CAT stock (Caterpillar) was a favorite stock of a friend of mine for several years. In January 2008 my friend invested in Cat stock and sold covered calls. Her plan was to earn the dividend and she wondered if I could help create a strategy of earning more than the dividend and protecting her position in Cat Stock.

My friend lives in Canada and as the capital was in her retirement account, Canadian laws do not allow for the selling of options without the underlying stock. Therefore in Canada a retirement account, which is referred to as an RRSP (Registered Retirement Savings Plan), only allows for the purchase of stocks and options, or the selling of a covered call with the underlying stock covering the call.

My friend explained that she was uncomfortable buying puts on Cat Stock because it meant she was laying out capital that may or may not end up in a loss which because it is a retirement account, she cannot write off as a capital loss. What I put together was a strategy to roll down and up covered calls to follow the trend of CAT stock.

Today my friend sent me her CAT Stock trades from January 2008 until July 2009 and thought readers might be interested in the outcome.

CAT STOCK – The Strategy:

The strategy I detailed to my friend was a simple strategy of selling covered calls and then using the 30 day and 50 day exponential moving averages to time rolling down the covered calls when these averages showed weakness. At the same time rolling up the covered calls on Cat Stock was based on when the sold covered call strike price was reached. Finally I explained to my friend that it is also important to accept exercise as a part of the normal process of owning CAT stock.

While the dividend on CAT stock is not enormous, being just .36 cents a quarter back in 2008 or 2.3%, the option premiums are always excellent which, if traded properly, more than makes up for the low dividend.

The easiest way to understand the strategy and the implementation is to look at the trades that were done. Here are her trades.

CAT STOCK – The Trades – 2008:

*All figures include commission charges.

The first CAT Stock chart below shows the beginning of the year when after the bear market of 2007, many analysts thought the worst was behind investors.

On January 22 2008, 500 CAT stock shares were purchased at $62.15

5 Covered Calls were sold for May $75.00 strike for $2.65 = Total income earned = $1308.76

In the chart below the 50 day moving average is in yellow and the 30 day EMA in blue. When the stock was purchased in January the 50 day was moving sideways and the 30 day was climbing higher. This meant the stock could safely be held as it was trending higher.

CAT STOCK – FIRST ROLL HIGHER

On April 11 Cat Stock reached $75.85 and closed at $74.80. Since the stock had reached $75.00 it was time to roll higher.

April 11 2008:

The 5 May $75 covered calls were purchased back for $3.85 = ($1941.24)

Sold 5 Aug $82.50 covered calls for $4.90 = $2433.76

CAT STOCK DIVIDEND CAPTURED:

On April 17 2008, a dividend was paid of .36 X 500 Cat stock = $180.00

Total amount earned to April 17 = $1981.28

Capital In Cat Stock = 500 shares X 62.15 = $31084.99

Return to Date = 6.3%

CAT STOCK – SECOND ROLL HIGHER

On April 18 Cat stock reached $82.50 and closed at $85.28. It was time to again roll the Cat stock covered calls higher.

April 18 2008:

The 5 Aug $82.50 covered calls were purchased back for $8.35 = ($4191.24)

Sold 5 Nov $85.00 covered calls for $8.85 = $4408.76

Income earned to April 18 = $2198.80

CAT STOCK – The Roll Of The Covered Call Explained:

The decision to roll the Cat Stock covered calls was already decided when the trade was started. The objective was to earn as much capital as possible from the stock and stay ahead of the possibility of assignment as long as the 30 day and 50 day moving averages indicated the stock was still in an uptrend.

The strike would be rolled higher, once the stock reached the value of the covered call strike.

The strike to roll to, was decided based on the credit that could be received and the closeness of the month. By rolling from May to August, the investor captured $492.52 additional income and moved higher by $7.50 in Cat Stock which would increase the capital gain should the stock reach $82.50.

By having set the goal, establishing the objective and putting in place the plan, there is little emotion to the trade. The moving averages showed the stock still moving higher, therefore the investor buys back as soon as her $75.00 strike was reached.

Should the 30 and 50 day moving average show a correction in the stock, the investor buys back and rolls the covered calls lower. You will see this as the fall of 2008 arrives.

CAT STOCK – The Decision NOT To Roll Above $85.00

There has to be a point where as an investor you feel that your stock is fairly valued. In 2007 the for Cat Stock high in July was $87.00. Cat stock had never been that high at any time in the past. By staying at the $85.00 strike the investor felt that if the stock got that high by November, it would be worth selling the shares and waiting for the stock to move lower before buying back in and repeating the process.

CAT STOCK – The Roll Down of Covered Calls:

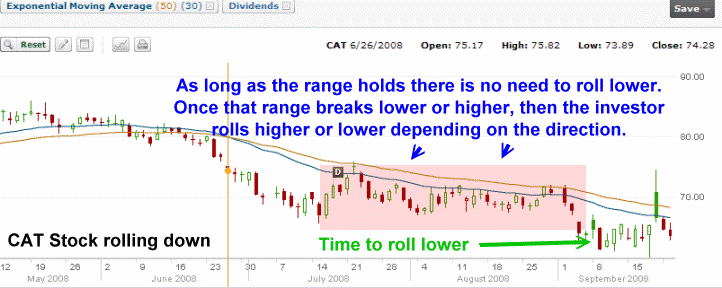

As the summer progressed Cat stock pulled back and the time came on June 26 2008 when the 30 day crossed the 50 day moving average and signalled the stock was in a downtrend. It was time to roll down the covered calls.

June 26 2008:

The 5 Nov $85.00 covered calls were purchased back for $4.80 = ($2416.24)

Sold 5 Nov $77.50 covered calls for $7.90 = $3933.76

Income earned = $1517.52

Income earned to June 26 = $3716.32

CAT STOCK – Continuing Rolling Covered Calls Lower:

The chart below shows the signal and the timing for the roll down of the covered calls. The choice of $77.50 for the strike was based on the decision to stay 1 strike above the present cat stock price.

As a sidenote, personally, when a stock is in a serious correction or the market is correcting such as in September to October 2008, I prefer to roll my covered calls into the money for extra protection, however my friend prefers to stay just out of the money.

The decision to stay in the same month is based on the knowledge that should CAT stock recover, the ability to roll back up will afford a better opportunity from the closer month. As the stock works its way toward November, the option premium will decline as it reflects the declining time before options expiry. By staying in the same month, if the stock should recover, the investor has a better chance to buy back the covered calls and roll higher up for a net credit by going further out in time.

When rolling covered calls lower, an investor can check the stock and pick the strike levels to use as a yardstick to decide when to buy back and roll down the covered calls. With Cat Stock, $5.00 increments were used as the stock can easily trade within a 5.00 range in a day or two. By picking a $5.00 increment the investor is trying to limit the amount of whipsaw they can experience.

On July 17 another dividend was paid out: 500 shares X .42 = $210.00

Cat Stock: How To Decide When To Roll Again – Up or Down:

The decision to roll the covered calls again may seem difficult, but by looking at the stock range, it is actually pretty simple. The stock after falling in June, set up a new trading range. Therefore it makes better sense to hold the Nov $77.50 covered calls while the stock is stuck in this trading range. By doing this, the option premium will continuously decline as November approaches and by staying out of the money the investor has little risk of assignment.

When the range breaks, either higher or lower, then it is time to roll the covered calls again. The whole purpose of rolling down is to capture more premium, protecting the investor’s capital while at the same time being aware that the stock could move back up or lower still. Rolling covered calls lower is actually simple to do, but many investors fear rolling lower and do not do it often enough during periods of weakness.

On September 9 2008 CAT stock collapsed 5.5% and closed at the low of the day at $61.38. The following day the investor rolled her covered calls down.

Sept 10 2008:

The 5 Nov $77.50 covered calls were purchased back for $1.05 = ($541.24)

Sold 5 Nov $65.00 covered calls for $3.70 = $1833.76

Income earned = $1292.52

Income earned to June 26 = $5218.84

Capital In Cat Stock = 500 shares X 62.15 = $31084.99

Return to Date = 16.78%

CAT Stock : The October 2008 Collapse:

The decision to roll down with every $5.00 move lower in the price of the stock was not as easy as it would seem. Primarily because the volatility was so enormous that the stock could swing $5.00 in a single trading day. But at the same time in a serious bear collapse it really doesn’t matter because an investor knows the stock is going to fall lower along with the market until it finally bottoms. Once the stock bottoms there will be enough time to buy back and roll higher should the stock recovery quickly.

Why Consider Rolling Covered Calls Down:

The most important aspect of the collapse is to bring in enough premium to keep protecting the original invested capital. By rolling lower and bringing in premium, the investor is effectively lower herself into the stock so when the stock recovers, the capital earned on the recovery will be much greater. When a stock falls, the investor wants to be paid back their lost capital. The only way to do this is either through buying a put which costs more capital, or through rolling down covered calls.

While an investor can consider not rolling down their covered calls and instead decide to commit more capital when he thinks the stock has bottomed, this can end up pulling more capital from the investor into the stock and there is no guarantee where the bottom is. Sort of a bottomless boat metaphor.

By rolling covered calls down the investor is having his capital returned and lowering his cost basis in the stock. In this way the investor does not need to be correct about the recovery point in the stock as she is effectively averaging herself down in the stock anyway but through having capital returned and not committing more capital.

The October Rolls Lower:

The CAT stock chart which follows the trades shows the days and the closing prices on those days. Remember that those are the closing prices and many days the stock swung 5%.

Here are the trades:

Oct 2 2008:

The 5 Nov $65.00 covered calls were purchased back for $1.75 = ($891.24)

Sold 5 Nov $52.50 covered calls for $5.80 = $2883.76

Total Income = $1992.52

Oct 6 2008:

The 5 Nov $52.50 covered calls were purchased back for $3.00 = ($1516.24)

Sold 5 Nov $45.00 covered calls for $6.05 = $3008.76

Total Income = $1492.52

Oct 10 2008:

The 5 Nov $45.00 covered calls were purchased back for $3.90 = ($1966.24)

Sold 5 Nov $40.00 covered calls for $5.10 = $2533.76

Total Income = $567.52

Oct 16 2008:

Dividend: 500 shares X .42 = $210.00

Oct 22 2008

The 5 Nov $40.00 covered calls were purchased back for $4.25 = ($2141.24)

Sold 5 Nov $35.00 covered calls for $7.45 = $3708.76

Total Income = $1567.52

Total Income For October = $5830.08

Total Income To Date = $11048.92

Capital In Cat Stock = 500 shares X 62.15 = $31084.99

New Cost Basis in Stock = $20,036.07 / 500 shares = $40.07

At this point the amount of capital returned to the investor = 35.5% of the original capital invested.

By October 27 2008, CAT Stock was at $32.35. The investor was sitting with a cost basis of $40.07 on the stock having earned $22.09 through selling covered calls and rolling down. She was holding the Nov $35.00 covered calls. If exercised at $35.00 the loss on the entire trade would be just $5.00 X 500 = $2500.00.

If the investor had not rolled down the loss on CAT Stock would have been probably around $12000.00.

To view today’s value of CAT Stock select here.