Today’s action was interesting to say the least. Friday’s market pullback picked up steam right from the opening. However while European markets are being trounced almost daily, the US Market is hanging tough.

I believe there is a lot more happening in this market than many investors are aware of.

The latest chart which you can see below, shows that the market is still in a range. Since August 8 the market has hung tough and actually appears to be trying to move higher.

The problem the market has been facing is the crisis in Europe. Strangely the VIX is flashing all kinds of warnings the past few sessions and today was no different.

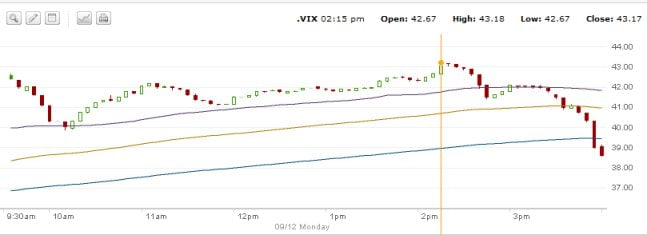

Below is today’s VIX chart. Throughout the day as the market worked it’s way lower the VIX rose. Then in the last couple of hours, the VIX pulled back. A few things caused this including the Italian Government raising their value added tax a full 1% and the news that China is interested in picking up Italian debt.

But the VIX has been warning of an impending severe pullback and today was no different.

Yet the majority of large investors are not holding puts or hedges. In fact many bought back in on the past few dips and believe this market is going to move higher. The belief is that the market bottom from this correction was put in on August 8.

While the SPY chart above seems to prove that the market bottom was put in on August 8th, today’s action as seen in the chart below, indicates that it was the news from Europe late in the day that pulled the market back from its slump.

So while analysts are writing about Obama’s job creation plans, the high US Unemployment and the continuing housing crisis, the market is right now, obviously focused on Europe. Therefore any good news out of Europe could move the markets higher. The European Markets are so low that a bounce should be expected overseas.

Looking beyond today’s market action, yields on US Treasuries and 10 year and 30 year US Bonds are forecasting a recession and many economists are bringing this to the attention of investors. But are they forecasting recession or reflecting the fear of investors who are fleeing to what they perceive as the safety of bonds, which naturally is pushing rates so low?

If the economy does slow more and turn to even a mild recession, then most companies will see earnings slump. This also means that price to earnings are too high on many stocks even with the August pull back. On the other hand if the European Crisis is limited to Greece could markets possibly recover?

Therein lies the question. The VIX and fix income yield are issuing warnings, yet large investors are unconcerned and if the European Crisis should be limited to Greece then the market might surprise and move back up. But can the market make significant new highs? I am on the bear side which is why I am staying with selling far out of the money puts or deep in the money covered calls.

On Friday I purchased 40 spy puts and today I sold just 10 put contracts. I am still holding 30 put contracts and in this environment I believe with Greek 1 year bonds at 90% and 2 year bonds today at 70%, interest rates do not go this high on sovereign debt if indeed, default is not already a foregone conclusion.

This reminds me of GM. The US Government spoke continually about how GM would not be allowed to fail. That it was unthinkable. In the end they went from denial to acceptance and put GM through bankruptcy and started over.

With Greek debt, Germany is already moving from denial to acceptance. I am sure they see only one answer. Greece will have to default. Eventually the European Union will have to decide which nations truly belong to the union. When Greece joined the EU, it did so through smoke and mirrors. Their debt structure did not meet the EU guidelines and yet they were allowed to join.

Italy and Spain are not Greece and I will be surprised if either country defaults. So the market could see some higher days ahead but overall I believe the problems in the economy are so large that most governments are at odds as to the difficult and unpopular steps that must be taken to bring the debt crisis under control. It is obvious that European leaders holds no answers to its debt problems. The concept of adding more debt to solve debt is ludicrous at best.

The three major problems facing the United States are massive debt, unemployment and housing. This is where the focus of the government needs to be.

I believe the markets could go sideways for years. I invested in the 1970’s and when that decade ended the markets had gone nowhere. But with high volatility comes higher option premiums and that is what I look forward to.

Every rally I look upon as an opportunity to sell stocks or buy to close sold puts. Every pullback an opportunity to sell puts. I believe there is a lot of profit to be made in this market, but I do believe this is a bear market. Investors need to remember that bear markets come with breathtaking rallies and blood curdling sell-offs.