 10-20-30 rule but I sold the Oct 105.00 for 1.12.

I have enough profit that if I am wrong I will buy

back the calls and sell some puts. I think I am

right after reviewing the yearly chart. Sometimes yo

have to look beyond the 10-20-30 rule and do what

your instincts tell you. Plus I have a lot of

friends who want to sell at $100.00 and get out. I

really think $100.00 is going to be tough for this

stock to reach and hold.

|

| Sep 24 09 |

90.16 |

STO Sold 5 Naked Calls Oct 105.00 @ 1.21 |

1.15 |

|

|

13.25 |

|

|

591.75 |

3485.75 |

52,500.00 |

|

SEP 25 2009: What a difference a day can make. We

are down to 75.04. Didn't even get a chance to buy a put.

Even the 10-20-30 rule could not warn me. Poor earnings

report and a couple of downgrades and here is what can

happen. This is why I prefer corporations that pay a

dividend and have slow but steady earnings. No surprises is

what I like. But then the volatility is much lower and

premiums are nothing like those we have made on RIM. Still

though this is way over dong it. I will get a chance to sell

naked puts soon I bet.

|

|

|

|

SEP 29 2009: A small bounce, but nothing really. The

10-20-30 rule is a bit out of sorts right now, as it tries

to re-establish itself.

|

|

|

|

SEP 30 2009: Now we get the 10-20-30 rule back

working. The 10 day SMA is crossing the 20 day EMA and

touches the 30 day EMA - Time to sell a Naked Call? Too

early I think after such a dramatic fall.

|

|

|

|

OCT 2 2009: The confirmation is now solid. The

problem is I have already sold my Naked Calls and there are

just no decent premiums unless I want to risk a bounce back

up in the stock. I think a move higher is in the cards.

Instead my Oct 105.00 Naked Calls are trading for .15 cents.

I will buy them back. Why would I do this. It closes the

trade, the profit is enormous and I can concentrate on

putting my capital to work for the next trade on RIM. Do I

think they will expire worthless. Absolutely! But I like to close the trade and

for .15 cents -why not.

|

| Oct 02 09 |

70.83 |

BTC Bought back 5 Naked calls Oct 105 @ .15 |

(.14) |

|

|

13.25 |

|

|

88.25 |

3397.50 |

0.00 |

|

OCT 7 2009: The 10 day SMA has fallen below 75.00

and the 20 and 30 day are down as well. The problem I see is

that we could go back to at least 80.00 in the short term as

the selloff was definitely overdone. I will wait a few days

I think before deciding whether or not to sell naked calls.

With today's move the stock closed at 71.49 which is a 1.46%

increase.

|

|

|

|

OCT 9 2009:

The 10-2030 rule

shows a stock very much under pressure. I have added a few other

technical indicators. The 50 day EMA and the 20 day

WMA. The 10 day has broken through all these levels.

However the Oscillator shows an oversold condition.

As well the Support/Resistance show 80 day support

still at 70.13 so even in the recent sell off the

stock did not break support. So what would be best

to do at this stage. As I am unsure the direction, I will sell an OTM Naked Call and

Put . As I am unconcerned long term on this

stock I would be willing to own this stock at either

of these levels. For those investors who are

concerned, I would suggest purchasing a farther OTM

Call and Put for protection. (Create bull/bear

spreads). For a put I will pick 64.00 which is 6

dollars below the 80 day support. For the call I

will choose the 85.00 strike which I think is far

enough OTM that it will not recover to that level by

Nov expiry.

|

| Oct 09 09 |

72.98 |

STO Sold 5 Naked Calls Nov 85 @ .66 |

.77 |

|

|

13.25 |

|

|

316.75 |

3714.25 |

42,500.00 |

| Oct 09 09 |

72.98 |

STO Sold 5 Naked Puts Nov 64 @ .69 |

1.07 |

|

|

13.25 |

|

|

331.75 |

4046.00 |

74,500.00 |

OCT 28 2009:

The 10-20-30

continues to show a stock in serious decline. Obviously I

should have listened to what the 10-20-30 rule was telling

me. My naked calls are doing very well but my $64.00 put is

under pressure. I have

today bought back the Naked Puts for Nov 64 and

rolled them to Dec 60.00 and I have sold an

additional 5 Naked Calls for Dec 80.00.

|

| Oct 28 09 |

65.65 |

STO Sold 5 Naked Calls Dec 80 @ .93 |

1.16 |

|

|

13.25 |

|

|

451.75 |

4497.75 |

114,500.00 |

| Oct28 09 |

65.65 |

BTC Bought back 5 Naked Puts Nov 64 @ 1.84 |

(2.8) |

|

|

13.25 |

|

|

(933.25) |

3564.50 |

82,500.00 |

| Oct 28 09 |

65.65 |

STO Sold 5 Naked Puts Dec 60 @ 2.07 |

1.72 |

|

|

13.25 |

|

|

1021.75 |

4586.25 |

112,500.00 |

NOV 2 2009: Today Citigroup issuing a sell

recommendation on RIM, the stock fell dramatically. Yet by

the close of the day the support held at 60.00. The 10-20-30

is telling me that that stock is still in decline.

The move I should make is to continue to have sold

naked calls but never have sold the naked puts. We

will see if RIM can hold onto support here. If not I

will probably roll my naked puts lower or go out

further to bring in more premium.

|

| Nov 2 09 |

59.14 |

STO Sold 5 Naked Calls Dec 68 @ 1.75 |

2.57 |

|

|

13.25 |

|

|

861.75 |

5448.00 |

146,500.00 |

NOV 12 2009:

Rim has moved up significantly but the 10 day still

shows stock is not recovering but moving sideways.

This could mean the new trend is sideways. My Dec 68

calls are on the verge of being ITM. I have added

the 5 day SMA to give us a better idea of the short

tern trend and we can see that it is definitely up

with the 5 day touching the 20 day. I am holding the

Dec 68 Calls. Should the stock hold above 69.00 I

will purchase 500 shares, so my Dec 68 calls will be

covered.

|

| Nov 20 09 |

63.66 |

Expiry: 5 Naked Calls Nov 85 expired |

|

|

|

|

|

|

|

|

104,000.00 |

NOV 24 2009:

The 10 day SMA

crossed the 20 day and is now turning back down. The trend

remains sideways to down. Resistance for 15 day is at 67.78

and support remains at 60.00, right where our Dec short put

is.

For this stock to recover in the next 4 weeks to

80.00 will require a significant change. I will

watch and BTC the Dec 80 when the premium falls

below .15 cents or so. However as the indicators

still point down, I want to gather more premium and

I have sold 5 Jan 76 strike at .85.

|

| Nov 24 09 |

62.98 |

STO 5 Naked Calls Jan 76 @ .85 |

1.14 |

|

|

13.25 |

|

|

411.75 |

5859.75 |

142,000.00 |

DEC 9 2009:

With the news

that RIM has made a deal to begin selling in Chiba, the

stock has picked up. The 5 day SMA has touched the 20 and 30

day EMA and the 10 day SMA has also turned up. My Dec 60

puts I believe will expire. I have

sold 5 Puts for Jan again at 60.00. which is

just below 80 day support. I am still holding the

Dec 68 calls, Dec 80 Calls and the Jan 76 Calls. I

have placed an order to buy 500 shares at 69.00 if

the stock reaches that level. This will turn my Dec

68 calls into covered calls. The stock has not hit

70.00 since Oct 27.

|

| Dec 9 09 |

67.03 |

STO 5 Naked Puts Jan 60 @ 1.65 |

2.75 |

|

|

13.25 |

|

|

811.75 |

6671.50 |

172,000.00 |

|

DEC 10 2009:

The 10 day has

now reached the 20 and 30 day EMA. I changed my order from

purchasing at 69 to purchasing at 68. I then bought to close

my Dec 68 calls and rolled to Jan 68 for a net credit of

about 3.80 after commissions. I

then closed my Dec 60 puts and shorted 5 Jan 62 Puts

for an additional 1.75. I will not hold these to

expiry but plan to hold them only while the stock

moves higher or sideways. This is purely an

intrinsic value play.

|

| Dec 10 09 |

68.00 |

Bought 500 Shares @ 68.00

COMMENTS: THE CAPITAL COMMITTED changed by just 7.00 as the

capital of 34000 was already committed to the DEC 68 calls

when they were sold as naked calls on Nov 2 2009 |

|

500 |

68.01 |

7.00 |

(34007.00) |

(34007.00) |

|

|

172,007.00 |

| Dec 10 09 |

68.20 |

BTC 5 Calls Dec 68 @ 2.95

COMMENTS: Again, the capital committed does not change as

these are now covered calls |

(4.33) |

500 |

68.01 |

13.25 |

|

(34007.00) |

(1488.25) |

5183.25 |

172,007.00 |

| Dec 10 09 |

69.25 |

STO 5 Covered Calls Jan 68 @ 5.05

COMMENTS: Again capital committed does not change as these

are now covered calls |

7.42 |

500 |

68.01 |

13.25 |

|

(34007.00) |

2511.75 |

7695.00 |

172,007.00 |

| Dec 10 09 |

69.25 |

BTC 5 Puts Dec 60 @ .36 |

(.60) |

500 |

68.01 |

13.25 |

|

(34007.00) |

(193.25) |

7501.75 |

142,007.00 |

| Dec 10 09 |

69.30 |

STO 5 Puts Jan 62 @ 1.75 |

2.82 |

500 |

68.01 |

13.25 |

|

(34007.00) |

861.75 |

8363.50 |

173,007.00 |

|

DEC 18 2009: With the earnings news beating

expectations the stock has come back to life. In the opening

minutes of today's trading, the stock jumped 13% allowing me

to close the Jan 60 and 62 Puts. To date we are up a little

over 21% in 6 months on RIM. Today is also expiry for

December. With the jump up in the stock price and the best

volume since September's news of poorer than expected

earnings, I will wait before making my next trade. I need

the stock to pullback a little and then look again at the

January or February puts. The Dec 80 calls will expire

worthless today.

|

| Dec 18 09 |

75.88 |

BTC 5 Puts Jan 62 @ .25 |

(.40) |

500 |

68.01 |

13.25 |

|

(34007.00) |

(138.25) |

8225.25 |

142,007.00 |

| Dec 18 09 |

75.88 |

BTC 5 Puts Jan 60 @ .17 |

(.28) |

500 |

68.01 |

13.25 |

|

(34007.00) |

(98.25) |

8127.00 |

112,007.00 |

| Dec 18 09 |

73.96 |

Expiry: 5 Naked Calls Dec 80 Expired |

|

500 |

68.01 |

|

|

(34007.00) |

|

|

72,007.00 |

| Dec 22 09 |

71.31 |

STO 5 Puts Feb 60 @ .74 |

1.23 |

500 |

68.01 |

13.25 |

|

(34007.00) |

356.75 |

8483.75 |

102,007.00 |

| Dec 22 09 |

71.31 |

STO 5 Calls Feb 80 @ 1.20 |

1.50 |

500 |

68.01 |

13.25 |

|

(34007.00) |

586.75 |

9070.50 |

142,007.00 |

END OF 2009 -

INCOME - $9070.50 for 7 months While the return would

appeaar to be just 6.3% it is actually considerably higher

as the percentage I show is a simple calculation of taking

the income and dividing it by the amount of capital that is

in use at the year end. Actually the return is higher based

on the amount of capital in use at varying times. So far the

strategy does appear to have merit. Next year should be

quite interesting.

SUMMARY OF STRATEGY: In my opinion the 10-20-30 moving

averages strategy was very successful this year, however I

am not sure it is necessary to take advantage of every

movement to sell more naked option positions. Next year I

will work towards having fewer option trades open at the

same time. |