One of the key elements in my put selling and covered call strategies is being able to pick support and resistance valuations in a stock. I show support and resistance levels often in describing my trades before they get underway. For example here is my write up for PepsiCo Stock where I pick key strikes built around understanding support and resistance levels in PepsiCo Stock. I believe no matter what option strategies for income is being used, it is important for any investor, whether doing put selling, covered calls, stock buying and selling, to spot key support and resistance levels BEFORE entering a trade.

Even for investors who are ONLY doing dividend investing for long term or short term, buying into a stock at random can be a detriment to any portfolio even if you are “in it for the long term”, as financial planners point out so often. Knowing support and resistance can greatly improve their returns. Why in the world financial planners came up with the idea that young people or “long-term” investors can withstand large losses because “time is on their side” is beyond comprehension. When you are young OR a long-term investor, it is the length of time that builds wealth and can compound a portfolio. Sustaining losses especially repeatedly means you are giving up that long-term advantage.

I will save that rant for another article. Needless to say knowing where support and resistance levels sit are important when investing no matter what option strategies for income or stock and option trades are being done..

But understanding support and resistance goes hand in hand with developing a method of investing AND understanding the company you are investing your money into. I really should be calling this article HOW TO INVEST because support and resistance is one of the most important key aspects to learning how to invest.

Understanding Support And Resistance

Before getting into how to spot support and resistance levels in a stock, it is important to understand what these levels represent.

Support and resistance are basically identifying levels of a stock where there is supply and demand. Support is demand and resistance is supply. At a specific price level buyers will step in as they feel the stock is undervalued. This buying leads to support in the stock as every time the stock falls to a specific level buys come back in again.

The same holds true for selling. When a stock rises in value and there is so much selling that the stock cannot climb through the selling, this becomes resistance. The stock value basically has too many sellers and buyers are resisting paying what they feel is too high a price for the stock.

Understanding this is a BIG benefit for investors and it is incredibly simple to use this knowledge to understand what is happening with a stock. Knowing support and resistance will save an investor from continually buying at the top. It will allow the investor to learn how to buy at support and sell at resistance.

Support and Resistance For Option Selling

The same is applied to option selling. Put selling should be done at support. When a stock falls to support, put sellers should consider selling puts either at support or to reduce the chance of assignment even more, selling just below support.

The same is true for Covered Calls. For investors who bought the stock at support, wait for the stock to head toward resistance and then sell at the money covered calls. By selling at the money there is a very good chance that resistance will hold and the stock will fall away from resistance. By selling at resistance, an investor will increase the chance that the calls will expire as the stock falls back AND they will retain their shares waiting for the next run up in the stock to resistance, allowing the investor to sell calls again.

Johnson and Johnson Stock Support and Resistance Example

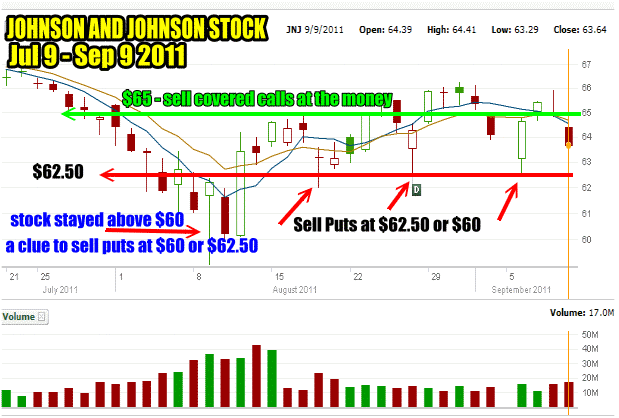

Looking at the Johnson and Johnson stock chart below, it becomes easier to spot support and resistance valuations to assist in put selling and covered call selling.

In August 2011 the stock fell with the rest of the market as a new bear market hammered stocks. On August 9 on larger than normal volume, the stock fell to a low of $59.08 and closed at $62.20. The following day, August 10 the stock fell to $60.01 and closed at $60.20. Both days on larger volume than normal, the stock failed to close below $60.00. This is a clue to put sellers that they should be selling the $60.00 put or even the $62.50 put. The following day on large volume the stock rose to a high of $64.19 before closing at $63.44.

Put Selling At Support

Support is obviously around $62.50 for this stock. In other words in the fall of 2011, there were buyers every time JNJ stock fell to or below $62.50. Looking at the chart you can see how often Johnson and Johnson stock bounced off $62.50. For put sellers, every time the stock fell to $62.50 they should be selling that put strike.

Covered Calls At Resistance

The same hold true for covered calls. Each time the stock rose above $65.00, it fell back. Obviously $65 is resistance. In other words a lot of investors feel that $65 is too expensive or too high a value for JNJ Stock. At that price level there are more sellers than buyer,or resistance to the stock moving higher.

For investors who bought the stock at support they should wait for the stock to reach resistance at $65 and then sell the $65 strike. As we can see from the chart, selling covered calls at $65 would have allowed a covered call investor to reap strong call option premiums. It also allowed them to buy back those covered calls and resell them a number of times throughout the fall period. For those less adventurous, they could have considered selling the $67.50 covered call strike each time JNJ Stock reached $65.00. This would have placed their covered calls cleanly out of the money and reduced the risk of assignment more than the $65 strike. Call option premiums at $67.50 though would have been small compared to the $65 strike for obvious reasons. As well market makers who set option pricing also follow support and resistance and they too can see that the likelihood of JNJ Stock in this period breaking resistance and moving to $67.50 is low. Call option premiums would reflect this inability of the stock to break resistance.

A chart such as above though also shows put sellers and covered call investors that stocks do not have to be highly volatile to generate significant profits. By learning to find support and resistance levels and selling at the opportune moments when stocks are at either support or resistance will allow option sellers to generate decent returns even on stocks with lower volatility.

Volume Technical Indicator

The volume technical indicator is a good addition to charting support and resistance and it will be discovered in part 2

Support and Resistance In PepsiCo Stock

Recently PepsiCo Stock was sold off by investors and has fallen all the way back to support at $62.50. I bought shares in PepsiCo Stock for a bounce in the stock. I also sold a variety of PepsiCo Puts. I had a lot of emails asking me why I did this and how did I know it was “safe” to do it. There isn’t really any “safe” stock, just support and resistance levels. No stock is “safe”. Investors must understand that when they place their capital into any market, whether it be stocks, commodities, forex, any option strategies for income, you are RISKING losses and they can be enormous. As an investor I risk my capital to earn profits not to accept losses.

Understanding The Underlying Asset Is Important

In order to do this I have to understand support and resistance levels in the underlying security. In my case I stay primarily with stocks because I can easily spot support and resistance BUT also because I understand what the company does.

For example, PepsiCo Inc. (PEP), sells Non-Cyclical consumer goods and services as well as beverages into the non-alcoholic sector. In other words non-cyclical means there are no cycles to their earnings. They are not affected by winter versus summer, March versus September. While they do have stronger sales in periods such as Christmas or hot summer days, overall PepsiCo Inc., is great to own because they make money all the time. They sell a lot of products at reasonable prices that are in high demand from consumers around the world. Their profit margin is a healthy 9.72% and they have a book value of $13.16. Book value basically means that if they went bankrupt and everything had to be sold today, that is basically what each share in the company is worth. It is very straight forward isn’t it.

Barrick Gold Corp And Commodities

Compare PepsiCo Inc to a company such as Barrick Gold Corp. Barrick is in the basic materials sector and precious metals and minerals industry. So what does this tell investors. Well, first they are going to be constantly whipsawed by the price of the underlying commodities they sell. This means they cannot set their own prices. With PepsiCo Stock when I buy their shares I know that the company itself has some control on setting prices. If the ingredients that are used in their products fluctuate and cost of production (running their business) increases they can calculate this and set prices accordingly. PepsiCo Inc., basically can control costs and stay profitable.

When I buy shares in Barrick Stock (ABX) I realize that they do not set their own prices for their product. Barrick stock will fluctate with the price of the underlying commodities, most often the price of gold. Barrick has no control on their prices. They try to sell their product on future prices which can work for or against them. If they sell at today’s prices for 3 to 6 months out in time and gold runs up to $2000 or $2500 they are losing huge profits. This is why Barrick stock often does not reflect the price of the underlying security. The same is true with Oil.

Analysts Need To Stop Talking

Analysts talk endlessly about how the underlying commodity prices are doing this or that, but the related stocks such as EXXON (XOM) is not keeping up or is too low or too high or whatever. Basically analysts should stop talking about things they do not understand. They should think about what is happening. Exxon just like Barrick sells their product based on prices in the futures. That’s all you really need to know. As an investor if you think oil prices are going to $300.00 in the next year or two then you would want to buy XOM Stock now and hold it.

In the AGQ ProShares articles I wrote, the investor who contacted me, Dan, believes Silver is going to climb incredibly high from present prices and he wants in “on the ride” so to speak. This is why he put over $400,000.00 into AGQ ProShares.

How This Relates To Support And Resistance

In case you haven’t spotted it, this all relates to support and resistance because some stocks such as PepsiCo Stock, Coca Cola Stock, Kraft Stock and many others are easier for put selling, covered calls and buying and selling. These stocks are excellent candidates for a variety of option strategies for income.

It is because selecting support and resistance levels are easier since they sell in a market with known variables and which they have some control over. This factor assists me in selecting support and resistance levels and being aware that the stock swings will only be so wide because these stocks are different from commodity type stocks.

Commodity stocks, forex and many other assets trade in unknown variables and as such I can endeavor to select support and resistance levels but there are so many unknown variables when it comes to these types of assets, support and resistance levels can never be confirmed with any degree of accuracy. Even world events affect these stocks more than those that control their own pricing. For example if I picked support today in XOM Stock (Exxon) at $75.00 you might think this would seem pretty accurate based on the past few months, but if the price of oil suddenly collapsed perhaps back to $70.00 then I can pretty well guarantee that XOM Stock will fall through support at $75.00. Same with resistance. I could pick $87.50 for resistance, sell covered calls and then find that something happens in the middle east that spikes oil. XOM Stock could fly to $90 or even %95 overnight.

Support And Resistance Are Key

Now you know why I am selective in the stocks I pick. When I sell puts against commodity stocks such as Exxon (XOM Stock), I make sure I only have a few of them in my portfolio. I like known entities rather than unknown ones. Remember, I am in this for the long haul and I want profits every year, not losses. To do that I need some factors on my side so by keeping stocks like Johnson and Johnson stock, PepsiCo stock, Coca Cola stock and such in my portfolio I am stacking the odds in my favor.

It is true that the profits from these stocks will pale in comparison to the profits from stocks like Exxon or Barrick. But if I sustain losses at varying times over a period of many years from these types of stocks, then I may as well not be investing at all. I see no point in risking capital for an annual return of 4 or 5 percent. That type of return can be achieved with far less risk than stocks. Therefore by keeping to just a small number of such stocks and filling my portfolio with known entities I am keeping the odds of annual success stacked in my favor.

It’s Not A Race

Investing is not a race, whether with buy and hold, option strategies for income, day or swing trading. If for example Dan’s trade works out with AGQ ProShares and I hope it does, he will take $400,000 and end up with over 2 million dollars. With my style of investing I believe I will eventually get there as well just not as quickly. But I will not be whipsawed around nearly as much and I sleep every night knowing that my money is growing and compounding. It’s a lot slower, but it is steady and certainly less stressful.

I feel I have a huge advantage in my strategy and that is the cash portion I keep. In severe bear markets, stocks collapse to what has to be considered fire-sale prices. I am always there picking up bargains. It is kind of like shopping at the dollar store. I can pick up my cart, wander the store for hours and selective pick up my favorite stocks at bargain prices. These bear market stock trades, when they recover, bring in returns that are often over 100% and then my cash returns to it safe nest waiting for the next time it is needed.

That advantage helps a lot in my getting to large compounds and advance my way to the same goal as Dan’s only through I feel less stressful methods.

Here for example are my stock trades from the bear market collapse in March 2009.

View The 2009 Canada Stock Portfolio Bear Market Trades

View The 2009 Retirement Portfolio Bear Market Trades

View The 2009 USA Stock Portfolio Bear Market Trades

So while many investors like the whipsaw of the commodity stock, I like the known entities of stocks like Johnson and Johnson stock, Kraft Stock, Walmart Stock, Intel Stock and the like. With these stocks I feel I can withstand a bear market and in a collapse, pick and choose stocks at firesale prices for huge returns. I only need this type of event once in 10 years to make my style of investing to work. It is also obvious from this article that it is not just a matter of knowing support and resistance levels but a combination of strategies that can make investing successful and enjoyable.

In Part 1 I have touched on just a small part of using support and resistance for investing. I will look at more aspects of using support and resistance in upcoming articles.

Read Support And Resistance For Put Selling And Covered Calls Part 2