Johnson and Johnson stock is one of those assets you just know is solid. A huge company that operates in 3 segments, Consumer, Pharmaceutical and Medical Devices and Diagnostics with a profit margin of 14.87%. Presently the annual dividend is $2.28 and Johnson and Johnson stock has seen its dividend increase annually for more than 50 years. With a market cap of 174.7 billion and revenue of 65.8 billion this is an enormous company.

I just love put selling against big blue chips like Johnson and Johnson stock. If I am wrong and the stock tumbles and I was assigned, I end up selling covered calls against a very strong stock. This is the type of conservative investing I enjoy the most. I can sleep nights and never worry if the trade turns sour.

This morning on weakness the stock slipped a bit and allowed me to quickly sell puts that expire in one week for 4.6% return. If only I could do this every week on JNJ Stock, I would be a very happy investor!

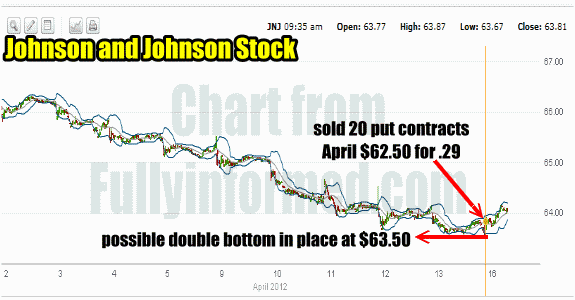

Here is what I saw occurring with Johnson and Johnson stock.

Johnson and Johnson Stock Put Selling Technical Indicators

On Friday I bought 1000 shares of Johnson and Johnson stock as the Ultimate Oscillator had previously flashed an oversold indicator two days earlier. The news 4 days ago that the company must pay more than $1.1 billion in fines over the drug Risperdal sent the stock lower and I waited to see if the stock would fall below the lower bollinger band on Friday.

It did and I bought shares. You can read that article here. Today at the open the stock was soft and I stepped in and sold April21 expiry $62.50 puts for .29 cents. This represents 0.46% return for exposure of 1 week. The stock must fall an additional 2.3% this week for these puts to be placed in the money.

I sold a large number as I do not plan to hold them but will close them quickly if they should lose more than half the put premium I earned. That means anywhere around .14 cents would be worth considering closing early should the stock continue to tumble after a brief bounce.

Johnson and Johnson Stock Price Chart

Below is the chart from this morning’s trade. The past 10 days has seen a continual slide in Johnson and Johnson stock. Too bad I hadn’t bought puts 10 days ago! I believe there could be a possible interim bottom around the $63.50 price for the stock.

Johnson and Johnson Stock Put Selling done April 16 2012

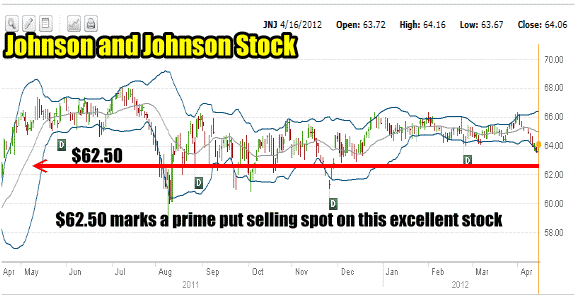

Johnson and Johnson Stock 1 Year Price Chart

Below is the 1 year chart for Johnson and Johnson stock. You can see why I have spent much of the year put selling the stock at $62.50 and once in a while buying it for a bounce as well. While investors tend to shy away from these types of stocks as they are not very exciting and certainly not high flying, I can easily earn 12% every year with extremely limited risk of capital loss. I remember years ago having JNJ Stock in my retirement portfolio and selling 6 month covered calls for almost 20 years against Johnson and Johnson stock. For those who are interested select this Johnson and Johnson stock link to visit JNJ Investor Relations.

The one year stock chart below shows that $62.50 has been an excellent put selling strike. A superb performer earning more than 12% annually while basically going nowhere. What is not to like about this put selling trade.

Johnson and Johnson Stock Chart For April 2011 to April 2012

Johnson and Johnson Stock Put Selling Summary

Whenever my favorite stocks offer an opportunity I like to be able to take advantage of it. Friday was the chance to buy shares and today the chance to sell puts. By watching for weakness in Johnson and Johnson stock I am able to compound my capital with limited downside risk.

I believe investors should put together a list of their favorite stocks and then:

- Delete those that are not strong performers.

- Delete those that in a plunge you would never buy.

- Delete those that do not pay dividends.

Then from the remaining list, plot your stocks daily and look for signs of weakness. On that weakness put in place a put selling strategy or consider buying the underlying stock for a bounce. Consider using the Ultimate Oscillator to pinpoint when the stock is going to turn and sell puts at that moment or buy stock.

It is this simple investment strategy that I use on not just JNJ Stock but almost all of my stocks. It is also why I have tended to stay way from stock ETFs. I have found that stock ETFs since they represent a basket of stocks tend to not have the same periods of weakness and strength making put selling premiums poorer and opportunities for stock bounces less. While it is true that they have more downside protection since they are a basket of stocks, I believe my large cap stocks do offer protection from falling too far in a downturn while at the same time offering terrific opportunities when they do fall. This is what has always been great about Johnson and Johnson stock.