Market Timing sometimes is easy to predict. The market was very overbought so market direction should be down for a few sessions. It usually just takes some news to turn the tide and today was “Back To The Future” as Europe returns yet again to haunt the markets and on Halloween too. This makes the job of market timing pretty simple. Since Oct 4 the market direction has been up as all North American indexes have been on a tear with the NASDAQ, which has led the recovery since March 2009, up 17% since Oct 4.

Market Timing / Market Direction – It’s Still All About Europe

Every investor should by now know that markets just don’t go straight up. Market timing as I have said many times is not science. Often it is a matter of looking at the technicals including sociopolitical events to spot the market direction. Since Oct 4 market direction has been up with a stall here and there that made me wonder if the rally was running out of steam. In the end it just took perceived good news out of Europe to blow the top off the market and now it is news from Europe that is bursting the bubble. Fun isn’t it.

Market direction is being dictated by Europe as most investors are looking for a quick fix for the Europe Debt and Banking Crisis. This isn’t going to happen. There is no quick fix. It took years for the mess to reach the tipping point and it will take years for the problem to be addressed and a successful resolution to appear. Market timing at this stage is difficult to predict because it is external events and not market technical events, controlling market direction. Therefore to make a market timing call I am going to return to the past.

Market Timing / Market Direction – Back To The Future

Market timing is actually a lot easier when I look back to 1974. In the mid 1970’s I had started to invest only to watch my capital be decimated by the oil embargo which started in 1973. Select this market timing link to see a great oil chart.

As I stood in long line-ups trying to buy gas for the next week’s trip to work I pondered how in the world did we get into this mess. The market was down 45% and my hard-earned money was being held ransom by Middle East countries that I knew very little about. Then there was a terrific rally in October and I thought everything was going to be alright. Boy, was I wrong.

I started market timing and market direction in 1974 after spending two years with a mentor. He explained to me that both market timing and market direction are a priority to successful selling of options as well as staying in the market during times of crisis.

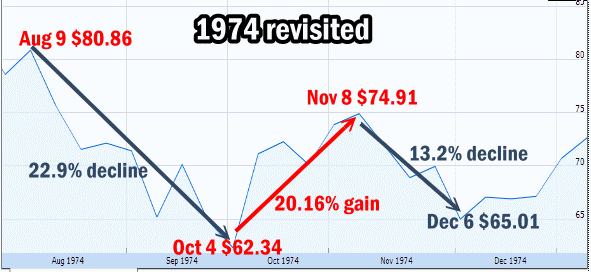

Below is my chart from Aug 8 1974 to Dec 6 1974. Spooky how much the similarities are isn’t it. Good thing I am writing this on Halloween, otherwise most of my readers might doubt if the past does meet up with the future.

Market Timing / Market Direction 1974 Revisited

Market Timing / Market Direction – 1974 REVISITED

1974 was a year I would rather forget and picking market direction was difficult. Just like today, market timing was being dictated by external forces, which back in 1974 was the oil embargo and the Middle East. The chart above shows just the pullback from Aug 9 1974 to Dec 6 1974. The collapse though started early in the summer 1974 and by Oct 4 was easily 45%.

But by Dec 6 I had learned a lot and my mentor was right. You want to stay invested in this kind of market. So I stuck it out and borrowed more money to stay in the market. My market timing as it turned out was not too bad in the late 1970’s and I recovered all my losses and doubled my capital.

Meanwhile by the end of the decade of the 1970’s the market pretty well ended up where it had started. On Jan 1 1970 the market hit an intraday high of $93.68 and on Dec 28 1979 the market closed at $107.84. That is a total gain of just 15% for 10 years. This is also why my mentor told me that mutual funds were pointless if I really wanted to build my portfolio.

Market Timing / Market Direction – Summary

It’s kind of nice at different times of the year to take a step back from market timing and market direction and do a review. Halloween is always a good time to do this. Tonight as I review my portfolio and the past decades of investing I can see that this decade may end up repeating the 1970’s. Back then investors were impatient to have a resolution to the oil crisis. They pushed up the market from Oct 4 1974 until early November 1974 only to watch it fall again. Back then I was using a handful of market timing indicators and they performed well. Today there is everything from the Ultimate oscillator to Bollinger bands to help.

Market Timing / Market Direction – DEJA VU?

While it may seem like there are uncanny resemblances, actually all crisis for stock markets are the same. Investors hate uncertainty and any opportunity where they believe things are finally resolved, they will buy and push markets to extremes. We have just seen that in the month of October. Now my market timing indicators show we should see some selling. When the selling happens investors will once again question the market direction and wonder if it was just a bear market rally.

Market Timing / Market Direction – I’M INVESTED

For me it doesn’t really matter what investors think. With Europe reeling, US unemployment high, growth remaining slow and the housing market showing little rebound, I will be staying with the cautious bull strategy and using my market timing indicators to watch for added problems.

Just like in the 1970’s, I am committed with my cash. These are the times that present the best opportunities for larger than usual profits. As the market whipsaws back and forth it keeps volatility high and allows me to benefit from higher than usual option premiums.

I plan to remain cautious, fully invested and stay far enough out of the money with selling puts, deep in the money calls and when necessary should anything unforeseen occur that pushes stocks lower than I anticipated I will still be able to continue with my strategy and roll my puts lower if the market moves lower thanks to my market timing indicators help.

Happy Halloween!