I started investing in 1973 and its incredible that this is the best October since 1974. The market direction has been up since October 4 despite so many market timing technical indicators that warned investors that this was just a bear market rally.

However the number of investors who are in this market now is low including the “smart money” investors. Even today most analysts are bearish and if you check out this market timing link you can see that bloggers are split with a slight bias to bearish.

Market timing and market direction is necessary for most investors to understand whether to commit capital or withdraw it.

Market Timing / Market Direction – The Best Reason To Sell Options

In a market that is racing higher such as October’s results to date, investors fear that the bear market will emerge and destroy their hard-won profits. This is the best reason for selling options as a strategy.

Despite being bearish since May of this year, I have remained invested and after the market timing indicators turned decisively bearish in late July and then the market direction pointed to the August collapse in stocks I committed most of my capital month after month.

But that capital was tied to selling puts rather than trying to use market timing to determine when to buy stocks and sell them.

Market Timing / Market Direction – Investors Remained Spooked By History

In a market such as 2011, the environment is quite different from the past. This market has seen two stock market collapses in just the past 10 years and in May 2010 a 1000 point intra-day drop. These kinds of events have very long shadows that keep investors spooked.

In May 2010 after the 1000 point intraday pullback on the Dow Jones, the market turned sideways and then commenced falling. By the time the market was down 20% investors were pulling out fearful that the economy would have a double dip. This year the same event occurred with talk of a double dip once more at the forefront along with a collapse of European financial institutions. These events make any investor fearful and with memories of the past stock market crashes still haunting investors, they sell and get out.

But just as in 2010, investors sold at the wrong time and are today now contemplating getting back into the market.

Market Timing / Market Direction – Dow Jones Chart October 2011

Here is the Dow Jones Chart for the month of October. It is now up 11.99%.

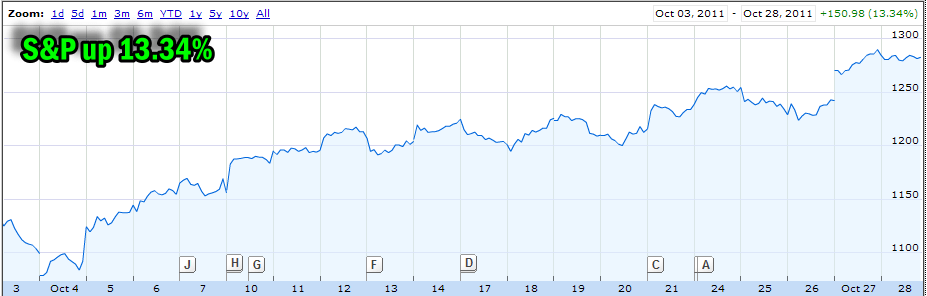

Market Timing / Market Direction – S&P Chart October 2011

The S&P 500 is up 13.34% for the month of October.

Market Timing / Market Direction – iShares Transport Index

Despite market timing analysis which showed a weak rally from Oct 4 to the present, the iShares Dow Jones Transport index was up 23.51% for the month of October to date.

Market Timing / Market Direction – Still Flashes Caution

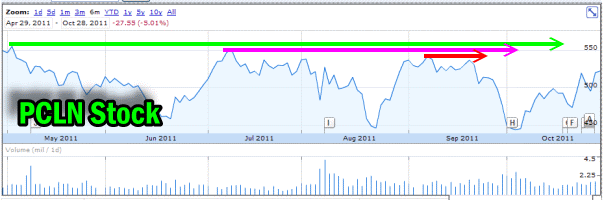

Yet despite the terrific October, market timing indicators are still warning that the market is not out of the woods yet and no bull market has returned. Stocks that have led this market recovery from 2009 have still failed to recover. Stocks like Priceline Stock (PCLN Stock) still show that market direction remains sideways.

In the chart below we can see three lower tops in Priceline and unless it can recover this will mark another lower high for PCLN Stock, which is not a sign of a bull market returning.

Market Timing / Market Direction – The Beauty Of Options

Despite market timing indicators that kept saying market direction sideways to down, selling options allows an investor to stay in this volatile market but at a safe distance from the action. Sort of like going to a football game and sitting in the upper gallery rather than on the sidelines. The action is a lot more exciting on the sidelines but up in the galleries my chance of being hurt is much smaller. So it is with selling options.

Market Timing / Market Direction – Generating Income Remains The Plan

While market timing warns that this is a bear market rally and market direction remains uncommitted it doesn’t matter. Whether I am selling out of the money naked puts (my preferred choice) or selling out of the money naked calls I can continue to generate income and profit from the increased volatility despite not being sure which way the market is heading. It’s the best of both worlds. The market is indecisive, so it races higher or plummets lower. Volatility spikes up and suddenly far out of the money options have premiums often in excess of 1% making selling them very profitable.

Market Timing / Market Direction – Timing Is Everything

While returns within instruments such as iShares Transport index look wonderful when viewed from top to bottom, overall the returns are still just trying to recover from the June and July selloff.

Below is the iShares Transport chart from the August 8 collapse to October 28 2011. The return over that period is just 4.8%. This shows that the return is all based on the moment of buying and of selling, something very few if any investors are capable of doing.

Market Timing / Market Direction – It’s About Consistency

Instead, through consistently selling options I don’t have to be right all the time and I don’t have to try to pinpoint the bottom in a move or the top. Market timing could not have told me when to buy the iShares Dow Jones Transport or sell through this period. With market direction always being down or sideways, rather than trying to second guess market direction, I can profit from the whipsaws and volatility through selling far out of the money puts and calls.

Market timing and market direction are important aspects of my investing strategy and I would not want to invest blindly without any concept as to where the market may be heading. But in a bear market volatility also plays a role of importance, as it assists in my being able to stay invested in the bear market due to higher options premiums for far out of the money options.

Market timing is a significant asset in determining market direction, but the ability to find strategies which can be used in bull and bear market is an important aspect of my trading method.