SPY PUT hedge returned to action this morning with the selloff sparked by Intel’s earnings warning. What a difference a weekend can make. As indicated in my market timing / market direction comment on Friday, while it was a nice rally, none of the market timing indicators supported the move higher. Indeed my favorite tool, the Ultimate Oscillator refused to confirm the trend had changed on Friday. Indeed it still pointed to market down.

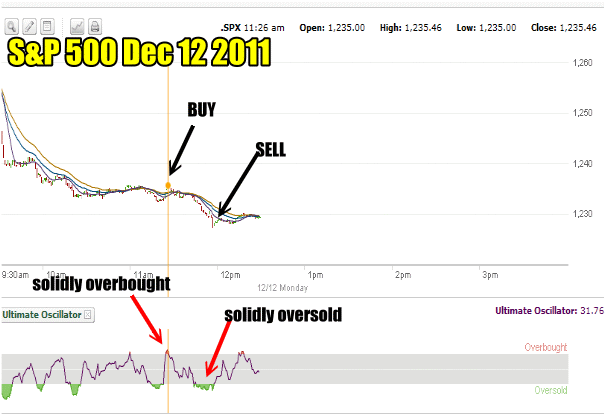

This morning, looking at my market indicators, they all confirmed that we have lower to go. With that in mind I was a little slow to get my SPY PUT hedge in place (I’m old remember). It wasn’t until I saw a solid overbought indicator from the Ultimate Oscillator at 11:30 AM today that I stepped in and bought 20 Spy Puts for 21JAN12 at $123.00 put strike.

The cost to buy was $3.88. Shortly before noon the S&P fell and signalled an oversold on the Ultimate Oscillator. I sold my 20 spy put contracts for $4.38.

SPY PUT Chart For Dec 12 2011 – Morning Trade

The morning chart for the S&P is below. I am writing this as of 1:00 PM and I am expecting the opportunity to double dip later in the afternoon. I am watching the market as I believe later this afternoon it should rise a bit allowing me to purchase SPY PUT contracts again and then sell off into the close where I plan to sell them.

This has been the typical market move during the past 6 months of this bear market. I see no reason to expect this day to be anything different.

SPY PUT morning trade for Dec 12 2011

SPY PUT Morning Trade Summary

While it would have been nice to have bought these SPY Puts on Friday near the close, that is not the manner in which I trade the spy put. I have repeatedly commented on the importance of strategy and having a plan.

My strategy is to wait for the market to signal its true intent. This morning the market opened down which confirmed what my market technicals indicated all day Friday. I wrote a number of pieces on Friday including a piece at noon, indicating that my market timing indicators refused to support the rally. Yet I did not buy SPY PUT contracts despite the market timing indicators because the rally on Friday could easily have lasted another day or even two.

There is always money to be made trading the SPY PUT, but my experience has always been that the most consistent money in trading the SPY PUT is made by staying with the same strategy I have used since the SPY was introduced in 1993. That is to wait for the turn down, bring up the ultimate oscillator to follow the SPY PUT and then look for the Overbought indicator to buy my SPY PUT contracts and the Oversold to sell them.

I DON’T ANTICIPATE THE DIRECTION AND BUY SPY PUT CONTRACTS

By staying within the day I have found over the years of trading the SPY PUT that my hedge performs consistently. It builds my cash cushion every day. As the cash cushion grows it protects my entire portfolio more every day. I found over years of trading the SPY PUT hedge, that there is no reason to second guess the market and buy my spy puts in anticipation of a move lower. Instead I can buy the SPY PUT contracts when the market is turning down already. By buying the spy put contracts as the market falls, I have found that the results are far more consistent.

MY LOSS EARLIER THIS YEAR WAS A DIRECT RESULT OF NOT FOLLOWING THE PLAN

Don’t forget my trade earlier this year with the SPY PUT contracts wherein I lost in excess of 3,000.00 simply because I tried to anticipate the move lower and held my spy puts too long. You can read an extension article discussing this loss from Sept 2011 here. Even the very best of investors makes mistakes and I am no exception. However I learn from my mistakes and anticipating a move lower in the market is really not needed to profit from it.

My SPY PUT hedge has been consistently profitable when I stay with the plan. That plan means no anticipating the move, but instead wait for the move and then put in place the SPY PUT hedge.

You can review all the spy put trades for 2011 here.

You can review information about Spyder ETFs through this spy put link.

You can review my Spy Put Trade Strategies Here:

1) The Short Version Using The Ultimate Oscillator This is my favorite way to trade the SPY PUT hedge.

2) Trading The SPY PUT When I Can Watch The Market Throughout The Day

3) Trading The SPY PUT When I Am Away From The Market All Day (such as when I worked)