On Friday my Market Timing / Market Direction outlook was negative despite the rally. The Ultimate Oscillator on Friday refused to turn positive but instead stayed negative despite the rally higher on Friday.

You would have thought that Friday’s optimism would have lasted longer than 1 day. All this up and down action simply confirms that the bear market is not leaving any time soon. While pundits are still calling for a Santa Claus rally, we may indeed get something, but it will probably be from lower down on the S&P 500.

Market Timing / Market Direction for Dec 12 2011 – DOWN

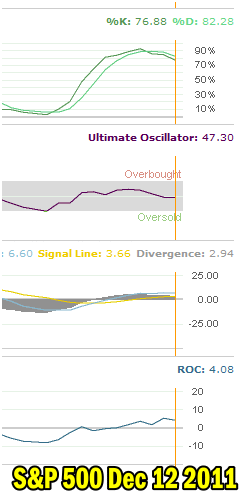

Today all the market timing indicators confirmed that the next phase is lower, so on Friday when my market timing indicators refused to turn positive, they were correct. My market timing indicators for today are below. The top indicator is the slow stochastic and at 82.28 it continues to fall from last Wednesday.

The Ultimate Oscillator, my favorite market timing tool, is already turning a lot lower with a reading of 47.30 and the third indicator, MACD is at 2.94 again indicating that the market direction will move lower. The last indicator is the rate of change and while not negative, it is down from Friday’s big jump. However it is important to remember that the rate of change is a short-term momentum indicator. It is not predicting at this stage where the next move is. With the top 3 indicators all turning negative, the next move in market direction is a confirmed down.

Select this market timing link to learn more about the stochastic oscillator.

Market Timing / Market Direction for Dec 12 2011 is Down

One last market timing indicator is today’s candlestick which is a black candlestick which because the market opened lower than Friday’s close and closed lower than today’s open signalling that the market will move lower.

Market Timing / Market Direction Shows Light Support at 1200 on the S&P

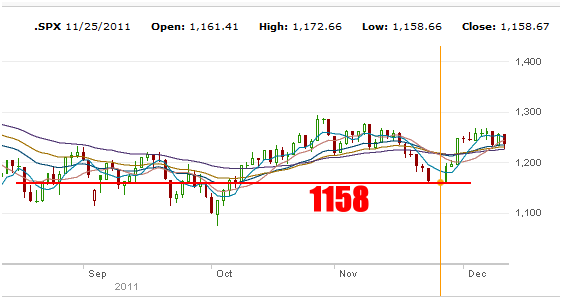

At 1236.50 the S&P is still not at 1200 but I believe it will easily fall through 1200 as there is only light support. Once that happens more selling will enter and the next stop could be the Nov 25 low of 1158. Today the S&P at one point was lower than Dec 8 low of 1231.47. Again this is bearish.

Market Timing / Market Direction S&P 500 for Dec 12 shows that 1200 should have light support and then it is an easy fall to 1158

Market Timing / Market Direction Summary For Dec 12 2011

It was not all bad news today though. McDonalds Stock set another new high and in Canada BCE Stock also set a new high. With a number of large cap stocks still setting new highs there is still enough strength in the market that I don’t believe any large drop is coming soon. It looks more like a grinding lower of the indices.

There is no need to rush into selling puts at this point. The market direction is confirmed lower but the market timing indicators will have to turn a lot more bearish for the market to fall quickly. Instead right now anyway, they are indicating that the market will fall at least to 1200 and then an assessment of the market timing indicators will have to be made to determine if the market direction will continue lower or revert back to sideways as the year-end approaches.