Market Direction today like so many of the past few days was all about Europe. Europe dominates everything now. Articles abound about Europe and what could happen or should happen or may happen. Actually I think the market direction is totally now in the hands of Europe. Articles like this one on Marketwatch are pretty telling about what could happen.

Market Direction Still Sideways

I believe the market should have pulled back harder over the course of the last few weeks, but the August 9 low seems to still be holding in place.

Over the past few days I have put up various charts showing the weakness in the market, but overall despite all the technical damage, the market is hanging on as it waits for Europe. This could be a long wait and that is where I think the market direction could end up being lower. Germany has no need to rush in and try to bail out Greece at this point. The strategy from Europe has been to keep on muddling along and it suits their present needs, although it is damaging to their stock markets, investor sentiment, consumer sentiment, banking industry, and overall credibility.

So the chance that this will get solved in short order is probably slim to nil. Our markets can stay range bound for only so long and then they will break. Without positive news they will break to the downside.

Market Direction – News From The Market Leaders

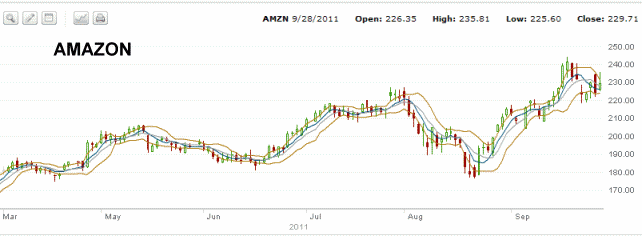

The news from Amazon about their new kindle and how it will compete with Apple’s iPad was compelling.Amazon’s stock was up and continues to stay at the top end of its recent high.

Apple stock handled the news from Amazon, well. Its stock also remains near its high.

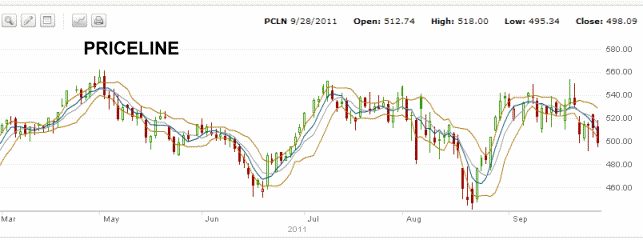

Last is the Priceline Chart which shows the stock still hanging on and not yet willing to admit its run might be over. If you recall from my previous market direction posts, Priceline has been leading this rally since the March 2009 lows.

Market Direction – What The Leaders Are Saying

These stocks which have been leaders of the market direction are all still telling investors that there could be higher highs ahead. They have continued to sit near their highs and it’s obvious to any market observer that any concrete good news out of Europe will push their valuations higher.

The market direction is sideways with a bias to the bear side. If there is some European concrete good news the entire market should break to the upside. Whether or not the news is that Europe will pile on more debt to try to solve the debt problem, will make no difference. The market does not care if the problem is pushed down the road for 6 months or longer. The market is only concerned about a clear direction not an actually solve the problem resolution.

Market Direction Summary – Sep 28 2011

The leaders in this market are flashing a sign to investors that this is not October 2008 and those analysts who are calling for the market to revisit the March 2009 lows are kidding themselves. I still believe the market has a good chance to see the S&P 500 fall to the 1000 level, but the March 2009 lows, I believe, will have to wait. Market direction is now going to be determined completely by the outcome in Europe, most notably Germany’s upcoming parliamentary vote on the Greek debt issue.

The market