AT&T Stock (stock symbol T) has been in my stocks to watch list for a while, but my capital was tied up with other stocks. Today (Jan 6 2011) I closed my position in MRK Stock and transferred the $70,000 I was using for that trade to AT&T stock (T stock) for the next two weeks. I sold the January $28 strike in AT&T Stock.

The $28 strike has reasonable support for this two-week period. To understand further how I decide on what put strikes to sell as well as my stock selection process, you can read this article AT&T Stock, Why T Stock? The stock selection process I applied to AT&T Stock is the same process I apply to all my stocks. That same process can be applied by any investor to any stock to understand better how to invest and how to avoid buying at over-valued levels in a stock such as AT&T Stock (T Stock).

Select this AT&T stock link to learn more about AT&T Inc for investors.

AT&T Stock – $28 Strike Puts Sold

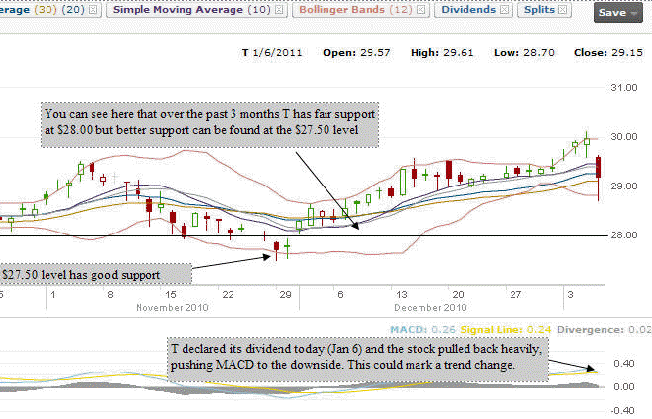

Today AT&T Stock paid its dividend and T stock pulled back hard pushing to the lower Bollinger Band and creating a great opportunity to sell the $28 strike for two weeks to earn a little more than 1/2 a percent return. If you read understanding my strategy you will see the reason for this trade. The 1/2 percent gain will be added to my MRK Stock return which means I have earned better than 1% for just a couple of weeks work.

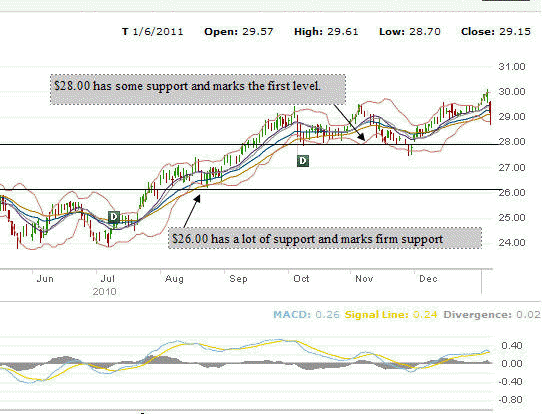

Looking at the 1 year T Stock chart (below) AT&T stock has a lot of support at the $26.00 strike and fair support at $28.00. While 2010 looks like it might have been a rather lackluster year for AT&T stock holders, it would have been a good year for put selling on T Stock. AT&T Stock had a very nice sideways range which would have provided decent monthly returns for those investors interested in put selling.

AT&T Stock (Stock symbol T) has been on my watch list for some time. Today I commenced put selling on AT&T Stock

Support Levels On AT&T Stock

Below is the 3 month AT&T stock chart. The support for T Stock at $28.00 is more obvious when viewed on this chart. Today’s AT&T Stock pullback pushed T stock to the lower Bollinger Band and turned MACD (Moving Average Convergence / Divergence) to the downside. While this could mark a downside trend, my strategy is to sell the $28 strike for 2 weeks. If the premium vanishes from the $28 strike or should the stock end up below $28.00 then I will buy to close my sold puts and roll them out to Feb. With good support at 27.50, I think $28.00 is a good choice for two weeks exposure to AT&T stock.

AT&T Stock for Jan 6 2011 shows the drop in the stock to the lower Bollinger Band

AT&T Stock Jan 6 2011 Summary of Trade

The importance of having a plan for every trade cannot be understated. I chose AT&T Stock not at random but after doing months of research and studying the chart pattern on the stock. I urge readers to read both my strategy article and the article Why T Stock to understand how I came to select my stocks and why selling puts on AT&T Stock (T Stock) at $28.00 makes a lot of sense.