The market direction action today was certainly telling. Investors waiting for Mr Bernanke’s speech were definitely disappointed. It appears that many investors really did believe that the Federal Reserve would commence a third round of quantitative easing. Why anyone would believe this is a possibility strikes me as quite odd.

The first two rounds did not reduce unemployment and did not stop the housing tumble. Both of these issues are forefront for the economy and so far nothing has worked. QE1 and QE2 were terrific for stocks but as per my April 2011 article, Dance Near The Exit, there was lots of warning that the Federal Reserve was going to change direction.

Yet investors still want to believe, just as many believe Greece won’t default and the European Crisis will be averted. How this is going to happen is definitely beyond me. So far the European leaders have made no real progress and certainly appear to not only not truly grasp the situation, but have no real strategies on how to solve the situation.

Today’s drop in the last hour is just another sign that the bull market is over and market direction has changed. It may go down in history as the shortest bull market, but definitely it is over. For those who are into stocks there will be lots of opportunity ahead for buy on weakness and sell into rallies.

However for those who like me prefer options, this volatility is playing right into our portfolios. Put premiums are higher as the volatility increases with the change in market direction and I have been selling puts on large down days, such as today, in order to take advantage of this volatility.

There is no need to rush. Investors should take their time and pick strikes carefully. I have not been able to update all my trades, but I will do my best to bring them up to date over the coming days. Just to review here is my strategy going forward:

My goal is 1% a month for the entire portfolio. For example, my US Portfolio is 609,000.00. This means I need to earn 6090.00 this month. Therefore I can select far out of the money options, both puts and calls on my stocks. They are at varying strikes.

For example, on Monday I sold 5 puts on YUM stock at the $48 strike for .72 cents. This is more than 1%.

Once I have sold enough options to earn $6000.00, the rest of my capital can be used to sell naked calls or puts at strikes that are much further out of the money, in order to augment this month’s income.

For any stock such as Nucor, which I am holding, I have sold deep in the money covered calls to protect against further erosion of prices.

Played properly, staying in a bear market can lead to terrific returns, but it is important to be careful and not get greedy. Close profitable positions early to lock in the profit and then look for new opportunities. Stay with large cap, quality stocks. Take your time as patience will definitely be rewarded in any bear market.

Consider new strategies for bear markets. My financial investment strategy since Jan 2011 has been the cautious bear. Consider such strategies when the market direction is clearly down.

Keep some cash always available for big down days and watch using margin. I prefer to keep margin to a minimum or not use it at all.

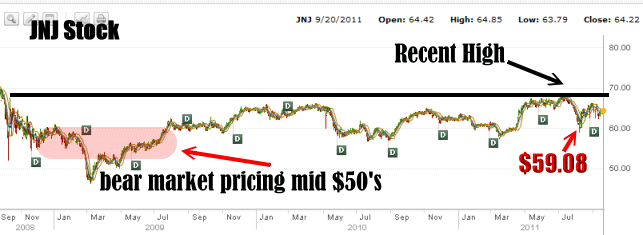

Remember too that in bear markets not all stocks are treated equal. Some stocks since the downturn began in earnest in early August have not fallen much if at all. So take time to view stock charts such as JNJ below to make yourself aware of strike points and do not sell at high levels. In serious pullbacks, all stocks will fall presenting better opportunities.

Take time to look back at historic charts. For example, below is the Johnson and Johnson stock chart from 2008 to Sept 2011. Look at how the recent high in JNJ was just in July. But even today the stock only fell 1.7% to $63.13. In the bear market collapse of 2008 to 2009 this stock traded in the mid 50’s range. On August 9 2011, the stock fell to a low of $59.08 before quickly recovering. This pullback is a warning that there is limited support at or above $60.00 in the stock.

I have been trying for several sessions to sell the Oct $57.50 put for .65 cents. I have come close on Monday of this week, but still not quite there. But patience will prevail and I expect to sell that put for easily .65 if not more soon enough.

MARKET DIRECTION SUMMARY:

The market drop in the last hour of today’s trading on just the Fed’s announcement and Mr Bernanke’s comments about the weakness in the economy, are warning signs. If just this kind of talk can drop the market more than 280 points, imagine what will happen when Greece defaults. Keep cash available, I believe there will be great opportunities ahead as market direction remains down.