The Shark Option Trading Strategy is design for investors who have no real outlook on the underlying shares and no long-term design. They do not care whether the shares are moving up, down or sideways. All the investor wants to do is profit no matter what direction of the underlying ETF.

Sharks feed on fishing grounds. In the Shark Option Trading Strategy, the chosen stock or stocks are the fishing ground. The shark is looking for plump option premiums. What the Shark needs though is clear signals to tell him when to buy and sell his option positions. The three biggest advantages to the Shark strategy is the small amount of capital required to do the trades, the ability to close losing trades quickly to keep losses reasonable and no long-term commitments to holding shares in a highly volatile asset like an Ultra ETF such as AGQ Ultra Silver ETF.

Since I introduced this strategy two years ago to investors dozens of investors are profitably using it. Every once in a while I get questions from investors who are using the shark strategy. I prefer to answer those questions on the forum so other investors can learn and profit from the information discussed.

Shark Option Trading Strategy Investor Questions

I have edited this question for brevity and for readability.

I purchased your four strategies PDF and I am very interested in the shark strategy. I have followed your spy trades and recently you used the ultimate oscillator on a one minute chart and made two great trades that day. I have three questions:

1.) How does the shark strategy compare against using the ultimate oscillator on a one minute chart as you do in your Spy Puts Trade?

2.) Which method do you think is the most successful, the Spy Puts Trades using the Ultimate Oscillator or the Shark Option Trading Strategy using the Moving Averages and Fast Stochastic settings you outlined in your article?

3.) Which time-frame should the shark strategy be used on? One minute or daily or a different time frame?

Thanks – Carl.

The best way to answer these questions is individually.

Question 1: Shark VS SPY – Comparison

Your question got me thinking about how I could probably design a Shark Option Trading Strategy around the SPY Options – both calls and puts! That would be interesting since I only do the Spy Put Options with my Hedge. This is because over the years I have found that I do better buying and selling the Spy Put Options in a downturn then I do either Put Selling Spy Put Options or buying Spy Call Options. Using the Shark Strategy on the SPY options could be very profitable, so thanks for tweaking my brain to consider it.Now on to your question.

I think far and away the Shark Strategy is far more profitable than the Spy Puts Trade. I don’t think there is ANY doubt about it. The Shark Strategy earns income constantly, in up, down or sideways markets. As the Shark Strategy is designed for highly volatile stocks or ETFs like the AGQ SILVER ULTRA ETF, it brings in much larger returns. A good example would be the Apple Stock trades where all year I used the Shark Strategy. You can view the returns from just the puts trades of September to November here. I spent a total of $28,379.50 on September 25 and earned $82,730.50 by November 15. Earlier in the year I made a number of Shark Strategy trades in Apple Stock and earned over $85,000.00 on those trades.

The Shark strategy hands down is far more profitable and it requires you to be less nimble, there is less trading, and rarely day trading. The Apple Stock trade is a good example where I started the trade on September 25 and then did my second Shark Strategy trade on Nov 12, the third trade on Nov 13 and the fourth and final trade on Nov 15. Four trades in total over that time period. The Spy Puts Trade are day trades that require you to watch your monitor and day trade to add income to your portfolio. The Shark Strategy can be used in the evenings and then the trade done out the following day when the signal is given.

Question 2: Shark VS SPY – Which Strategy Is More Successful

As to which one is more successful I would have to say it depends on your goal. The Spy Puts Trade is a day trade. At the most I have held the trade for just a day or two. I rarely have held over a weekend. In 2011 or 2010, I cannot remember which but it is in the Spy Puts Trades in my website in the tables for the different years, there was a large loss taken because I held the Spy Puts Trade too long. So for ease of use, the Shark Strategy is easier to use.

The Spy Puts Trade is easier to follow because you are basically using just one timing tool, the Ultimate Oscillator whereas with the Shark Strategy you are using three tools, namely the Fast Stochastic and two moving averages.

If your goal is the most profit with the least risk I think I would go with the Shark Strategy. It is more forgiving when you error and make a wrong entry or exit call. With the Spy Puts Trade if you enter at the wrong time you almost always either break-even or end with a loss. If you are not careful your losses can be quite large. The Shark Strategy can be tweaked and as it is not meant for day trading I think the Shark Strategy allows you more than one chance to be wrong and still end up with a profit.

As to which one can provide the most profit, that would be a complete toss-up because it depends on the amount of capital in use and the stock or ETF you are trading.

Question 3: Time Frame For The Shark

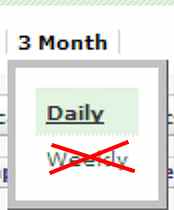

The most optimum time frame I have ever found for the Shark is a 3 month time frame set for daily as per the image below.

Shark Option Trading Strategy Time Frame

Thank you for your questions and I hope I have provided the answers you were seeking.

To Understand More About The Shark Option Trading Strategy Select This Link and scroll down near the bottom of the PDF article for a full description.

Internal SPY PUT Links:

Articles Discussing The Spy Puts Trades

Understanding Spy Put Hedge Strategy – Part 1

Understanding Spy Put Hedge Strategy – Part 2

Understanding Spy Put Hedge Strategy – Part 3