Bull put spread strategy is designed to work on stocks that are range bound or rising as the investor is bullish to neutral on the stock. The bull put spread is an often used financial investment strategy where the investor is not actually interested in owning the stock but more earning a profit from the spread he puts in place. When an investor considers option strategies for income, the bull put spread is a good choice.

Normally in a bull put spread, the investor wants to benefit from the range bound or rising stock but with more protection than a simple put selling strategy. As a financial investment strategy it is far more conservative than put selling and while less profitable it can still be a profitable option strategy for income.

Bull Put Spread – The Concept

The bull put spread concept is straight forward. The investor sells a put and then buys a lower strike put with the same expiration. When the trade is established the investor receives a net credit immediately since he sold a put and then bought a lower strike put. This is why many investors refer to the bull put spread as a bull put credit spread.

If the stock rises both puts expire worthless and the investor retains the net credit.

If the stock falls the breakeven is the higher strike less the net credit received. Unlike put selling, with a bull put spread any loss is defined at the outset of placing the trade.

Among Option Strategies For Income Bull Put Spread Is More Conservative Than Put Selling

The Bull Put Spread is more conservative than many option strategies for income including put selling and it is popular among option investors. When an investor gets involved in put selling, they have left the risk open to the downside on the stock. With a bull put spread, the investor has limited his downside at the outset of placing the trade. In return however he often will earn less than the put selling strategy, but not always.

Bull Put Spread Strategies Abound

There are many types of bull put spreads in use by investors. While they all have the same basic characteristic, buy a put, sell a put, there are many variations in use by investors. To understand more, let’s look at an example.

Bull Put Spread Example

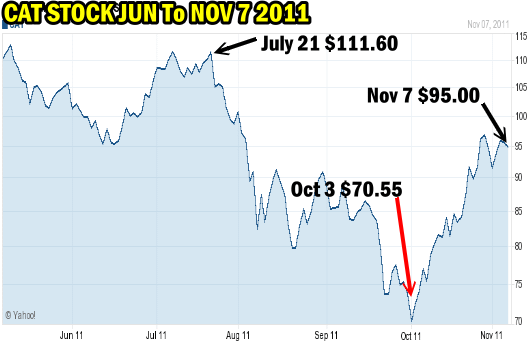

For our example I have chosen a fairly volatile stock, Cat Stock or Caterpillar stock. As of Nov 7 2011 Cat stock closed at $95.00. Select this bull put spread link to view the last 6 months of Cat Stock. Cat stock has been pretty exciting this year and for many investors it was an ideal candidate for the bull put spread strategy.

Cat Stock Chart From June to Nov 7 2011

Bull Put Spread Options

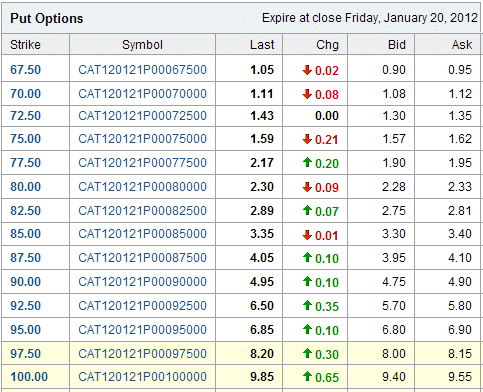

Below is the January 2012 Put Option chart for Cat Stock as of November 7 2011. An investor interested in putting together a bull put spread might choose these put strikes.

He might sell the January $85.00 for $3.35 and buy the January $75.00 for $1.59. Total net credit is $3.35 less $1.59 = $1.76. The break even on this bull put spread is $83.24. It is based on the $85.00 put strike sold minus $1.76 net credit on the trade for a break even of $83.24.

If by January options expiry the stock is below $83.24 the investor will lose money on this trade. In theory the worse loss that the investor could sustain would be realized if the stock fell to $75.00 by January options expiry.

If on January 20 2012 Cat stock is at $75.00, the investor would sustain a loss of $83.24 (Break even) minus $75.00 (bought put) = $8.24. Therefore on 1 put contract the investor could only lose $824.00 maximum on the trade.

Cat Stock January 2012 Put Options on Nov 7 2011

Bull Put Spread Advantages

These include a limited downside protection and income earned when a stock is range bound or moving higher.

Bull Put Spread Disadvantages

These include having a smaller return than a simple put selling strategy since the investor has spent some of the income earned to purchase a put for protection. As in the case of put selling, the upside is limited should the stock rise as the bull put spread establishes the income earned at the time of implementing the strategy. Again as in the case of put selling, the amount of capital that can be lost with a bull put spread is naturally greater than the amount of capital earned.

Bull Put Spread Summary

The bull put spread is a popular conservative option strategy where unlike put selling, the largest amount of loss is established at the outset on the trade. The bought put limits the downside risk and the sold put produces the income from the trade.

While in theory the maximum amount earned is set right at the outset when the trade commences, just as in most option strategies, there are many variations to the bull put spread and many ways to roll and adjust the bull put spread during its lifetime to earn more income and at times provide even more protection.