As a financial investment, put selling is a great strategy. Put selling gives me so many financial investment advantages that I created a page referencing some of my best reasons why I love selling naked puts. Select this financial investment link to read my reasons.

This financial investment article is designed to show the market timing technical tools I use to try to avoid holding or selling puts on a stock that is on the verge of collapsing so hard that it leaves me with huge losses. Selling options is a financial investment strategy that does not involve making thousands of dollars when selling an option. Option selling strategy is of small profits that over time can create a substantial gain. However selling an option for a small gain only to see a stock collapse, wiping out months of gains is not something I enjoy. Over many years I have found several market timing technical tools that aid me in setting up an early warning that my stock choice might be in trouble. Of those financial investment tools, two stand out, MACD and Bollinger Bands.

Financial Investment Strategy That Can Damage A Portfolio

The first thing to remember is my financial investment strategy of NOT selling naked puts on stocks that I would not want to own and they must pay a dividend. Often the stocks I buy will fluctuate 10, 15, or even 20 percent. This rarely concerns me as these are companies paying dividends, I keep cash ready to buy stock on a decline or sell more naked puts and I look forward to the stock’s recovery. Stocks fluctuating is part of a financial investment plan and as an investor I must be prepared to accept this.

Through my market timing indicators and charts, I have confidence in the stocks AND the strikes that I sell puts against. But sometimes, like in October 2008 stocks can plummet more than 25% and the loss can be staggering, especially if I am holding a naked put I sold for .50 cents and it would now cost $12.00 to buy to close. Can this happen? Absolutely and faster than investors can imagine. A collapsing stock which I have sold a naked put against for pennies can severely damage my financial investment portfolio.

In order to protect my financial investment and be able to continue put selling, I spent a number of years studying market timing tools to put together a set of tools that I could use as an early warning system to spot a collapsing stock before it could damage my portfolio.

Financial Investment Alternative Strategies

Many investors will explain there are lots of other financial investment strategies an investor can use to protect the naked option positions such as selling spreads instead, which in a downturn still locks in a loss. Another financial investment strategy is to put in place a stop-loss that can help in downturns but also will lock in a loss in a downturn. I have also found that spreads can lock in a loss during a whipsaw. Whipsaws happen a lot in bear markets and I am sure most investors have experienced them. I have had stocks plummet 15% and turn around and rise 20%. I hate it when I close a position for a loss only to find out that it was not necessary as the stock recovers.

Other option sellers will tell you that the best thing to do is buy back the option when it has reached 50% or so of the value received at the time of selling. For example, the investor sells an option for 1.00 and he should buy it back if it reaches $1.50. By using this financial investment strategy an investor locks in a loss but escapes from further losses should the stock plummet further. The problem with this financial investment strategy is that stocks move around a lot and a naked put can easily reach 1.50 and a few days later be back at .25 cents to close. This type of whipsawing in bear markets can definitely create management problems.

Financial Investment Tools to SPOT the Collapse BEFORE Large Losses

What I really want is some financial investment tools that will help me decide BEFORE I sell the naked puts whether there is trouble brewing. I want to try to spot trouble with the stock either before I even sell puts OR quickly after selling my puts so I know to close it and get out while any loss is small. I also want to have some comfort knowing that it was the right financial investment decision to close early and take a loss or a reduced gain.

There is no fail safe system when it comes to risky assets such as stocks. I just hope to be right more often than wrong. Let’s take a look at how I use the two financial investment tools of MACD and Bollinger Bands to spot a collapsing stock.

FINANCIAL INVESTMENT EXAMPLE: NUCOR STOCK

n July 2008 I received an email from an investor, Gary asking for help.

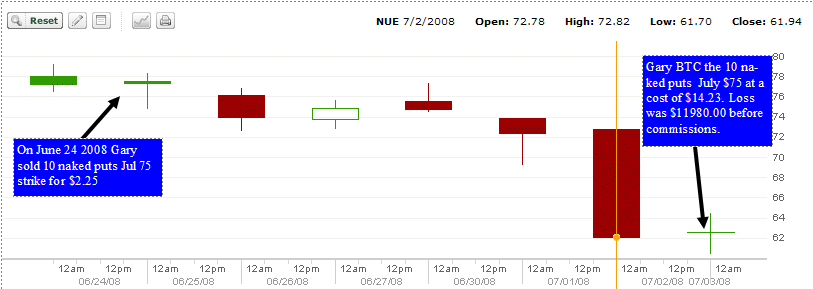

Here is what happened: On June 24 2008 Gary sold 10 naked puts on Nucor at $75.00 for $2.25 for a total income of $2250.00 before commission. 6 days later the stock closed at $61.94. The cost to close the naked put was $14.80.

The financial investment losses from a collapsing stock such as NUE Stock can devastate a portfolio.

This represented a loss of 557%. That is a staggering financial investment loss. When the stock fell on Jul 2 2008, he was shocked and the following day he closed the put and paid 14.23 for a cost of $14230.00. The financial investment loss was $11,980.00. (There was no bounce back up just more down moves) In his email, Gary explained that the financial investment loss was still substantially less than if he had bought the stock on Jun 24 and sold it on July 3. He asked me if I knew what he could have done so he could learn how to protect himself from making the same mistake in the future. I told him the best I could do was show him the financial investment market timing tools I use and how I use them. Use this financial investment link to review NUE Stock for the past year.

THE FINANCIAL INVESTMENT TOOLS I USE TO SPOT A COLLAPSING STOCK:

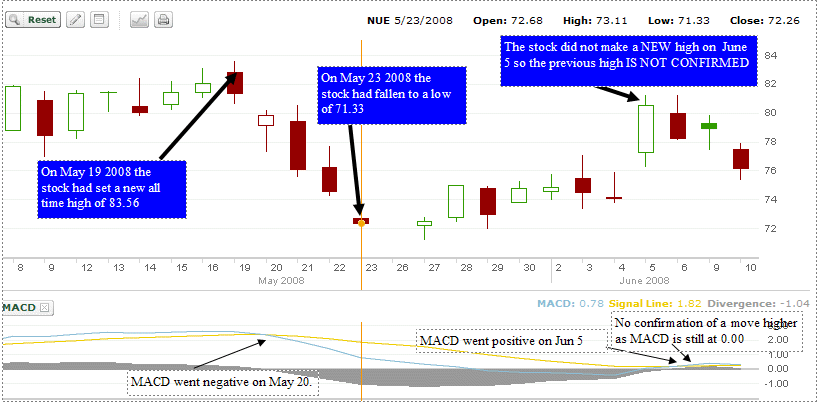

1) I sent Gary a number of images. The image below was from May 8 to June 10 2008. I explained that NUE stock on May 19 2008 set a new all time high and then it fell 14.6% in just 4 days. This makes the new high suspect that this could be a trap.

First Financial Investment Market Timing Tool is MACD

On May 20 the day AFTER the new high, MACD (Moving Average Convergence / Divergence) went negative with a reading below 0.00. This is a solid warning that the stock is under pressure. After May 23 the stock bounced higher but MACD did not go positive until June 5. On JUNE 6 the stock fell which then is a warning that the May 19 2008 new high is not confirmed.

A new high should be followed by some pullback but the trend should continue higher. However after June 5 MACD did not confirm an uptrend, but sideways and within a day it was neutral at 0.00. All these financial investment technical readings from MACD were warning signs for Gary to hold off selling the naked puts.

As a financial investment tool, MACD is excellent at early warnings of a stock in trouble.

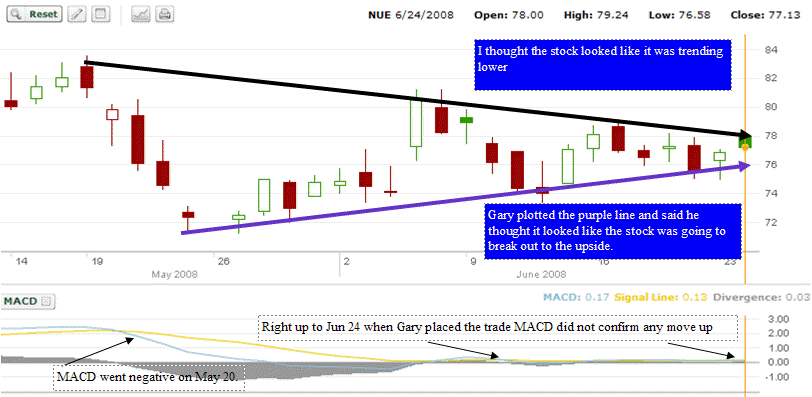

2) Gary had sent me an image showing the purple line below and indicated that he was sure NUE stock was going to break out and move higher. I sent him the image below and showed him I thought the stock seemed in a downtrend. However to confirm either I looked at MACD and it definitely did not confirm any uptrend in progress. This is a definite warning sign. Remember the stock is sitting close to it’s all time high. The best course of action here is to wait for a clear direction.

Often MACD will not confirm an uptrend. This is an important financial investment technical indicator warning the investor to not sell puts.

Second Financial Investment Market Timing Tool Are Bollinger Bands

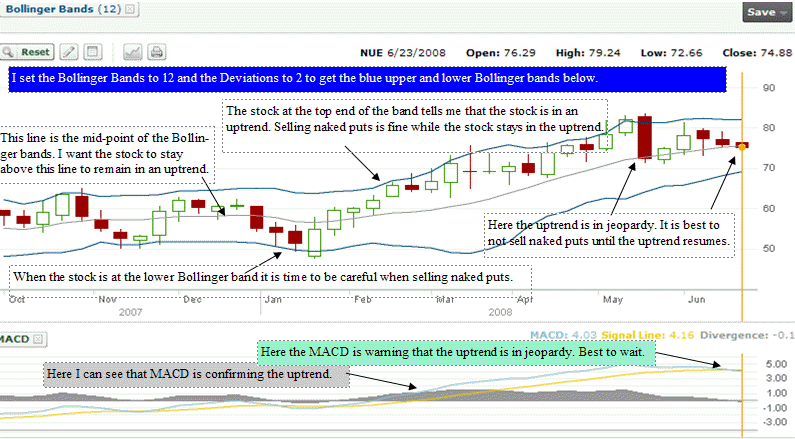

3) I also sent Gary the below image. NUE Stock all the way back to Oct 2007. I set the Bollinger Bands to 12 and the standard deviation to 2. This Bollinger Bands are my second financial investment market timing tool.

When the stock stays at the upper end of the Bollinger Band the stock is in an uptrend and it is a better time to sell naked puts. However by the time Gary sold his Naked Puts on June 24 2008, the Bollinger Band was warning that the uptrend was in jeopardy which means this is time to hold off on selling naked puts.

I have added MACD (Moving Average Convergence Divergence) which shows again that the uptrend was confirmed in February right through to May, but by the time Gary sold the naked puts, the uptrend was no longer confirmed. This is time to be careful. MACD is a momentum indicator that takes two moving averages of prices and shows their relationship to present a buy and sell signal for investors.

Financial Investment Tool MACD And My Settings

The settings I use for MACD are, Fast Points of 12 which is for the 12 day EMA and the slow points of 26 which is for the 26 day EMA. The smooth I use is 9 which is the 9 day EMA (mid-point on the Bollinger) which many people refer to as the signal line. So basically I am comparing the movement of the 12 day and 26 day and plotting it against the 9 day EMA. It’s fairly accurate at spotting the changing in trend. MACD does not predict a change, just confirms the current trend.

MACD as a financial investment tool does not predict the future. Instead It Confirms the Trend.

4) There are lots more other tools that can be used but I prefer the above two financial investment tools, MACD and Bollinger Bands to spot a collapsing stock.

In Part Two I look at a variety of stocks and how I use these financial investment market timing tools to help in spotting a collapsing stock.

Go to Part Two of Financial Investment Tools To Spot A Collapsing Stock