Visa stock has been steadily declining over the past few trading sessions. Investors are worried about what the government may do regarding debit transaction fees.

Debit transaction fees are a major part of VISA’s earnings and any hint that these fees could be adjusted downward in a big way will impact VISA’s earnings. Mastercard is not the same as VISA and debit transaction fees have little to no impact on Mastercard. This fear is pushing VISA stock lower and increasing the stock’s volatility. This means more opportunity for me in selling puts for better premiums.

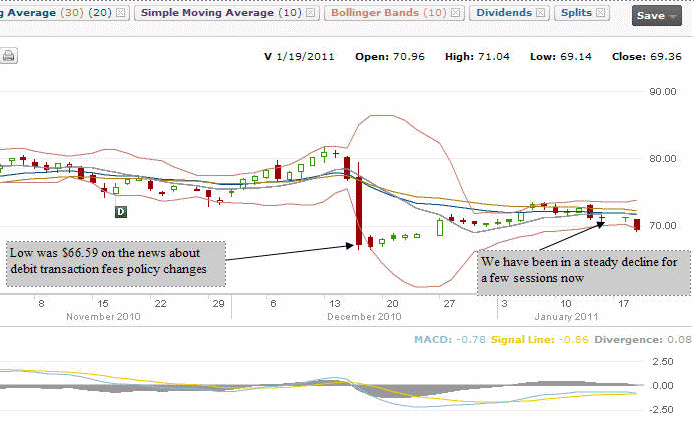

VISA STOCK COULD RETEST $66.50

I believe the steady decline in VISA stock means that it could retest the $66.50 range. In the chart below I have marked the heady selling back in December when the news came out about the debit transactions being “looked into”. Following that drop VISA Stock has climbed, albiet slowly, but in the past few sessions Visa stock is falling and today it had a nice move below $70.00 and closed near the low at $69.36.

As I believe looking at the chart that VISA stock could retest the $66.50 range, I will stay at the $65 put strike.

VISA Stock Trade Nets 1.3% For 1 Month

Therefore I closed my January $65 puts for .04 cents and sold VISA Stock Feb $65 puts.

It is rarely worth holding my January puts when I can close them for .04 cents. Meanwhile with today’s 3% drop in VISA stock, volatility is high and this pushes up put premiums.

I sold the Feb $65.00 puts for .85 cents guaranteeing a 1.3% return for the month. If I was assigned at $65.00 I would take the stock and sell covered calls as I believe that VISA stock at $65 is very undervalued.