|

|

|

|

|

|

|

|

|

|

|

| Jan 4 2011 |

35.88 |

STO 20 Naked Puts Jan 35 @ .28 |

0.8 |

0.00 |

|

32.00 |

|

|

528.00 |

528.00 |

|

JAN 4 2010: I am starting

a new position today in MERCK. I really like this stock. I

plan to commit 70,000 into Merck. I like Merck as it is a

strong company that has been ignored for most of the past

year. My charts below show that it has not recovered to

the 2008 highs. The stock is stuck in a trading range. I

plan to sell naked puts in large quantities throughout the

year at various times whenever the stock reaches the lower

bollinger. I am not planning on going very far out. My first

naked put foray, is for Jan expiration which is less than 3

weeks away. I am not planning to constantly have naked puts

in Merck but will work with the bollinger on this stock for

short term trades. Let's look at the past for MRK. The first

chart is 3 years showing no real recovery. The second is the

past year showing the sideways movement in the stock for

most of the year. The third shows my trade today at the

lower bollinger.

|

| Jan 6 2011 |

37.10 |

BTC Naked Puts Jan 35 @ .07

COMMENTS: 2 Days later and it is worth closing and moving

this amount over to AT&T which has a nice pullback today. |

(0.20) |

|

|

32.00 |

|

|

(172.00) |

356.00 |

| Jan 19 2011 |

33.74 |

STO 21 Naked Puts Feb $32 @ .34 |

1.0% |

|

|

33.25 |

|

|

680.75 |

1036.75 |

|

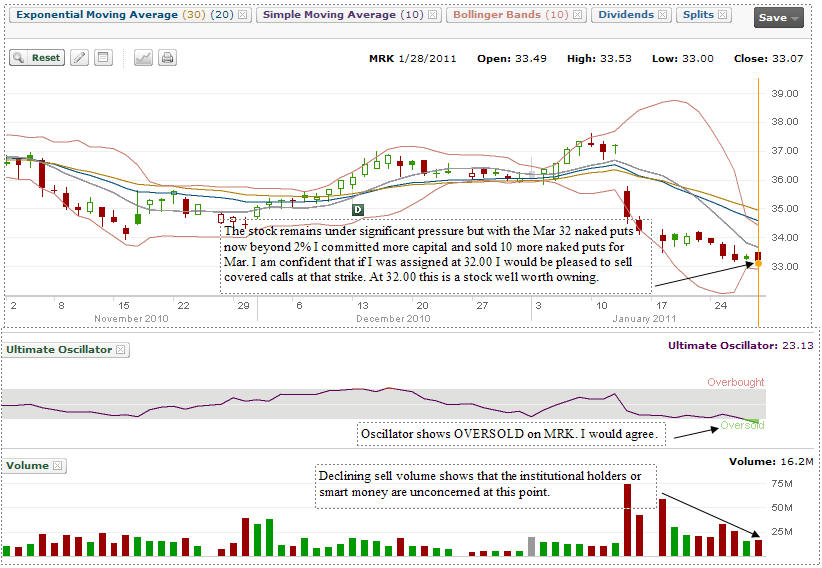

JAN 19 2011: The chart below shows

the status.

A nice move lower and I am back selling naked

puts. The volume is now up to 21 contracts as I have

earmarked 70,000 for this trade which works out to 21

contracts at the $32 strike. Merck opened higher than

yesterday and could be entering a sideways movement as it

bounces along the lower Bollinger. I will close this trade

early on an upswing that removes the premium from my $32

put. I do not intend to stay the entire month in Merck. I am

hoping AT&T will pullback again allowing me to move from

Merck back to AT&T. I like both stocks but I want to use the

$70,000 to trade each on weakness. Right now AT&T is back

up, so I moved into Merck. I feel pretty comfortable at

$32.00 and so for 1% gain I sold Feb $32 strike.

|

| Jan 28 11 |

33.00 |

STO 10 Naked Puts Mar $32 @ .74 |

2.3% |

|

|

19.50 |

|

|

720.50 |

1757.25 |

|

JAN 28 2011: MRK

remains under strong pressure,

but the oscillator shows over

sold condition and the Volume shows a lack of sellers at

this level. This means the so called smart money or

institutional holders are not bailing out. Yet the March 32

naked puts are up over 2%. I had to take advantage and I

jumped in and sold another 10 naked put contracts. This is

why it is so nice to always have some cash available for my

trades. I can back up this trade without margin, through my

own cash. I believe the Feb 32 naked puts will expire as

well.

|

| Feb 18 11 |

32.85 |

Expiry: 21 Naked Puts Feb 32 expired |

|

|

|

|

|

|

|

|

|

March 16 2011:

Merck dropped big today,

but at this level below $32.00 I feel it

is very undervalued. I sold another 12 naked puts at the

April 32 strike. Expiry is in two days for March naked puts.

I will be buying to closed my 10 March 32 naked puts and

rolling them into April as

well.

|

| Mar 16 11 |

31.20 |

STO 12 Naked Puts Apr 32 @ 1.48 expird |

4.6% |

|

|

22.00 |

|

|

1754.00 |

3511.25 |

|

March 18 2011: A

very nice recovery over the past two days.

Today I bought back my puts and

sold out to April 32. There is good support at $32 for Merck

but if the next set of earnings do not improve, there is a

good possibility that Merck could fall to the $30.00 level.

This trade I am splitting up between AT&T and Merck,

flipping back and forth with the same capital.

Right now though, Merck is the place to be for my naked put

trades.

|

| Mar 18 11 |

31.88 |

BTC 10 Naked Puts Mar 32 @ .20 |

(0.625%) |

|

|

19.50 |

|

|

(219.50) |

3291.75 |

| Mar 18 11 |

31.88 |

STO 10 Naked Puts Apr 32 @ .74 expired |

2.3% |

|

|

19.50 |

|

|

720.50 |

4012.25 |

|

Apr 15 2011: A

very nice recovery over the past month.

I have done incredibly well on

Merck. At this level though, Merck is too high to consider

selling naked puts against. It's the 32 level that was the

great spot to sell at. I need the stock to fall back to the

lower Bollinger before considering naked puts. Time to look

elsewhere for a trade and wait for Merck to come back down.

|

| Apr 15 11 |

34.51 |

Expiry: 22 Naked Puts expired |

|

|

|

|

|

|

|

4012.25 |

| |

| Sep 6 11 |

32.28 |

Sold 5 Puts Oct $29 @ .50 |

1.6% |

|

|

13.25 |

|

14513.25 |

236.75 |

4249.00 |

| Oct 21 11 |

33.35 |

Expiry: 5 Naked Puts Oct $29 expired |

|

|

|

|

|

|

|

|

| Nov 9 11 |

33.65 |

Sold 10 Naked Puts 17DEC11 $30 @ .35 |

1.1% |

|

|

19.50 |

|

30019.50 |

330.50 |

4579.50 |

| Dec 16 11 |

36.25 |

Expiry: 10 Naked Puts 17DEC11 $30

expired |

|

|

|

|

|

|

|

|