|

|

|

|

|

|

|

|

|

|

|

| |

|

CARRY FORWARD FROM 2010 |

|

|

|

|

|

|

|

4518.50 |

| Jan 7 11 |

20.35 |

Sold 10 out of the money puts Feb $19 @ .44

Comments: Today's sharp drop in Intel the

world's largest chip maker was perfect to try to gain a

little income, so I sold the Feb 19 out of the money put for .44. The lower

bollinger was broken today so we may see more selling, but

at $19.00 I know from the past that this is a good level to

be in naked puts on Intel corporation stock. |

|

|

19.50 |

|

19019.50 |

420.50 |

2.21 |

4939.00 |

|

Jan 12 2011:

On

this pullback the Intel stock didn't fall below 20.00.

You can see the drop on Jan 7. Since then the

stock has moved to the upper bollinger but the

move higher is not confirmed by MACD.

|

|

Jan 20 11 |

20.50 |

Sold 4 out of the money Puts Feb $20 @ .38

COMMENTS: I am sure my Jan sold puts will expire tomorrow but

the sharp drop today pushed volatility up and I sold

the Feb 20 naked put out of the money. |

|

|

12.00 |

|

8012.00 |

133.00 |

1.66 |

5072.00 |

|

Jan 21 11 |

20.82 |

Expiry: 4 Naked Puts Jan 19 expired

COMMENTS: As expected these puts expired. |

|

|

|

|

|

|

|

5072.00 |

|

Feb 18 11 |

22.21 |

Expiry: 10 Naked Puts Feb 19 expired; 4 Naked Puts

Feb 20 expired. |

|

|

|

|

|

|

|

5072.00 |

|

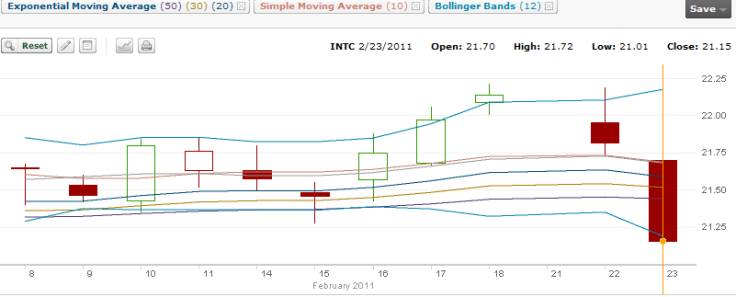

Feb 18 2011:

On

this pullback Intel stock didn't fall below 20.00.

You can see the drop on Jan 7. Since then the

stock has moved to the upper bollinger but the

move higher is not confirmed by MACD. With such

a fast move to the upper bollinger in just 4

sessions, the uptrend has to be considered

suspect. But looking at the below chart, there

are many conflicting technicals to consider. The

stock has moved up like this before, as well the

general overall trend is up and MACD is

confirming the uptrend. I will wait a few days

and then decide what strike to sell next.

At

this point I am still holding Apr 20 and 22

naked puts from previous rolls. The April 22 put

was at one time an in the money put but with the

rise in Intel stock it has ended up out of the

money.

|

|

Feb 23 11 |

21.15 |

Sold 10 out of the money puts 19Mar11 $19.00 @ .22 |

|

|

19.50 |

|

19019.50 |

200.50 |

1.05 |

5272.50 |

|

Feb 23 2011:

Just two

sessions later and we have fallen back. There could be more

downside but I will sell the $19.00 put for March which I feel

is a good price point.

|

|

Mar 18 11 |

19.93 |

Expiry: 10 Naked Puts 19Mar11 $19.00 expired |

|

|

|

|

|

|

|

|

|

Mar 18 11 |

19.90 |

Sold 10 out of the money puts 16APR11 $19 @ .25 |

|

|

19.50 |

|

19019.50 |

230.50 |

1.21 |

5503.00 |

|

Mar 18 2011:

Very nice

decline and now we have turned sideways. The trading range

for Intel continues. With the expiry of my March puts I have

sold the April 19 puts. Meanwhile I am still holding the

April $22 and $20 naked puts from late last year. Both of

these puts have not become in the money puts.

I will hold for a while and then roll

further out in time. For the April $22 in the money puts I will also do my

usual where I reduce the number of contracts being sold

after I buy back the 3 April $22 Naked Puts. Remember that this is

a roll out from originally 4 put contracts in October ($22) to 3

put contracts in April ($22) and now I will roll enough out to

reduce my contracts to 2 in the money put contracts.

|

|

Apr 1 11 |

19.60 |

Sold 5 out of the money puts 21May11 $18 @ .25 |

|

|

13.25 |

|

9013.25 |

111.75 |

1.23 |

5614.75 |

|

Apr 1 2011:

The great thing about selling puts is there

is always opportunity somewhere. Today Intel is

down again on concerns over the semi-conductor

industry, and I took advantage of the move

lower by selling the May $18 strike. I did just

5 naked puts as I am hoping it may move lower

and I can sell another 5 puts at the same

strike. The chart below shows Intel falling

today and pushing the oscillator with it.

However the oscillator is trending toward

oversold which I think may occur if it hits

19.00 which I feel is fair value for Intel stock. The

10-20-30 moving averages

strategy however is not indicating

any recovery soon although the downward spike

seen over the past few sessions has flattened

out a bit. Meanwhile I am not closing my Apr $19

puts yet. I want to keep them open as I kind of

doubt Intel can fall much through $19, if at all

over the next 2 weeks. If it gets low enough I

will be able to roll those 10 naked puts at $19

from April into May at the same put strike, for a great premium. Now

that will be exciting!

|

|

Apr 4 11 |

19.55 |

Bought to close 5 in the money Naked Puts April $20 for .58 |

|

|

13.25 |

|

|

(303.25) |

(2.9) |

5311.50 |

|

Apr 4 11 |

19.45 |

Sold 4 in the money puts May $20 for 1.10

NOTE THE REDUCTION IN NAKED PUTS FROM 5 TO 4 ON THIS

ROLL |

|

|

12.00 |

|

8012.00 |

428.00 |

5.34 |

5739.50 |

|

Apr 4 11 |

19.55 |

Bought to close 3 in the money puts Apr $22 for 2.50 |

|

|

10.75 |

|

|

(760.75) |

(11.5) |

4978.75 |

|

Apr 4 11 |

19.45 |

Sold 3 in the money puts $22 for 2.85

Comment: I had contemplated rolling further out and

reduce the number of put contracts from 3 to 2 as

per my comments above on April 1. However the roll

produced better than 1% for one more month out in

time. |

|

|

10.75 |

|

6610.75 |

844.25 |

12.77 |

5823.00 |

|

Apr

4 2011:

Is It Time To Think More Aggressively About

Intel? The technicals on

INTEL show that the selling could continue but I

believe the big drop for the time being is over.

The oscillator is flat today while the stock is

down again today after Friday's big fall.

Looking at the stock it is probably near the

bottom of its trading range but it could slip

below $19.00 making the $18.00 naked put a

compelling sell for May. The 10-20-30 is showing

no bounce yet but also that selling has slowed

for now. This lack of selling is also supported

by the oscillator, momentum and MACD.

Therefore I feel pretty comfortable selling the

$18 strike naked puts for MAY.

Those who are more aggressive could consider the

$19.00 strike for April as they are picking up

1% for just two weeks of exposure and if they

are

assigned at $19 with April options expiry, they

will be eligible for the May 3 dividend of .18

cents or almost another 1%, and then sell a

covered call for May at the $19 or $20 strike.

I already have a lot of naked puts on Intel

including two sets that are in the money and

which I rolled today. I plan to hold and see if

Intel slips below that $19 strike. That

will be my entry point to sell more $18 naked

puts. Investors remain wary of Intel Stock and

analysts believe that the demand for processors

could be slower than expected. In particular

some analysts believe that Intel's Sandy Bridge

products are not stimulating demand and will

prove less profitable than Intel is forecasting.

But its operating cash flow is incredible with

10.9B in 2008, 11.2B in 2009 and a whopping

16.7B in 2010. That is an increase of 53% over

2008! If Intel should drift

below $19.00 it will be a compelling purchase

and I will be aggressively selling naked puts

and will probably consider in the money put

options.

POSITION UPDATE

With today's roll

from April to May I am now holding 4 in the

money May $20

naked puts, 3 May $22 in the money puts, 5 May $18

out of the money puts, 10 April $19 at the money puts

|

|

April 14 11 |

19.45 |

Sold 5 out of the money Puts 21Apr11 $19.00 @ .21 (expired) |

|

|

13.25 |

|

9513.25 |

91.75 |

0.96 |

5914.75 |

|

Apr 14 2011:

Here is Intel Corp Stock for today. The

news in the morning of the slower PC Sales

definitely hurt the tech stocks and Intel

followed all of them lower. However by 9:45 AM

the big selling was over and the rest of the day

the stock slowly rose and closed near the highs.

I sold 5 Naked puts for 21APR11 expiry at $19

strike as momentum stayed positive about half of

the day and the stock showed good strength in

the face of selling. Meanwhile though MACD at

the close did indicate that more selling could

come tomorrow. This is a 1 week trade for 1%.

Should the stock fall below 19 by then I will

roll further out and lower. Intel is one of

those stocks that I am pleased to stay with. It

is an enormous company, a world leader and it is

very well managed. With a book value of $8.97

and $2.93 cash flow, I tend to view weakness in

the stock as opportunity, but if you look at the

2010 trades you can see that this stock can fall

below 19.00 easily should more bad news arrive.

However I will be staying with Intel for a long

time yet.

|

|

Apr 15 11 |

19.75 |

Expiry: 10 Naked Puts April 19 expired |

|

|

|

|

|

|

|

|

|

Apr 15 11 |

19.60 |

Sold 5 at the money Puts May 19 @ .38

Comments: I only did 5 naked puts to start. Intel

may have a bit more downside and I want to have more

capital available to sell puts again in the next

week or two. |

|

|

13.25 |

|

9513.25 |

176.75 |

1.85 |

6091.50 |

|

Apr 18 11 |

19.50 |

Sold

15 at the money puts May $19 @ .31

COMMENTS:

I just

keep watching Intel and today it hit 19.50 and I

just had to sell more May 21 $19 puts. At 1.5% and

with all the cash I have available, it just makes

sense. If the earnings are poor I can see the stock

falling to perhaps 18.50 which is 5%. At 18.50 I

would buy back the 19 puts and roll them out into

June or July. Honestly to me, Intel is so under

appreciated, but then that's what I look for - a

great company that is so under priced that I can

sell puts and just keep earning more income. I have

a large amount of capital available from Friday's

options expiry so selling 15 more naked puts here is

an easy choice. In two days my other Apr 21 naked

puts expire. I am convinced this is a good trade.

|

|

|

25.75 |

|

28,525.75 |

439.25 |

1.53 |

6530.75 |

|

Apr 21 11 |

21.32 |

Expiry: 5 Naked Puts 21Apr11 $19 expired |

|

|

|

|

|

|

|

|

|

Apr 21 11 |

21.32 |

Bought to close 5 Naked Puts 21May11 $18 @ .02 |

|

|

13.25 |

|

|

(23.25) |

(0.25) |

6507.50 |

|

Apr 21 11 |

21.32 |

Bought to close 20 Naked Puts 21May11 $19 @ .04 |

|

|

32.00 |

|

|

(112.00) |

(0.29) |

6395.50 |

|

Apr 21 11 |

21.32 |

Sold puts 10 contracts 21MAY11 $21 @ .38 |

|

|

19.50 |

|

21019.50 |

360.50 |

1.7 |

6756.00 |

|

May 2 11 |

23.10 |

Bought to close 10 put contracts 21MAY11 $21 @ .11 |

|

|

19.50 |

|

|

(129.50) |

(0.61) |

6626.50 |

|

May 20 11 |

23.22 |

May Options Expiry: 4 Naked Puts May 20 expired; 3

Naked Puts May 22 expired |

|

|

|

|

|

|

|

|

|

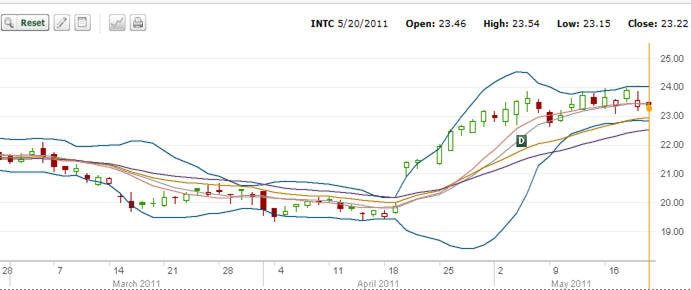

May 20 2011:

Intel has had an exceptional month since

mid-April. I had been selling naked puts at the

19.00 and 20.00 strike but with this rise all my

previous naked puts that were in the money puts

ended up out of the money and are

now expired. Intel has a terrific future and

with the news from Goldman that they have

advised investors to sell their shares in Intel,

the resulting weakness allowed me to sell 5 naked puts and I will wait for

further pullbacks to add to my position.

The May options

expiry also shows the value of staying with a

trade even when the naked puts I have sold get

caught in the money. But staying ahead of expiry

and continuing to roll further out, reduce the

number of contracts with each subsequent roll

and roll either at the same strike further out

or further out and down, eventually the stock

often will run up and past my naked put

positions, putting those positions that were

once in the money puts now out of the money puts. This was

the case this month when my May $21 and $22

put strikes ended up out of the money.

|

|

May 20 11 |

23.18 |

Sold puts 5 contracts 16JUL11 $21 @ .23 |

|

|

13.25 |

|

10513.25 |

101.75 |

0.96 |

6728.25 |

|

May 31 2011:

Intel Stock has moved down from its recent

high of $23.96. The announced by Goldman Sachs

on May 19, advising to sell Intel commenced the

downturn in the stock. The move down is obvious

in the 6 month chart below. Interesting the

influence brokerages have on stock. Do you think

Goldman is buying at these levels? Do you think

perhaps they held puts on Intel?

The move down has

allowed me to sell more puts at the $21 strike

at the $20 strike. I have a lot of capital which

I can still place and with June options expiry

just two weeks away, I am going to have a lot

more capital to invest.

$21.00 is an

excellent price to sell for premium. If Intel

stock slips below $21.00 then I can consider the

$20 strike or sell in the money put options at

the $21.00 strike. I have marked the second sell

point of $20.00 on the 6 month chart below.

Intel throughout much of the past year flirted

back and forth over the $20.00 strike making for

a compelling case of selling that put.

Meanwhile on Friday,

the stock continued to sell and came close to

falling below $22.00. At this morning's open I

sold more puts spreading myself out between the

$20 and $21 strikes into August. The oscillator

by today's close is turning back up and MACD

with a divergence of just -0.05 could be

signaling a move back up in Intel Stock. .

|

|

May 31 11 |

22.38 |

Sold 5 out of the money puts 20AUG11 $21 @ .56 |

|

|

13.25 |

|

10513.25 |

266.75 |

2.5% |

6995.00 |

|

May 31 11 |

22.38 |

Sold 5 out of the money puts 20AUG11 $20 @ .32 |

|

|

13.25 |

|

10013.25 |

146.75 |

1.4% |

7141.75 |

|

Jul 15 11 |

22.37 |

Expiry: 5 Puts 16JUL11 expired |

|

|

|

|

|

|

|

|

|

AUG 4 2011:

Today's stock market collapse finally

caught up to the tech stocks and Intel fell

right along with the market. I figured after

yesterday it would happen today and I bought

back my puts early in the day, so there was

still a profit in both the August 20 and August

21 puts I had sold.

Today Intel fell

4.40% and easily sliced through the 200 day

moving average. I believe a rally may be in

order and I will sell naked calls on Intel.

After that I think the stock could be headed to

$18.00

|

|

Aug 4 11 |

21.65 |

Bought to close 5 puts 20AUG11 $21 at .37 |

|

|

13.25 |

|

|

(198.25) |

(1.8) |

6943.50 |

|

Aug 4 11 |

21.65 |

Bought to close 5 puts 20AUG11 $20 at .18 |

|

|

13.25 |

|

|

(103.25) |

(1.0) |

6840.25 |

|

Sep 6 11 |

19.55 |

Sold 5 Puts 22OCT11 $16 @ .20 |

|

|

13.25 |

|

8013.25 |

86.75 |

1.08 |

6927.00 |

|

Oct 21 11 |

24.03 |

Expiry: 5 Oct $16 puts expired |

|

|

|

|

|

|

|

|

|

Nov 9 11 |

23.80 |

Sold 10 naked Puts 17DEC11 $21 @ .20 |

|

|

19.50 |

|

21019.50 |

180.50 |

0.95 |

7107.50 |

|

Nov 25 11 |

22.70 |

Bought 1000 shares @ $22.70 |

|

|

7.00 |

|

22707.00 |

|

|

|

|

Nov 29 11 |

23.75 |

Sold 1000 shares @ $23.75 |

|

|

7.00 |

|

|

1036.00 |

4.5 |

8143.50 |

|

Dec 16 11 |

23.23 |

Expiry: 10 Naked Puts Dec $21 expired |

|

|

|

|

|

|

|

|

|

Dec 16 11 |

23.25 |

Sold 10 Naked Puts 21JAN12 $21 @ .24 |

|

|

19.50 |

|

21019.50 |

220.50 |

1.0 |

8364.00 |