Scotia Stock Symbol – BNS

Scotia Stock Symbol – BNS

Scotia Stock is another one of those great stocks that has been in my Canada Portfolio and RRSP Portfolio for many years. Scotiabank, the third largest Canadian Bank is often ignored by option sellers and investors alike because many feel it is a stodgy performer. Nothing could be further from the truth. There is enough volatility and interest in options to make this a stock worth trading and investing in. This is the full index of all articles I have written about my Scotia Stock trades (BNS Stock). Scotia Stock (BNS) trades on both New York and Toronto Stock Exchange where the symbol is the same, BNS. The purpose of having an index page for each stock I trade is to assist readers is understanding the trading strategy being employed, its outcome and how it is implemented. Rather than focusing on duplicating my trades, I post my Scotia Stock trades so investors can contemplate the strategies they could consider employing and altering to profit from investing. Consider reading How I Treat My Investing Like A Business to understand how I approach investing.

I keep trading journals on all my stocks. With it I know at a glance how Scotia stock is performing, its earnings, dividend increases and past trades. This allows me to recall my goal and the strategies I have employed. I then can reflect on the effectiveness of those strategies and how I can improve of them. A trading journal is incredibly effective at reviewing past trades to study those that failed and the trades that won. Through studying the past Scotia Stock trades I improve on future trades which leads to consistency of income and profit.

Scotia Stock BNS Trading Journal Summary

| Trading Journal | Statistics | All Figures In US Dollars | Billions | ||||||

| Select Year To View | Year | Earnings / Net Income Billions / Billions | Dividend | Payout Ratio | PE | Book | Shares Outstanding | Debt To Capital | Profit Margin |

| 2007 | 13.0 / 4.01 | $1.79 | 0.5x | 13.6x | 23.55 | 0.984 | 57.5% | 10.05% | |

| 2008 | 12.2 / 3.1 | $1.94 | 0.8x | 12.7x | 22.75 | 0.992 | 58.5% | 26.5% | |

| 2009 | 14.4 / 3.54 | $1.96 | 0.5x | 10.9x | 23.90 | 1.025 | 56% | 27.0% | |

| 2010 | 15.8 / 4.2 | $1.96 | 0.5x | 11.2x | 25.01 | 1.043 | 57% | 27.8% | |

| 2011 | 18.7 / 5.21 | $2.08 | 0.5x | 11.8x | 26.06 | 1.1 | 56.16% | 29.97% | |

| 2012 Scotia Stock Trades | 2012 |

This Scotia Stock link will take interested readers to Scotia Stock’s investor relations. You should consider adding this type of link to your own Trader’s Journal because it gives you quick access to financial reports, forward-looking statements, dividend announcements and analysts recommendations. This BNS link will take you to the corporate annual reports of Scotiabank. Again by adding such links to your Trader’s Journal you can save yourself hours of work trying to find information about the underlying company.

Scotia Stock (BNS Stock) Goal and Strategy Employed

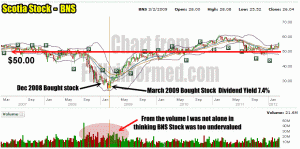

The Chart to the left shows Scotia Stock from 2007 to 2012. I am starting this Trader’s Journal as if this is a new stock in my portfolios to assist readers in understanding my approach and how I develop my strategy and apply it to the trades. BNS Stock is being held in both my Canada Stock Portfolio and my RRSP (retirement) Portfolio.

Strategy Employed

In my Canada Stock Portfolio I engage in put selling and use a degree of margin which varies depending on the stock price and events at the time. When the stock is very under-valued as it was in 2008 and 2009 I use as much margin as possible to pick up the Scotia Stock. When BNS Stock recovered I usually sell half of my position which covers all the margin used and retain the rest for long-term investing, if that is my goal.

The RRSP Portfolio is different. Canada has strict laws on Retirement Portfolios. I can only sell covered calls and naturally there is no margin available. The goal is different in the two accounts.

GOAL

The goal for Scotia Stock in my Retirement Account is for growth and compounding of the capital. The goal in the Canada Stock Portfolio is earning capital which I may or may not re-invest depending on my needs.

Below are all the articles I have written discussing the ongoing Scotia Stock trades. This BNS Stock index is updated with each new article written.

Scotia Stock Profit and Income Articles

Scotia Stock Added To Retirement Portfolio

Feb 12 2012 – Scotia Stock shares were added to my retirement portfolio again today. In this article I explain the Mr. Conservative Covered Call Strategy and why I am employing it on BNS Stock.

Scotia Stock Takes A Hit

Dec 4 2011 – Scotia Stock fell 3.5% after releasing its earnings announcement. While Scotia Stock beat analysts estimates the earnings showed that international growth remained weaker than expected. This rattled analysts and investors alike and pushed BNS stock lower. This article discusses how I approach a decline in a long-term stock trade such as Scotia Stock and how I can receive both Profit and Income from events such as this.

Scotia Stock Symbol – BNS

Scotia Stock Symbol – BNS