The SPY PUT has been my hedge since it was introduced in 1993. I have received a number of emails from readers wondering about when I will be again using the spy put. I also have had readers ask why I would even bother with put selling or covered calls when my SPY PUT hedge trades are so good.

To shed some light on the SPY PUT hedge I thought I would answer some of the questions in this article. First, the SPY PUT hedge is only for weakness in the market and it has to be noticeable weakness. I do not use the SPY PUT hedge to “try” to “guess” when market direction might change. It is solely for when the markets turn down.

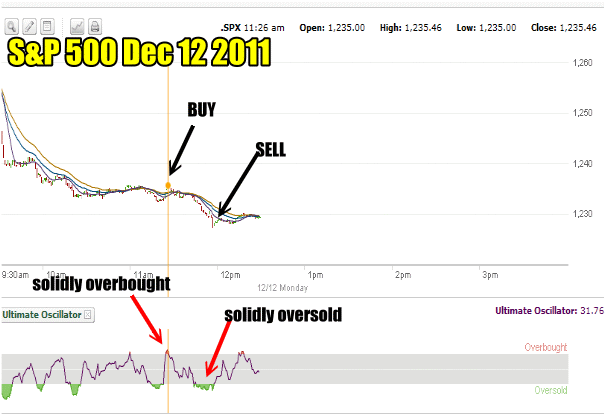

SPY PUT TRADE OF DEC 12 2011

The last SPY PUT trade was on December 12 2011, when I wrote “Spy Put Back In Action“. If you look at the chart below from Dec 12, you can see that the market opened lower and continue to fall lower. This is perfect for my SPY PUT hedge.

SPY PUT morning trade for Dec 12 2011

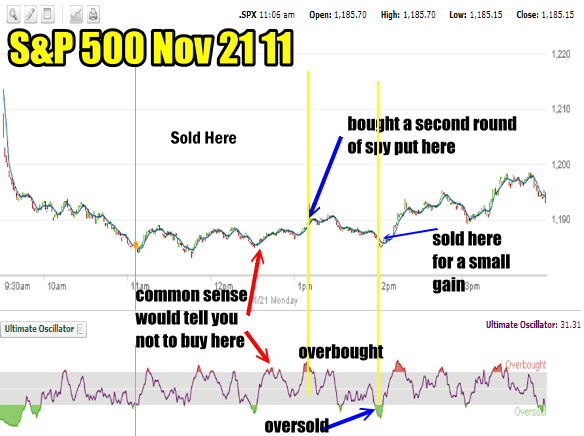

SPY PUT Hedge Trade Nov 21 2011

Below is the spy put hedge trade for Nov 21 2011. On this day I bought and sold spy put contracts twice for a double dip.

SPY PUT Double Dip on Monday as I purchased and sold spy put contracts a second time

SPY PUT Hedge And When To Use It

Both of the above trades and indeed all the trades from 2011 were during periods of solid market weakness. In other words I use the SPY PUT when the chance of success is HIGH. That means solid weakness in the market. Below is the SPY chart from today, Jan 25 2012 until around noon. There were no chances to buy the SPY PUT contracts before the market fell since the overall direction was down right at the open. This is more typical of a bull market than a bear. Bull markets tend to open lower and climb higher. Bear markets tend to open either higher or lower but slide throughout the day which makes the SPY PUT hedge perfect as it allows time during the day to buy the spy put contracts and then sell them as the market slides lower.

SPY PUT Hedge for Jan 25 2012 Shows Limited Chance Of Success

Investing is not a race and it is not gambling. There is no reason to rush to invest AT ANY TIME in ANY MARKET. Patience is the key to successful investing because patience breeds consistent returns. The SPY PUT hedge is used by me to build a cash cushion to protect my overall portfolio from large losses.

It may help fo read these three articles in which I lay out how I use the SPY PUT and the reasons for each style of trade.

Understanding SPY PUT Hedge Strategy – Part 1

Understanding SPY PUT Hedge Strategy – Part 2

Understanding SPY PUT Hedge Strategy – Part 3

Select this SPY PUT link to read more about the SPY for investors.

WHY NOT JUST INVEST WITH THE SPY PUT

In answer to the other question regarding why I would both to invest through Put Selling and Covered Calls, when obviously my SPY PUT hedge works so well, the answer is because the SPY PUT hedge is for weak markets. It performed very well in 2008, and part of 2009, but returns in 2009 were excellent for stock picking, put selling and indeed covered calls.

Indeed there are market periods when the SPY PUT hedge is not even needed. Below is my chart from March 2003 to March 2004 when my hedge was not placed once. If I relied solely on my hedge for compounding my capital I would have missed out on an excellent capital building period.

Put selling has enormous advantages in almost every market condition. Covered Calls are a necessity in my retirement portfolio because in Canada the RRSP (registered retirement saving plan) laws are strict about what options you can and cannot do. I cannot sell puts in my RRSP. I can sell covered calls.

In my RRSP I can buy and sell spy put contracts but if I am wrong and there are capital losses, I cannot use those losses against capital gains as it is a retirement plan or tax deferred plan. Therefore selling these types of put contracts in my retirement plan makes limited sense. In Canada we also have a tax-free savings plan which the Canadian Banks love to push because Canadians are fairly conservative with their money. They stick money into these types of plans to avoid paying taxes. However most simply squirrel it away in a Guaranteed Investment Certificate from a bank which banks love to sell since investors money is locked up and they get to use the money to expand their bottom line while paying out meagre interest rates. Once again Tax Free Savings Plans do not allow for the selling of puts, but I can do covered calls in them.

IT’S IMPORTANT TO UNDERSTAND THE SPY PUT HEDGE STRATEGY

To conclude, it is important to understand the SPY PUT hedge as a strategy. It is for periods of solid market weakness in order to increase the odds of a successful trade. Often if the trade is not working one day, it will work the next or certainly within a few trading sessions, but only in bear markets.

Buy having more than one trade strategy in my arsenal I can take advantage of any market condition be it bull, bear or neutral. By using various trade strategies I can become more proficient at consistently applying those strategies to compound my capital.

It bears repeating that investing is neither a race nor gambling. It is through consistently applying sound strategies like Put Selling, Covered Calls and the SPY PUT hedge at the right moments that I can continue to compound my capital and lower risk.