Microsoft stock has been a favorite of mine for years. Yet for most investors it has been a go nowhere stock. In this article I explain how Microsoft Stock returned 33% annualized each year for the past 8 years, making it a better investment than gold. None of the figures in this article take into account inflation. This is a simple calculation.

Microsoft stock has been a favorite of mine for years. Yet for most investors it has been a go nowhere stock. In this article I explain how Microsoft Stock returned 33% annualized each year for the past 8 years, making it a better investment than gold. None of the figures in this article take into account inflation. This is a simple calculation.

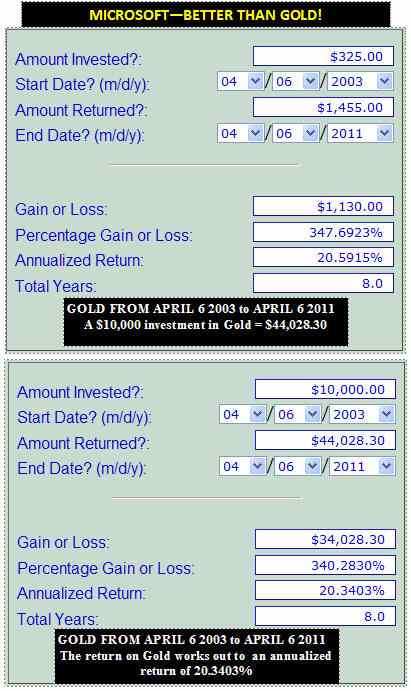

In April 2003 gold was trading at around $325 US an ounce. Today (April 6 2011) it is around $1455.00 – This is a 347% return. If I had invested $10,000 in gold at $325.00 US an ounce and cashed out today I would have a total of $44,028.30 which includes the return of my initial $10,000.00. Annualized this is a 20% gain or an incredible total return of 340%.

However unlike selling Microsoft Stock options, it would be difficult to have cashed out my gold position each month or year and reinvested the earnings back into gold as the price fluctuates greatly making cashing in and out a difficult strategy. Therefore it would be very hard to have compound returns with gold, but this is not the case with Microsoft Stock where when put options expire or are closed, the income is immediately available for reinvestment. This is the beauty of selling options on any stock. Each time the trade ends the capital is released. It grows monthly and the cycle is repeated.

Let’s look at my Microsoft Stock Analysis to see the returns from my Microsoft trades.

Microsoft Stock Versus Buying Gold

Below you can see the terrific return on Gold over the past 8 years. The chart tells the entire story of gold’s advance. Gold has been an excellent investment as long as the investor stayed invested and did not cash out during those periods when gold went nowhere or declined. But what about a seemingly “no-go-where” stock like Microsoft stock?

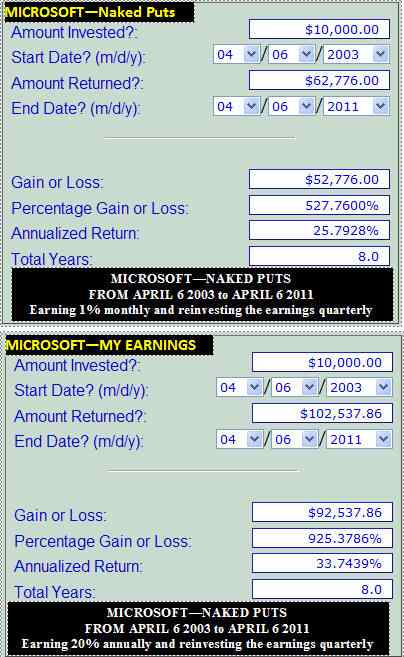

The chart below shows my Microsoft stock trades over the same 8 year period – a 33% annualized return and a total gain of 925%! This return was not just averaged out, but selling Microsoft Stock put options earned double digits consistently every single year.

The Microsoft Stock Analysis of my trades shows that if I had made just 1% a month through selling Microsoft stock put options over the course of 8 years and took my earnings and reinvested them quarterly back into selling more Microsoft puts, I would have $62,776.00 at the end of 8 years. Despite earning just 1% monthly selling Microsoft stock put options, the compounding effect creates a 25% annualized return. See the top half of the chart above labeled “Microsoft – Puts”.

Microsoft Stock Options Put Selling Strategy Earned Even More

However my actual earnings were higher at almost 20% a year. So when I take the same $10,000.00 I now would have $102,537.86 or annualized it is a 33% return. See the bottom half of the above chart labeled “Microsoft – My Earnings”

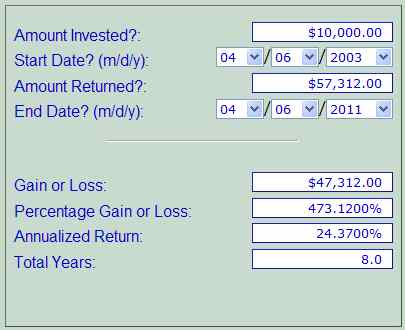

Even earning just three quarters percent a month and continuing to reinvest the earnings from selling Microsoft Stock put options returns 24% annualized. (See chart below)

The purpose of this Microsoft Stock Analysis is to show the potential earnings power of selling put options even with a small starting investment and how over time if those earnings are allowed to grow, selling puts are not only a superior investment, but they also offer more income potential than investing in gold.

As well over the 8 year period of selling Microsoft stock options it offered a true annual return not a return such as in the case of gold, which can languish for years while waiting for price appreciation, or in the case of a stock, stock value appreciation. With selling options, the income is deposited to my account the day after the option is sold. My earnings are immediately credited to my account and can be promptly put to use.

Selling Microsoft Stock Options Offers Enormous Profits

I believe options offer greater potential for consistent profits than simply buying and holding stocks or commodities and either gathering the dividend, or in the case of gold waiting for a crisis to push the valuation higher. This is why I have stayed with the strategy of selling options against large cap, quality, dividend paying companies like Microsoft stock. Over the long haul I don’t need to chase stocks, consider the latest stock tips from hundreds of newsletters and analysts, jump into whatever is the hottest stock for the season or look at “too good to be true” investments.

Instead I spend my time examining a handful of large cap stocks that are leaders in their field, have solid earnings and a nice trending chart like Microsoft stock. Doing studies such as this Microsoft Stock Analysis have always been my keys to success. Select this Microsoft stock link to learn more about Microsoft investor relations.