Rule 1: The most important rule is stock

selection. Stocks have to be large blue chip companies with

strong dividends, solid balance sheets, low P/E ratios, good

cash flow, low debt levels and reasonable payout ratios.

This may seem like a tall order, but these stocks do exist.

Jason has studied my 7 rules

and believes that RIM is a stock he is sold on. Sadly though

RIM does not meet my rules as there is no dividend,

but it does have good cash flow, low debt levels, low P/E

ratio, a good balance sheet BUT a declining market

share and profit margins. All in all it would not be my

choice to own. However for the sake of my example I shall

continue.

Rule 2: Set reasonable guidelines as to

the quantity of stock and dollar amounts you want to invest

in any one stock. 15% of your total stock portfolio in one

stock is probably more than enough for most people.

Jason has committed $40,000

which is 15% of his overall stock portfolio so he feels he

has met those guidelines.

Rule 3: After

setting your guidelines as to the amount of stock you wish

to purchase, average into that quantity over time, to take

advantage of pullbacks. If not a Canadian retirement

account, average into stocks through selling naked puts.

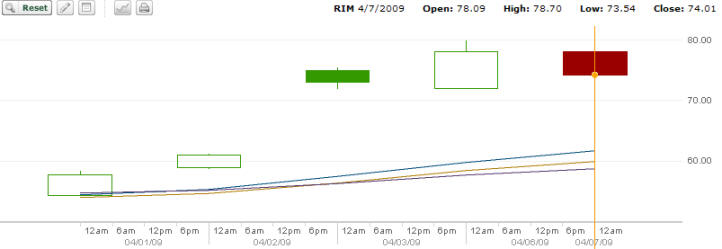

Jason broke rule number 3

right at the outset by jumping in and buying 300 shares

rather than averaging into the stock over time. He did

though believe he has bought on a pullback which occurred

just a few sessions earlier. Looking at the above chart I

would agree he bought near the low for the past 6 months.

But by jumping in and buying 300 shares right away he has

only $6400.00 left to invest. This will not buy him any

shares in RIM at this point.

Rule 4: Use the selling of puts to generate

income while waiting for a decline in stocks. Consider

laddering your naked puts if required in order to keep to

the strike point you originally selected. For example if you

wanted to be in a stock at 30.00 and the stock rises to

45.00, you may have to go out 6 to 12 months to continue selling

naked puts at the 30.00 strike. Remember that stocks move

around a lot more than analysts might have you believe. A

sudden run-up in a stock can be followed by just as dramatic

a downturn.

Jason is willing to try naked

puts although he has never done this to work his way into

stocks. He will also use covered calls.

Rule 5: If your stock declines dramatically,

research the stock to determine if the fundamentals have not

changed. If they have not, you could consider rolling down

your covered calls and going further out in time. You can

also consider placing a collar on your stock. (I will post

another article on collars soon). Try not to sell below your

cost basis however which can lock you into a loss situation.

Jason doesn't understand or like collars. He is not an options person and does not

understand covered calls. But he is willing to learn.

However upon researching his stock he determines that the

fundamentals of RIM have changed since his purchase. RIM now

has serious competitors. Market share is declining.

Competitors have newer technology available. Competitors

products seem more trendy. Security questions have also come

up which are costing RIM more money. RIM is spending

billions of research trying to catch up. All of this should

tell Jason that RIM may be a bad investment. But he is

determined to get his capital back.

Rule 6: I believe in keeping 30% of my

portfolio in cash instruments in case my stocks should

decline or a new opportunity presents itself. If you examine

my

Royal Bank trade

or my Sunlife

trade, you can see that my returns hinged completely on

being secure in the belief that I could average down and add

to my position as the stock declined. If I had not been able

to do this with confidence, then my return would have been

greatly reduced. So while Sunlife and Royal Bank saw

dramatic declines along with other financial stocks, the

fundamentals of both companies remained solid, making the

decision to average down, easy.

Jason didn't do this at all. He is almost fully invested. At

this point all he has is the $6400.00 in cash and the stock

in his account which is marginable - (can be loaned

against).

Rule 7: After averaging down, commencing

selling covered calls immediately in order to protect the

stock you just purchased from further declines and attempt

to generate income to reduce your overall cost basis on all

the shares you have purchased. If you look at my Sunlife trades

you can see that I averaged down a number of times as the

stock declined. I then immediately sold covered calls and if

my cost basis was too high for covered calls, I sell covered

calls on the most recent stock purchased.

Jason is ready to do this. So let's see how he can fare: No

commissions are taken into account. Always use a full

discount broker. Option prices shown are actual prices

available on the respective day.

Original Capital Invested -

$33,600.00

Additional Capital Available To Invest - $6,400.00

Position Summary:

Starting Capital Oct 1 2008: $6400.00

STOCK HELD:

Sep 12 08 Bought 300 shares @ 112.00

Oct 8 Stock Price - $64.00 -

Jason sells 3 covered calls for Oct $70.00 - Income is $3.90

a share due to the high volatility which is beyond 54 on the

VIX.

He also has $6400 available in

capital. Jason sells 2 naked puts (margin being used for 100

additional shares) for October $64.00 at $5.55

Oct $70 strike - Covered Call

Income - $1170.00 + naked puts income $1,110.00

Capital now available to invest - $6400.00 + $2280 =

$8680.00

Position Summary:

Starting Capital OCT 1 2008: $6400.00

STOCK HELD:

Sep 12 08 Bought 300 shares @ 112.00 (holding 3 CC Oct 70

against)

COVERED CALLS HELD:

3

covered call - Oct 70 @ 3.90

NAKED PUTS HELD:

2

naked puts - OCT 64 @ 5.55

Capital available Oct 8 2008: $8680.00

THIS IS APPLYING RULE #4 and #7 - SELL COVERED CALLS

IMMEDIATELY to protect the stock from further

declines and attempt to generate income to reduce the

overall cost basis on all the shares purchased. Sell naked

puts to generate income and wait for the stock to decline.

OCT 17 2008 - Expiration: RIM

Closes $70.25

Jason is exercised of all

shares. Total capital now available- $29680.00

Position Summary:

Starting Capital OCT 18 2008: $29680.00

STOCK HELD:

COVERED CALLS HELD:

3

covered call - Oct 70 @ exercised

NAKED PUTS HELD:

2

naked puts - OCT 64 @ expired

Capital available Oct 18 2008: $29680.00

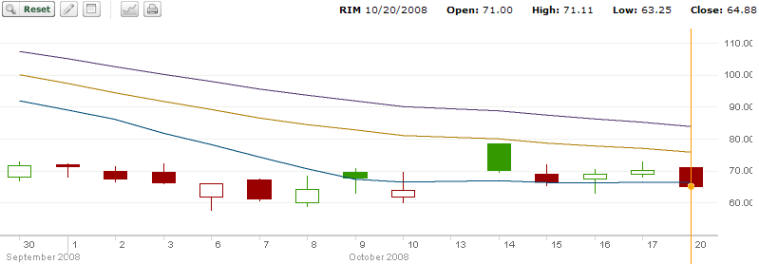

On the Monday Oct 20 the stock falls from $71.11 to $64.88

which is 8.7%. It is obvious to anyone including Jason that

we are in the midst of a market panic. There is no need to

rush in and buy all the stock here. Instead he picks up 100

shares and sells a call.

Now Jason will apply Rule 3: Average

into stocks over time to take advantage of pullbacks.

He will also use Rule 4 - Sell Naked Puts for income and

wait for the stock to decline.

OCT 20 2008: Buy 100 shares of

RIM at $64.88 - SELL 1 COVERED CALL NOV $66.00 for $5.55

Capital still to invest -

$23,747.00

OCT 21 2008: Buy 100 shares of

RIM at $61.54 - SELL 1 COVERED CALL NOV $62.00 for $5.40

Capital still to invest -

$18,133.00

On October 22 the stock closed

at $60.52 which meant selling a Nov 62 covered call. Jason

already has a $62.00 covered call so he does not do any

buying today.

OCT 23 2008: Buy 100 shares of

RIM at $58.19 - SELL 1 COVERED CALL NOV $60 for $5.25

Capital still to invest -

$12,839.00

OCT 24 2008: Buy 100 shares of

RIM at $52.00 - SELL 1 COVERED CALL NOV $54.00 for $6.90.

Capital still to invest -

$8,329.00

OCT 24 2008 With Rim at $52.00

- Jason sells 3 Naked Puts (using margin for 100+ shares)

NOV $48.00 for $4.25

CAPITAL LEFT TO INVEST -

$9604.00

Position Summary:

Starting Capital OCT 18 2008: $29680.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88 (holding 1 CC Nov 66

against)

Oct 21 08 Bought 100 shares @ 61.54 (holding 1 CC Nov 62

against)

Oct 23 08 Bought 100 shares @ 58.19 (holding 1 CC Nov 60

against)

Oct 24 08 Bought 100 shares @ 52.00 (holding 1 CC Nov 54

against)

COVERED CALLS HELD:

1

covered call - Nov 66 @ 5.55

1 covered call - Nov 62 @ 5.40

1 covered call - Nov 60 @ 5.25

1

covered call - Nov 54 @ 6.90

NAKED PUTS HELD:

3

naked puts - Nov 48 @ 4.25

Capital available Oct 25 2008: $9604.00

Margin being used - $4796.00

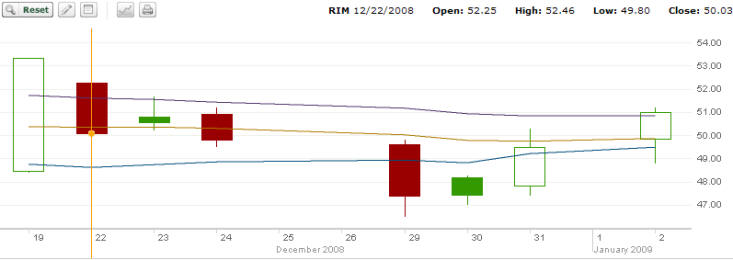

Above is the chart for those

wild October days. Options premiums were all over the place as

volatility kept climbing each day.

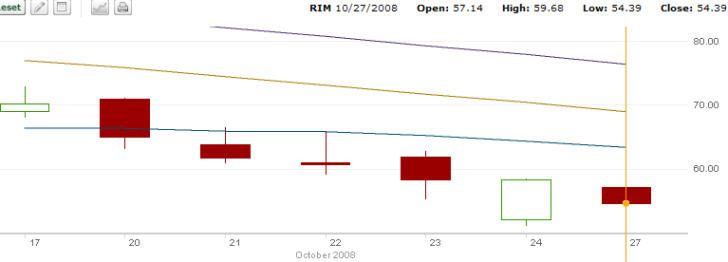

However Jason is now holding

November calls on 400 shares of stock, that range from

$52.00 to $66.00 and 3 Naked Puts at $48.00

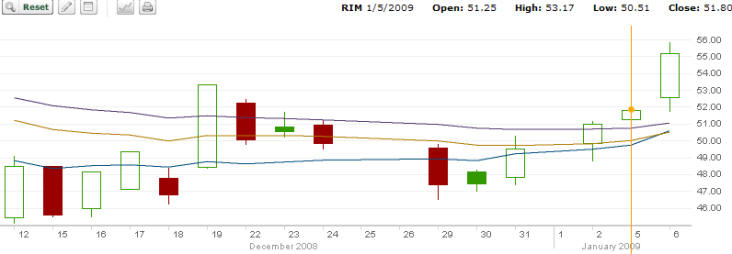

Above is the stock chart for the days leading up to Nov 21

2008. On that day the stock closed at $57.45.

NOV 21 2008: Expiration: RIM closed at $57.45

Jason is exercised of Nov 54.

Position Summary:

Starting Capital OCT 25 2008: $4796.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88

Oct 21 08 Bought 100 shares @ 61.54

Oct 23 08 Bought 100 shares @ 58.19

COVERED CALLS HELD:

1

covered call - Nov 66 @ expired

1 covered call - Nov 62 @ expired

1 covered call - Nov 60 @ expired

1

covered call - Nov 54 @ exercised

NAKED PUTS HELD:

3

naked puts - Nov 48 @ expired

Capital available Nov 22 2008: $15004.00

Margin being used - $0.00

3 Naked Puts at $48.00 expired

Total capital now available- $15,004.00

Covered calls to sell again- 1 X $66 1 X $62 1 X

$60

November 24 2008: The

following Monday RIM ranged from 59.26 to 55.27

Jason sold 1 DEC 66 call for

2.75 1 DEC 62 calls for 4.10 and 1 DEC 60 calls

for $5.70

Total capital now available -

$16,259.00

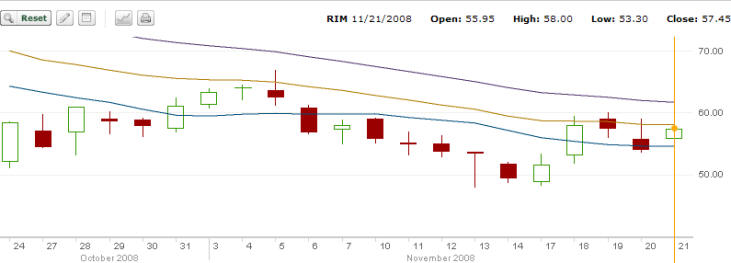

Now Jason has to decide when

to buy next. It's actually simpler than it seems. Jason

should buy on down days when the stock moves into a lower

range. For example, look at the chart below. On Nov 24th RIM

traded pretty well in the same range as expiry. Not a lot of

reason to buy 100 shares. Next day though RIM moved lower.

Jason buys 100 shares on Nov 25.

November 25 2008: RIM closes

at 50.77 - Jason buy 100 shares at 50.77 and sells a DEC 52

Covered Call for 5.10

Capital Now Available -

$11,692.00

The next 4 days RIM stays

within the same range as Nov 25. Therefore there is no

reason to buy on those days, but On Dec 2 RIM moves lower

again. Jason buys another 100 shares on Dec 2.

December 2 2008: Buys 100

shares at $45.00 - Jason sells a Dec $46.00 covered call for

$6.05

Total Capital now available -

$7797.00

December 2 2008 Jason sells 3

Naked Puts Dec $44.00 for 4.10 (again using some margin)

Position Summary:

Starting Capital NOV 22 2008: $15004.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88 (holding 1 CC Dec 66

against)

Oct 21 08 Bought 100 shares @ 61.54 (holding 1 CC Dec 62

against)

Oct 23 08 Bought 100 shares @ 58.19 (holding 1 CC Dec 60

against)

Nov 25 08 Bought 100 shares @ 50.77 (holding 1 CC Dec 52

against)

Dec 2 08 Bought 100 shares @ 45.00 (holding 1 CC Dec 46

against)

COVERED CALLS HELD:

1

covered call - Dec 66 @ 2.75

1 covered call - Dec 62 @ 4.10

1 covered call - Dec 60 @ 5.70

1

covered call - Dec 52 @ 5.10

1

covered call - Dec 46 @ 6.05

NAKED PUTS HELD:

3

naked puts - Dec 44 @ 4.10

Capital available Dec 3 2008: $9027.00

Margin being used - $4173.00

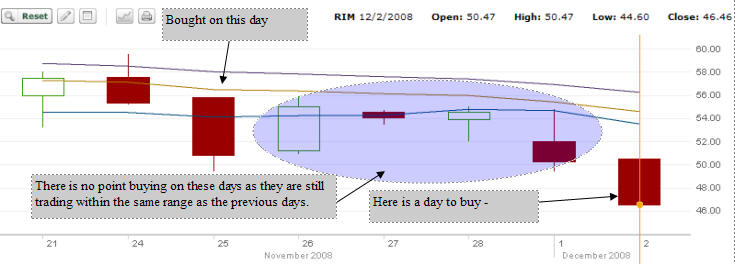

DECEMBER 19 2008 - Expiration:

RIM Closes at $53.32.

Jason is exercised of Dec $52

and $46.00

December $44.00 Naked Puts

expire

Total capital now available- $18,827.00

Covered calls to sell again- 1 X $66 1 X $62

1 X $60

Position Summary:

Starting Capital DEC 3 2008: $9027.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88

Oct 21 08 Bought 100 shares @ 61.54

Oct 23 08 Bought 100 shares @ 58.19

COVERED CALLS HELD:

1

covered call - Dec 66 @ expired

1 covered call - Dec 62 @ expired

1 covered call - Dec 60 @ expired

1

covered call - Dec 52 @ exercised

1

covered call - Dec 46 @ exercised

NAKED PUTS HELD:

3

naked puts - Dec 44 @ expired

Capital available Dec 19 2008: $18827.00

Margin being used - $0.00

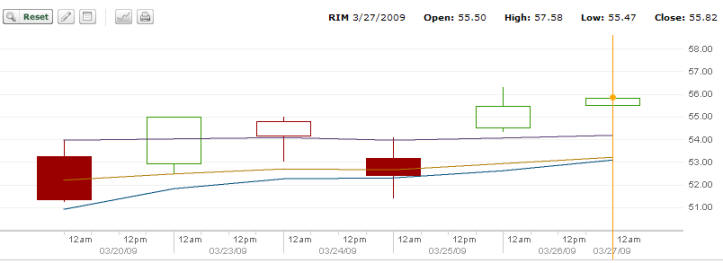

Below is RIM for the days

after Dec 19 expiration:

On Dec 22 Jason Sells 1

Covered Call for JAN $60.00 at 1.75 - Sell 1 X FEB $62.00

for 1.80 and 1 X FEB $66.00 for .50

Total capital available -

$19,232.00

On Dec 22 the stock closes at

$50.03 - Jason Buys 100 shares at $50.03 and sells Jan 52

Covered Call for $5.10

Note how the premiums are

beginning to decrease as volatility in the market is

reducing.

Capital available: $14,739.00

On Dec 23 and Dec 24 the stock

stays within the same Range and Jason does not buy any

shares.

On Dec 29 the stock falls to

$46.50 before closing to $47.36- Jason buys 100 shares at

$47.36 and sells 1 January $50.00 covered call for $4.90 Jason sells 3 Naked Puts

(again using some margin) for JAN $44.00 at $3.15

Position Summary:

Starting Capital DEC 19 2008: $18827.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88 (holding 1 CC Feb 66

against)

Oct 21 08 Bought 100 shares @ 61.54 (holding 1 CC Feb 62

against)

Oct 23 08 Bought 100 shares @ 58.19 (holding 1 CC Jan 60

against)

Dec 22 08 Bought 100 shares @ 50.03 (holding 1 CC Jan 52

against)

Dec 29 08 Bought 100 shares @ 47.36 (holding 1 CC Jan 50

against)

COVERED CALLS HELD:

1

covered call - Feb 66 @ .50

1 covered call - Feb 62 @ 1.80

1 covered call - Jan 60 @ 1.75

1

covered call - Jan 52 @ 5.10

1 covered call - Jan 50 @ 4.90

NAKED PUTS HELD:

3

naked puts - Jan 44 @ 3.15

Capital available Dec 29 2008: $11438.00

Margin being used - $1762.00

Over the next few days the

stock stays in the same range and Jason does not buy any

more shares.

By Jan 5 RIM is above 50.00

and closes at $53.17. With the stock in a new range, Jason

buys 100 shares today at $52.00 and sells 1 covered call for

Jan $54.00 for $4.10.

Position Summary:

Starting Capital DEC 29 2008: $11438.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88 (holding 1 CC Feb 66

against)

Oct 21 08 Bought 100 shares @ 61.54 (holding 1 CC Feb 62

against)

Oct 23 08 Bought 100 shares @ 58.19 (holding 1 CC Jan 60

against)

Dec 22 08 Bought 100 shares @ 50.03 (holding 1 CC Jan 52

against)

Dec 29 08 Bought 100 shares @ 47.36 (holding 1 CC Jan 50

against)

Jan 05 09 Bought 100 shares @ 52.00 (holding 1 CC Jan 54

against)

COVERED CALLS HELD:

1

covered call - Feb 66 @ .50

1 covered call - Feb 62 @ 1.80

1 covered call - Jan 60 @ 1.75

1

covered call - Jan 52 @ 5.10

1 covered call - Jan 50 @ 4.90

1 covered call - Jan 54 @ 4.10

NAKED PUTS HELD:

3

naked puts - Jan 44 @ 3.15

Capital available Jan 5 2009: $6648.00

Margin being used - $6552.00

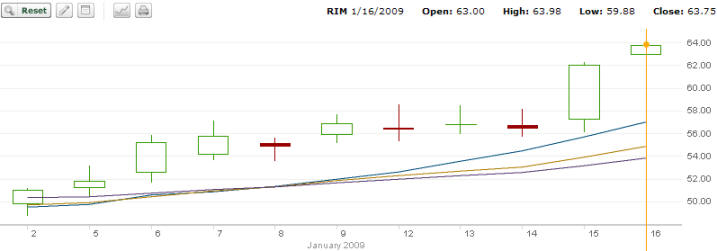

Below is RIM for the days

leading up to Jan 16 expiration:

JANUARY 16 2009 - Expiration:

RIM Closes at $63.75

Jason is exercised of JAN

$60.00, JAN $54.00, JAN $52.00 and JAN $50.00

All Jan $44 Naked Puts Expire.

Position Summary:

Starting Capital JAN 5 2009: $6648.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88 (holding 1 CC Feb 66

against)

Oct 21 08 Bought 100 shares @ 61.54 (holding 1 CC Feb 62

against)

COVERED CALLS HELD:

1

covered call - Feb 66 @ .50

1 covered call - Feb 62 @ 1.80

1 covered call - Jan 60 @ exercised

1

covered call - Jan 52 @ exercised

1 covered call - Jan 50 @ exercised

1 covered call - Jan 54 @ exercised

NAKED PUTS HELD:

3

naked puts - Jan 44 @ expired

Capital available Jan 16 2009: $28248.00

Margin being used - $0.00

Total capital now available- $28,248.00

Covered calls left - 1 X FEB $66 and 1 X FEB $62

Here is RIM following Jan 16 options expiry. On Jan 20 Jason

buys 100 shares at $63.00 and the stock soars to $66.00. He

sells 1 X FEB $64 covered call for $7.90. On Jan 26 the

stock falls to $60.50. Jason buys 100 shares on the way down at $61.00 and

sells 1 X FEB $62 covered call for $6.55. On Jan 29 the

stock moved from $66.25 to $67.10 and Jason buys 100 shares

at $66.50 and sells 1 X FEB $68.00 covered call for $3.80.

Jason see no opportunities for naked puts at these levels.

He prefers to sell naked puts at 50.00 or below.

Total capital now available-

$11,023.00

Position Summary:

Starting Capital JAN 16 2009: $28248.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88 (holding 1 CC Feb 66

against)

Oct 21 08 Bought 100 shares @ 61.54 (holding 1 CC Feb 62

against)

Jan 20 09 Bought 100 shares @ 63.00 (holding 1 CC Feb 64

against)

Jan 26 09 Bought 100 shares @ 61.00 (holding 1 CC Feb 62

against)

Jan 29 09 Bought 100 shares @ 66.50 (holding 1 CC Feb 68

against)

COVERED CALLS HELD:

1

covered call - Feb 66 @ .50

1 covered call - Feb 62 @ 1.80

1 covered call - Feb 64 @ 7.90

1

covered call - Feb 62 @ 6.55

1 covered call - Feb 68 @ 3.80

NAKED PUTS HELD:

none held

Capital available Jan 29 2009: $11023.00

Margin being used - $0.00

FEBRUARY 19 2009 - Expiration:

RIM Closes at $51.30

Jason is exercised of no

shares and can resell all his covered calls.

Position Summary:

Starting Capital JAN 16 2009: $11023.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88

Oct 21 08 Bought 100 shares @ 61.54

Jan 20 09 Bought 100 shares @ 63.00

Jan 26 09 Bought 100 shares @ 61.00

Jan 29 09 Bought 100 shares @ 66.50

COVERED CALLS HELD:

1

covered call - Feb 66 @ expired

1 covered call - Feb 62 @ expired

1 covered call - Feb 64 @ expired

1

covered call - Feb 62 @ expired

1 covered call - Feb 68 @ expired

NAKED PUTS HELD:

none held

Capital available Feb 19 2009: $11023.00

Margin being used - $0.00

Over the next few days here

are the covered call premiums earned:

FEB 20 Sells 1 Covered Call

APR $60.00 for 3.90

FEB 20 Sells 1 Covered Call APR $62.00 for $3.10

On FEB 23 Jason Buys 100 shares at

$46.83 and Sells 1 Covered Call MAR $50.00 for $4.90

On FEB 23 Jason Sells 3 Naked Puts MAR

$44.00 for $5.20 (using margin)

On FEB 26 Jason sells 1 Covered Call

APR $64 for $1.40

On FEB 26 Jason sells 1

Covered Call Apr $66 for $1.15 and 1 Covered Call May $68

for 1.10

Position Summary:

Starting Capital FEB 19 2009: $11023.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88 (holding 1 CC Apr 66

against)

Oct 21 08 Bought 100 shares @ 61.54 (holding 1 CC Apr 62

against)

Jan 20 09 Bought 100 shares @ 63.00 (holding 1 CC Apr 64

against)

Jan 26 09 Bought 100 shares @ 61.00 (holding 1 CC Apr 60

against)

Jan 29 09 Bought 100 shares @ 66.50 (holding 1 CC May 68

against)

Feb 23 09 Bought 100 shares @ 46.83 (holding 1 CC Mar 50

against)

COVERED CALLS HELD:

1

covered call - Apr 60 @ 3.90

1 covered call - Apr 62 @ 3.10

1 covered call - Apr 64 @ 1.40

1

covered call - Apr 66 @ 1.15

1 covered call - May 68 @ 1.10

1

covered call - Mar 50 @ 4.90

NAKED PUTS HELD:

3

Naked Puts Sold Mar 44 @ 5.20

Capital available Feb 26 2009: $9455.00

Margin being used - $3745.00

MARCH 20 2009 - Expiration:

RIM Closes at $51.30

Jason has just 1 covered call

in Mar and is exercised at 50.00

The 3 March $44.00 naked puts

expire

Position Summary:

Starting Capital FEB 26 2009: $9455.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88 (holding 1 CC Apr 66

against)

Oct 21 08 Bought 100 shares @ 61.54 (holding 1 CC Apr 62

against)

Jan 20 09 Bought 100 shares @ 63.00 (holding 1 CC Apr 64

against)

Jan 26 09 Bought 100 shares @ 61.00 (holding 1 CC Apr 60

against)

Jan 29 09 Bought 100 shares @ 66.50 (holding 1 CC May 68

against)

COVERED CALLS HELD:

1

covered call - Apr 60 @ 3.90

1 covered call - Apr 62 @ 3.10

1 covered call - Apr 64 @ 1.40

1

covered call - Apr 66 @ 1.15

1 covered call - May 68 @ 1.10

1

covered call - Mar 50 @ exercised

NAKED PUTS HELD:

3

Naked Puts Sold Mar 44 @ expired

Capital available Mar 20 2009: $14455.00

Margin being used - $0.00

Over the next few days Jason does the following and the

chart below shows the next few days in March 2009.

March 25 2009 Buys 100 shares at 52.39 and

sells 1 Covered Call April

$54.00 for $5.55

March 25 2009 Sells 3 Naked

Puts Apr $48 for $3.10

By April 1 the entire stock

market was climbing rapidly and on Apr 3 RIM hit a high of $75.00.

Position Summary:

Starting Capital MAR 20 2009: $14455.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88 (holding 1 CC Apr 66

against)

Oct 21 08 Bought 100 shares @ 61.54 (holding 1 CC Apr 62

against)

Jan 20 09 Bought 100 shares @ 63.00 (holding 1 CC Apr 64

against)

Jan 26 09 Bought 100 shares @ 61.00 (holding 1 CC Apr 60

against)

Jan 29 09 Bought 100 shares @ 66.50 (holding 1 CC May 68

against)

Mar 25 09 Bought 100 shares @ 52.39 (holding 1 CC Apr 54

against)

COVERED CALLS HELD:

1

covered call - Apr 60 @ 3.90

1 covered call - Apr 62 @ 3.10

1 covered call - Apr 64 @ 1.40

1

covered call - Apr 66 @ .68

1 covered call - May 68 @ 1.10

1

covered call - Apr 54 @ 5.55

NAKED PUTS HELD:

3

Naked Puts Sold Apr 48 @ 3.10

Capital available Apr 1 2009: $10701.00

Margin being used - $3699.00

APRIL 17 2009 - Expiration:

RIM Closes at $83.35

Jason is exercised of all

positions except May 68:

Position Summary:

Starting Capital APR 1 2009: $10701.00

STOCK HELD:

Oct 20 08 Bought 100 shares @ 64.88

Oct 21 08 Bought 100 shares @ 61.54

Jan 20 09 Bought 100 shares @ 63.00

Jan 26 09 Bought 100 shares @ 61.00

Jan 29 09 Bought 100 shares @ 66.50 (holding 1 CC May 68

against)

Mar 25 09 Bought 100 shares @ 52.39

COVERED CALLS HELD:

1

covered call - Apr 60 @ exercised

1 covered call - Apr 62 @ exercised

1 covered call - Apr 64 @ exercised

1

covered call - Apr 66 @ exercised

1 covered call - May 68 @ 1.10

1

covered call - Apr 54 @ exercised

NAKED PUTS HELD:

3

Naked Puts Sold Apr 48 @ expired

Capital available Apr 1 2009: $10701.00

Margin being used - $41301.00

Jason has his capital returned and in May the 68 covered

call will be exercised as the stock closed on

May 15 2009 at $85.23.

Total amount in the end would

be - 48,101.00 for a return of 20%. Yet RIM as of March 2011

has not recovered to the original purchase price of $112.00.

This trade is just an example to show various trading

strategies and how they can be applied to assist in recovery

of capital despite a declining stock. I have done my best to

review all the calculations. If you note an error please

contact me and I will adjust the calculations for any

miscalculation.