Bear Market Plunges Dow 634 Points

This is what I hate the most. Analysts everywhere “think” they know what is going to happen. When S&P downgraded the Triple AAA rating of the US Debt markets, analysts spoke about how any downgrade was already baked into the market. Don’t you just love that expression; “Baked In”. Well after a 634 point crash do they still think it was “baked in”.

So now when analysts tell you that any default by Greece is baked into the market remember – it isn’t. When investors are nervous NOTHING is baked into any market.

What I really enjoyed about today was watching President Obama try to calm the markets and then mention how he would be asking for extensions on unemployment benefits. What? Big mistake. Doesn’t this tell citizens that the economy is actually getting worse? Why would you seek unemployment benefits extensions if the economy is getting better? Did you see the selling increase after his comment? This just goes to show everyone that President or not, these are just ordinary people trying to do what they think is the best thing for the moment.

Overall I think the S&P comments on the downgraded tells the whole story. In my opinion they basically downgraded based on the belief that Congress, the Senate and the President have no idea how to get the US fiscal house in order. It appears that more and more citizens believe that the main focus of all politicians is to get re-elected rather than serve citizens and this belief appears to have good foundations.

Overall today’s market collapse should have been expected. Even the overseas markets didn’t fall as much as North American markets.

We all know that the markets are extremely oversold and should bounce, but that doesn’t mean it will happen. Instead I believe if there is a bounce or perhaps I should say when there is a bounce, there will be a lot of selling into it. Today’s market was ugly, ugly and ugly. Every little bounce no matter how small brought in more selling and the news that institutional players were now dumping stocks didn’t help the market any.

Bear Market Next Stop

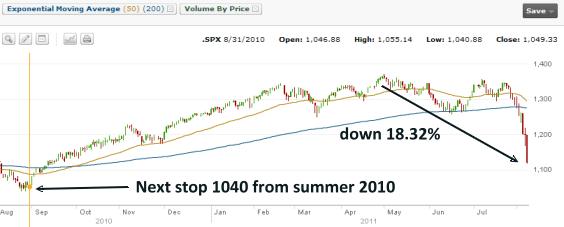

So where do we “fall” from here? Even if there is a rally I indicated in my August 1 market direction call that the bear market next stop for the S&P is 1175. The market reached that level with no problem and today closed at 1119.46. The S&P 500 has fallen 251 points from its high of May 2011. That’s a loss of 18.32%.

There is no need to look at the Dow Transport Index or the Financial Sector Index to confirm what everyone now knows. The market is in a severe bear market collapse. Once the S&P hits 1040 which is only 79 more points lower, where is the next support?

Looking at the chart below we can see that the summer 2010 market correction saw a loss of 208 points. In this bear market we are already down 251 points. Another 79 points puts us to 1040. I don’t see any support after 1000 in the S&P until 878. This would be another 297 points! Could the market actually fall that far?

Bear Market Direction – Conclusion

Unlike the collapse of 2008 to 2009, this bear market is not yet seeing financial crisis on a scale like that of 2008. As well corporate America is well financed and sitting on a mountain of cash. Earnings have been excellent, but that can change overnight. This then leads an investor to wonder is the selling overdone? I personally don’t have a clue. Panic selling leads to more panic selling until the market has had enough and the sellers are exhausted. The fact that the institutional investors came out today and sold large quantities does not bode well for the short term. This would seem to indicate that selling could easily continue.

Today for the first time the VIX showed real fear among investors as it closed at the high of 48.00. The very fact that it closed at the high showed just how devastating today was.

The markets have suffered a tremendous amount of technical damage. Moving to cash is definitely warranted by every investor. I closed a number of put contracts today as well and took the losses to get out and move to the side. Other positions such as Coca Cola stock I wouldn’t mind being assigned at the levels I have sold puts at.

It’s rare when a bear market has this much destruction at the outset, even if the bear started back in May. This really makes me suspect that as I indicated in my articles Dance Near The Exit of April 16 and Watch Out For June from Feb 11, this really wasn’t a new bull market but a balloon made with Fed dollars that burst as soon as the party ended.

This is a market to be careful in. I would rather hold SPY Puts in this bear market and be wrong, than hold stocks and be right.