YUM Stock was sold this morning on the quick jump to $71.00. I looked at the charts last night and put in my offer to sell at $71. There is probably more to the upside with YUM Stock and I am not saying goodbye to it, but looking at the chart for YUM Stock it seems to me that it has had an incredible run up in value and needs a rest. Select this YUM Stock link to view their investor relations.

If the stock should turn sideways and the overbought condition disappear I will enter YUM Stock again within my retirement portfolio. If the stock pulls back I will definitely buy it again once the charts show that YUM Stock has bottomed.

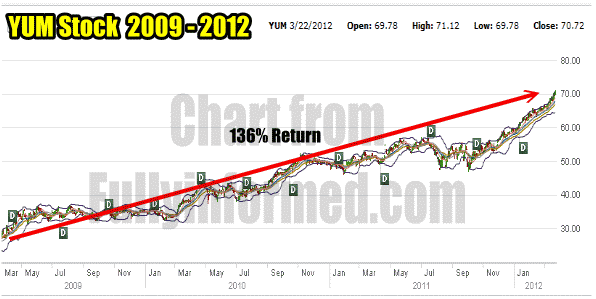

YUM STOCK 2009 to 2012 CHART

The chart below show the run up in Yum Stock over the past 3 years. With a total return to date of 136% I do believe the stock has more room to the upside, but perhaps a pullback might be in order.

Yum Stock from 2009 to 2012 has had a 136% run up in valuation.

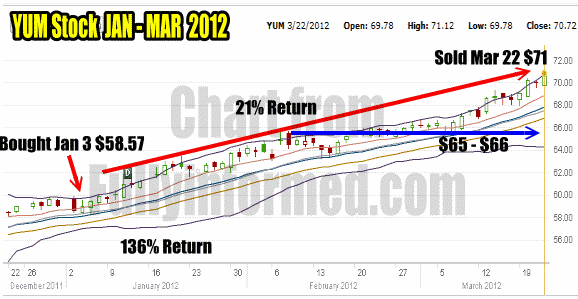

YUM Stock Jan to March 22 2012

When I purchased Yum stock on January 3, I had thought based on the chart above that there was still upside left in the stock. It major competitor is McDonalds Restaurant which is presently trading at 18.4X earnings and has been stalled around the $95 to $97 valuation for a while now. YUM Stock however is trading at 25.5 X earnings and has basically moved straight up not just for months, but as you can see from the three-year chart above, for years. Eventually it will become over-valued and I believe this is what has happened to YUM Stock.

Yum Stock Chart From Jan 2012 to March 22 2012

There is a good chance there could still be some upside left in the rally but I also believe based on technical analysis, that the stock could pull back to the $65 to $66 level where I would be interested in buying it again if the technical analysis shows that any pullback is simply a rest.

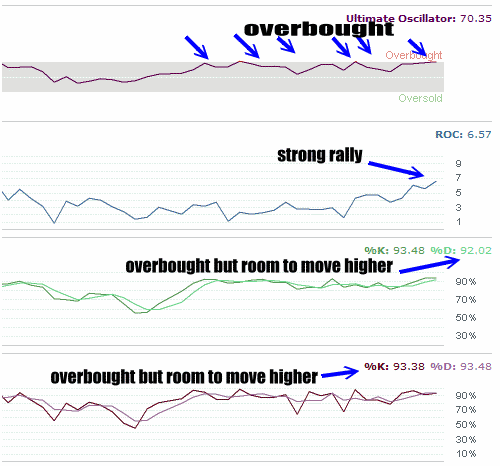

Below are my technical analysis tools which I checked last night. These readings though are from today. The Ultimate Oscillator has been overbought for over a month. ROC or Rate Of Change shows that the rally is in full swing with an incredible reading of 6.57. This is a very strong rally. The Slow and Fast Stochastic are both showing that the stock is very overbought but I have seen readings at 99 before a stock finally pulls back so there could still be room to the upside.

Yum Stock Technical Analysis as of March 22 2012

Why Not Covered Calls Instead For Yum Stock

I had looked at covered calls for Yum Stock. I did contemplate selling either the $70 covered call or go in the money for the $65 covered call. If I did the $70 I would want to go out just a couple of months and the May $70 covered call could have been sold for $2.54. I would be selling my Yum Stock then for $72.54. This would have returned an additional $1.54 or 2% for my trade. If I sold the $65 covered call I would want to go out to at least July. The July $65 covered call could be sold for $7.00 or basically I would be selling for $72.00.

I decided against both of these strikes primarily because if the stock continued to rise I will not participate in any rise above $72.54. I felt that for $1.54 extra I did not want to be tied to the stock. Instead I hope Yum Stock will pull back to $65 to $66 where I could enter again. If this does occur I would prefer to be back buying shares for another run up to probably past $72.00.

Yum Stock Trade Summary For March 22 2012

It has been an incredible rise for investors from 2009 to the present. Investors believe that YUM Brands which is found throughout China and is growing rapidly in Asia will become another powerhouse similar to McDonalds. There is a growing middle class in Asia which will soon far out number the middle class of North America. With such a large presence in Asia YUM Brands is poised to earn very strong profits which should push the dividend and Yum Stock higher.

Presently though I have to follow my technical analysis and it has been overbought for weeks. Eventually it will break either to the downside to work out that overbought condition or sideways to accomplish the same task. I preferred to lock in my profit now with Yum Stock and then evaluate it again to determine the next point to enter the stock for the next leg up.