MACD is probably among the best of my market timing indicators and it continues to be negative. In my Market Timing / Market Direction call of November 11 which you can review through this market timing link, I was looking for a bull break out and the chance for the Santa Claus rally to end the year on an up note. In my comments I indicated what could derail the rally. I said it would have to be something bigger than what we have seen coming out of Europe. However Italian Bonds above 7% and Spanish bonds moving higher rattled the markets but the cautionary words from Fitch late this afternoon is the “bigger” event. The very notion that US Banks could be seriously impacted by further erosion in European Bank and Debt woes will sink any Santa Claus rally.

US Banks had indicated repeatedly that their exposure to Europe issues was not large. One figure tossed about was less than 50 billion dollars. However Fitch definitely disagrees and that will end any rally.

Market Timing / Market Direction – No Bull, Santa’s In Trouble

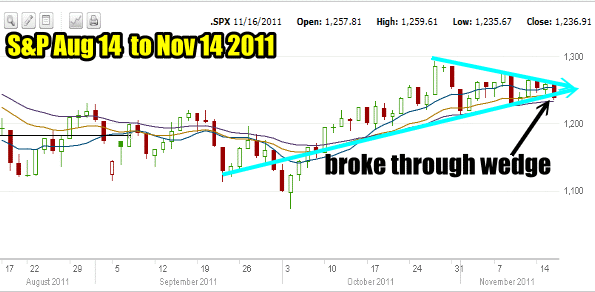

The news from Fitch hit the market hard in the last hour and the selling pushed the market through the rising wedge on the downside. From this point forward even if the market recovers tomorrow or next week, any move up has to be suspect that the bear is alive, well and waiting. Select this market timing link to go to Fitch Ratings.

Market Timing / Market Direction for Nov 16 2011 shows that late in the day the selling broke the rising wedge or triangle to the downside.

FITCH RATINGS Didn’t Really Say Anything New

The news from Fitch though isn’t really anything new. Everyone has known that Europe’s problems if they persist can only get worse and will threaten to put the global economies into a serious recession. All of this coupled with Europe’s debt and banking woes will hurt most US Banks and possibly even those in Canada. (Heads up fellow Canadians).

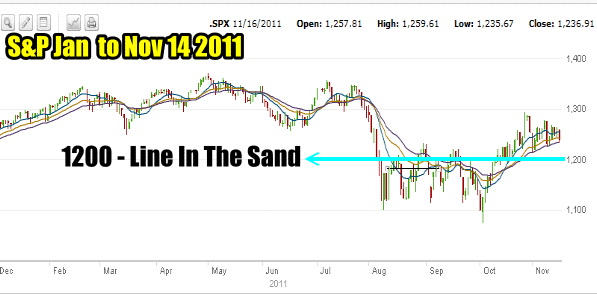

Market Timing / Market Direction – Line In The Sand – Can It Hold?

The 1200 level must hold for there to be any rally into the Christmas season. The constant bombardment of bad news is pressuring the markets at every turn. Today’s drop was almost 21 points. The 1200 level is now just 37 points away. Any break of 1200 will see a quick fall in the markets and I believe a strong rally in Bonds.

Market Timing / Market Direction shows that 1200 is just 37 points away. Today the S&P dropped 20.90 points which would seem to indicate that a few more days of selling and 1200 will be broken.

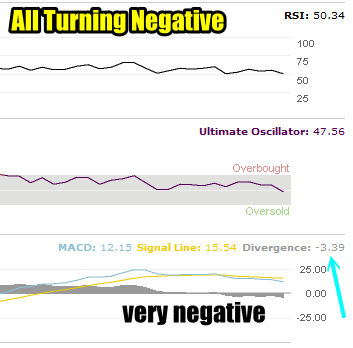

Market Timing Indicator MACD is warning that Market Direction Is Changing

All my market timing indicators are turning down. The worse sign though comes from my best market timing indicator, MACD which has been negative since Nov 9.

Here are my market timing readings from MACD over the past few sessions:

Nov 9: negative 1.57

Nov 10: negative 2.72 (this was a positive day on the S&P)

Nov 11: negative 1.92 (this was another positive day)

Nov 14: negative 2.25

Nov 15: negative 2.11

Nov 16: negative 3.39

MACD one of the best Market Timing Tools has been negative for a few sessions.

Market Timing / Market Direction Final Chart Is Negative, The Russell 2000

The Russell 2000 is still clinging to the 20 day moving average but MACD went negative on Nov 9 and has refused to turn positive despite the move higher by the Russell 2000. In the last few years the S&P 500has not been as good a bellwether index as the Russell 2000. Despite this though when the S&P 500 gets into trouble, the entire market follows.

Russell 2000 has become a better market timing and market direction aid that the S&P

Market Timing Is Warning To Be Careful that Market Direction Is Turning Negative

If there is a Santa Claus rally, which I now doubt, I will be very careful doing put selling into January. It would be better to keep as many sold puts as possible into the closest month and keep my cash out of the market. Fitch’s ratings news was not really anything new but it did remind investors that this is a dangerous time for the world’s economies and stock markets in general.

I plan to stay as far out of the money as possible and look for opportunities to do more put selling in the coming days. My market timing indicators are clearly telling me that any bull is just a bear and market direction will change rapidly.