Market timing in a technical analysis to determine market direction which many investors do not believe in. The non-belief is a direct result of investors not understanding how market timing and market direction analysis works. Market timing takes into account many aspects of the market environment including market sentiment, economic-political events and market technical tools such as moving averages, MACD, RSI and many others.

When market timing indicates a particular market direction, whether up or down, and the market timing call is wrong, many investors immediately point to market timing as being inadequate and inaccurate. Instead they need to look at market timing as a gauge which while it can be wrong at times, often does give a general overview of what is happening in the market and does pinpoint market direction. It is this market direction that is important in knowing when to commit capital and when not to. Market timing provides a basis to look at the markets and try to determine overall market direction.

Market Timing / Market Direction – Line In The Sand Breaks

Throughout the past couple of weeks I have pinpointed a “line in the sand” which I mentioned in many market timing / market direction reports. For the S&P that line was 1200. I indicated that if the line breaks then there is a very good chance the market will penetrate deeper to the downside. My overall outlook was for the market to eventually see 1000 on the S&P. With the news out of Europe continuing to worsen I believe the market could break the 1000 level unless Europe acts decisively.

Market Direction Cannot Change Without Action From Europe

There are now in the market place too many problems for the stock market to rally. The move by Germany to insulate themselves from the rest of Europe does not bode well and indicates that the government is probably preparing for a move away from the Euro. France which had pushed for the Euro to curtail the dominance of Germany in European economic clout has no “wiggle” room to negotiate. Holding most of the Italian debt was an enormous mistake which even the most basic of investors knows, “never put your eggs into one basket.”

Market Timing Could Show An Improvement

Europe could get their act together and issue common bonds and print Euros. Either of these two actions would improve market timing technicals and thereby increase the likelihood of a major rally in stocks. The chance of common bonds is small due to Germany’s adamant decision against such a move. Europe’s fear of turning on the printing presses to print their way out of this debt mess, will probably mean the end of the Euro. In such an uncertain environment stocks cannot regain their footing at the 1200 level and as such must move lower to entice investors to take “a chance” on stocks. But investors know that if Europe slides into a serious recession stocks will fall simply due to earnings falling. It’s a domino effect that will pass from continent to continent. Every nation will slow which will lead to lower earnings which will lead to lower stock valuations.

If Europe turns on the printing presses stocks will rally for a while, but should inflation begin to creep in, stocks will once more begin to fall as interest rates rise.

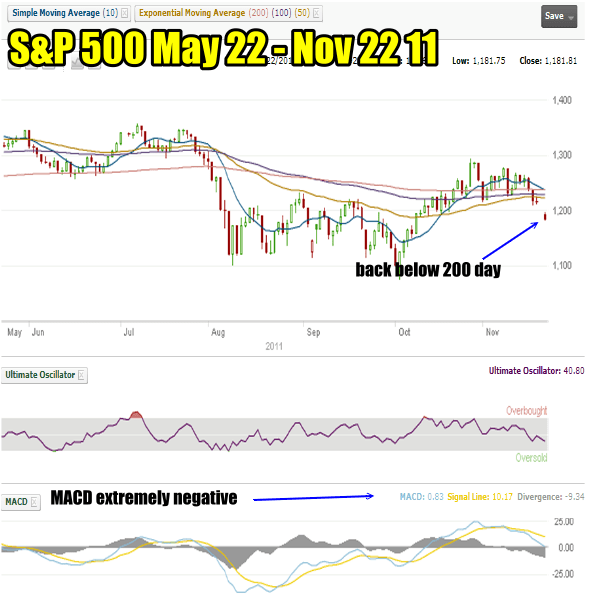

Market Timing / Market Direction Chart – Morning Nov 22 2011

Here is the S&P this morning. It is back below the 10, 50, 100 and 200 day moving averages, down below 1200 and MACD extremely negative at -9.34. Bias is lower.

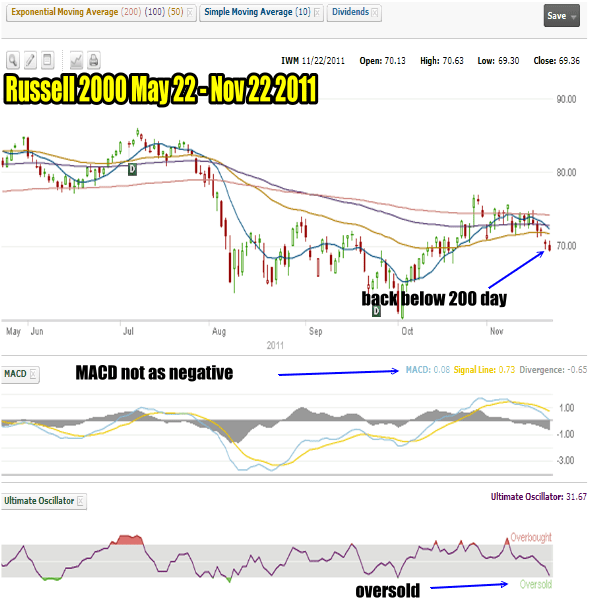

The Russell 2000 is also below the 10, 50, 100 and 200 day moving averages. The ultimate oscillator is flashing an oversold indicator but with MACD at just negative -0.65 there is lots of room for the Russell to fall lower.

The Russell 2000 is a good market timing tool that I often use. It is not covered as often by analysts who tend to focus on the S&P 500. To view a 6 month IWM Stock chart select this market timing link.

It is in markets like these that the importance of having a plan proves its worth. The problems the world faces are large and as such investors need to keep asking themselves what impetus will push stocks higher. Without positive news the market direction cannot change solidly to up. Right now all my market timing indicators show a market under stress stuck sideways with a bias to keep moving lower. Until there is a change in the world’s economic outlook, every rally has to be suspect and I will continue to sell into those rallies and use my spy put hedge to protect on downside moves. The strategy in use remains The Cautious Bull. It is important to remember that investor should treat their investing like a business. In bad times look for more bargains while protecting your capital. Market timing is clearly warning that market direction is down.