ProShares lists itself as the alternative ETF company and they certainly have earned that name. They have a variety of ETFs including the popular AGQ ProShares Ultra Silver. AGQ ProShares seeks daily investment results before fees and expenses that are twice (2X or 200%) the daily performance of silver bullion as measured by the US Dollar.

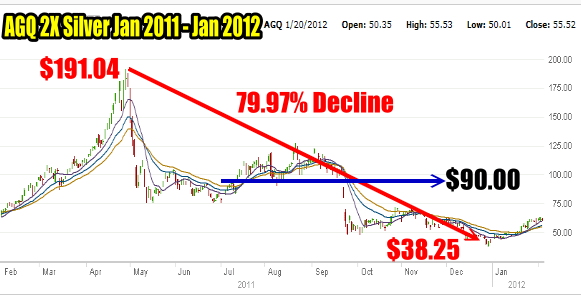

It goes without saying that AGQ is a very volatile ETF. The chart below is for the past 1 year. AGQ ProShares ETF has been as high as $191.04 and as low as $38.25 and today, Feb 3 2012 closed at $60.45 down 4% for the day. Obviously looking at the chart below, AGQ ProShares will not suit every investor.

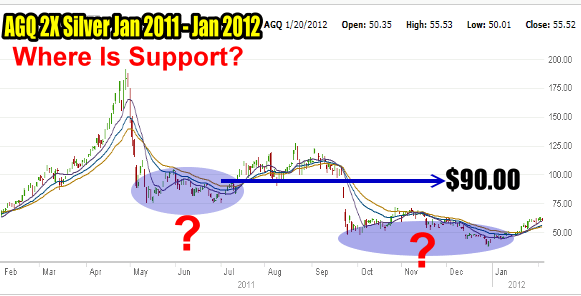

AGQ ProShares Ultra Silver Chart Jan 2011 to Jan 2012

Reader’s Question On AGQ ProShares

Recently I received an email from a reader, Dan, who is holding 4500 shares in AGQ ProShares ETF with the average cost of $90.00. We have had a few emails back and forth and I am going to summarize his position and questions to make it easier to discuss possible strategies going forward.

Understanding AGQ ProShares

Before summarizing his questions, it is important to understand a few things about AGQ ProShares ETF. It does not hold ANY silver. As well, with 2X and 4X funds, the daily results will slowly be skewed a bit with each passing week just due to the nature of a fund giving 200% daily returns. In other words, if silver and the US dollar did not move for an entire year, this fund’s price would not be the same but would slide a few pennies every week. That’s the nature of a 2X ETF. A 4X ETF is of course worse. This is a tracking issue which is related to these Ultra type funds. Therefore these funds are not meant to be held for long periods of time, such as years. Select this AGQ ProShares link to view the ProShares website.

Next it is important to understand that as the US Dollar declines or rises, AGQ ProShares Silver ETF will also move. If the US Dollar rises, AGQ ProShares ETF could fall in value. If the US Dollar falls, AGQ ProShares ETF could rise in value. This is because the price of silver is tied to the US Dollar.

Last, it is important to also understand that all commodities are reasonably volatile. Demand and supply has a lot to do with pricing, swings in the US Dollar as well as manipulation at various periods.

Readers now understand that AGQ ProShares 2X silver ETF will fluctuate widely, and is at the whim of supply, demand, manipulation and US Dollar moves. It is VOLATILE usually in excess of 94% daily volatility. But that volatility is what investors in commodities like, as well as those that do specific types of option trades. Premiums on the options connected to AGQ ProShares are always high.

Reader’s Position Summarized

Dan has been in AGQ ProShares ETF for a short while and has traded enough options to get his break even down to $75.00 a share. So his cost is $90.00 and his break even $75.00 (good going Dan). Dan is presently holding 45 March Covered Calls at the $90 strike. Therefore if AGQ ProShares reaches $90 by March and Dan is exercised, he will make $67,500.00 or 16.6% which is not bad at all.

Dan Is Bullish On Silver And AGQ ProShares ETF

But Dan doesn’t want to hold out for $90.00. Dan is bullish on silver. He believes silver will get to between $150 and $300 per oz in the future, which he thinks should mean AGQ ProShares ETF will be around $500 per share. That would put his value at over 2.2 million and Dan could pretty well retire I should think.

Dan does not want to put any more capital into this trade. He is looking to keep generating income to reduce his cost basis of the 4500 AGQ ProShares ETF shares he is holding while waiting for silver to rise in price.

That’s Dan’s case in a short summary.

My Approach To This Financial Investment

When asked if I could provide some strategies that Dan could consider, I realized that there are three over-riding factors that have to be considered.

1) Dan believes silver is moving a lot higher. Therefore it is important to not get trapped selling covered calls too close to the money or his average share cost, as to be exercised out of the shares below his cost would create a loss.

2) Dan does not want to put any more of his own additional capital into the trade.

3) Commodities swing a lot. AGQ ProShares ETF has many days with more than 4% swings. Therefore it is important to take advantage of those swings.

Every Investor Is Different

It is important for readers to understand that every investor has different outlooks and levels of risk. I tend to be neutral to more conservative. I am definitely not a large risk taker. That does not mean I do not like trading commodity related stocks and ETFs but I am always aware of risk and I do not like to take on too much risk. When reading through all my strategy suggestions for AGQ ProShares ETF, remember my disclaimer. Nothing I write is financial advice or recommendation. You trade at your own risk. Before outlining my strategies I want to thank Dan for his donation to assist me with the time for this article.

Looking Backwards Before Forwards On AGQ ProShares Ultra Silver ETF

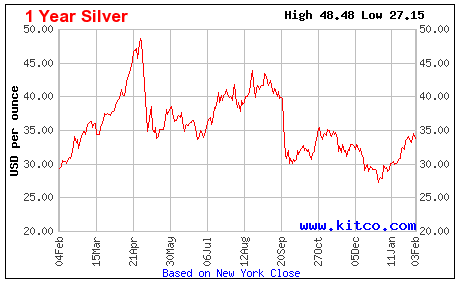

One Year Chart – Price Of Silver

The 1 year chart for silver is below. The problem here COULD be that silver rose too quickly and needs time to consolidate before moving higher. This is a comment often heard in precious metals particularly gold. Those who believe strongly in Gold moving into ranges over $3000.00 believe that the global economic crisis will collapse the US Dollar and drive Gold to extreme prices. It’s sort of a doomsday scenario. They could be right of course and they could also be wrong.

When AGQ ProShares ETF fell in May 2011 it was also during a period when the US Dollar rose. The price of silver fell from $48.552 to an eventual low of $27.007. A lot of the decline in AGQ ProShares this year coincides with the rise of the US Dollar.

Price Of Silver For Jan 2011 to Jan 2012

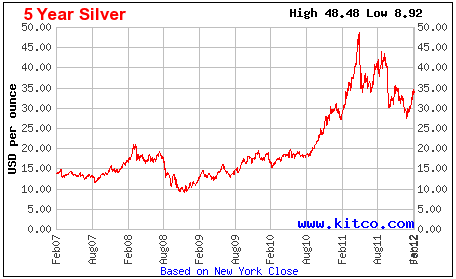

Five Year Chart – Price Of Silver

The 5 year chart on silver from Feb 2007 to Feb 2012 is not nearly as bullish.

5 Year Chart Price Of Silver

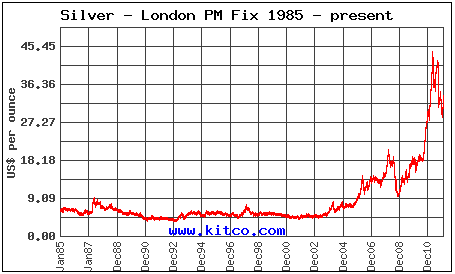

Price Of Silver Since January 1985

Looking back even longer to 1985, the price of silver has been reasonably steady. However since 2005 the price has moved higher. All of these silver charts do not take inflation into account so you can understand that the price of silver has in fact declined over the past 20 years as it did not keep up with inflation.

The Price Of Silver Since 1985

So What Could Be Driving The Price Of Silver Higher?

So what has changed since 2004 to begin to see a rise in the price of silver?

For one thing, the US Dollar is weaker which has definitely inflated the price of silver. However the demand for silver is also rising as more cellphones, laptops, tablet’s and all kinds of hand-held devices are growing in demand. They all use silver within their components and electronic boards. As well jewelry has been a big user of silver for decades and while it shows no signs of slowing demand, it doesn’t show any signs of widely expanding demand either. Therefore silver’s rise and fall could be tied into the Us Dollar and the electronics demand, more than investors’ realize.

While this may not mean a climb into the $300.00 range any time soon, it could mean that there is a floor under the silver price that is no longer at $8.00 to $10.00 an ounce as was often the case in the past. Instead silver could set a base around $25 to $30.00 an ounce and then begin a climb from there with periods of weakness followed by a further climb. I think this could take a long time and I certainly wouldn’t expect this to happen overnight. This though is just a prediction. No one knows what the future may bring. If for example the weakness in the US Dollar today is the worst the market will see and the US economy does turn the corner so to speak, and get its deficit under control then the US Dollar could rise strongly which would be negative for silver.

As well, the rising price of silver could bring new substances to market for handheld devices to replace silver. As everyone knows, when a commodity becomes too expensive, alternative products are experimented with, developed and often used in replacement. I would think this would be detrimental to the price of silver.

Back To The One Year Chart

That brings me back to the 1 year AGQ ProShares ETF chart below. If this was a stock I would be concerned. It has a natural collapsing pattern and an inability to hold new highs. But this is not a stock, but a silver 2X ETF. When AGQ ProShares ETF fell in May 2011 it was also during a period when the US Dollar rose. The price of silver fell from $48.552 to an eventual low of $27.007.

If I look back 1 year and try to find support it’s a tough call because this is a commodity trade and not a stock. There are however two areas where I might believe there could be a decent trade. The first is from May to Jul 2011 when AGQ ProShares ETF was trading between $75 and $95. We can see looking at the chart that Dan’s shares are near the high range. However Dan has through selling covered calls, taken his break even on AGQ ProShares ETF down to $75.00 which is the low-end of the summer range. This could end up being a good thing if AGQ rises that high by March 2012.

The second level of support is from October 2011 to early January 2012 when AGQ ProShares ETF traded in a range between roughly $45 to $64. In the last few trading sessions AGQ ProShares ETF has risen back into the high-end of that range.

AGQ ProShares Chart For 2011 - 2012 Trying To Find Support

AGQ ProShares ETF Key Aspects Of Trading Strategies

Based on the above information and my past trading knowledge I can come up with a number of key aspects that could be used to develop different trading strategies for AGQ ProShares. They are:

1) Options can be sold but not over long periods of time.

2) I would suggest not covering all shares with covered calls but leave some open to be able to move up if the price AGQ ProShares does move up and traps any sold covered calls.

3) On large dips I would suggest selling small amounts of puts in AGQ ProShares but these puts must only be sold when dips are large, pushing volatility higher and inflating put premiums.

4) I would suggest setting up technical indicators to follow the AGQ ProShares ETF to try to spot periods of strength and weakness to help pinpoint when to sell options and buy them back. Bollinger Bands will be critical along with rate of change and momentum. The Ultimate Oscillator will not be as helpful with a 2X Silver fund as there are other factors besides just investors buying and selling the shares of the ETF that drives AGQ. I would also use these indicators to spot support areas to consider for selling puts or if more conservative put credit spreads.

5) I would suggest using these indicators to assist in knowing when to lighten up on AGQ ProShares ETF shares and when to add to positions.

6) Since Dan is long-term bullish on silver, every time $45,000 is earned he could consider retiring 500 shares from selling options. This means he will eventually end up with shares of AGQ ProShares ETF that will be free of covered calls, paid for entirely by earned income and allow him to take advantage of moves higher without having to buy back and roll up covered calls. Over time he could eventually end up with 2000 shares paid for which would assist with the tracking problem of 2X and 4X type ETFs since basically all his capital will have been returned for those shares. That way if he is wrong and the price of silver does not climb then he can at least take comfort in knowing that he is not losing any capital on shares that are complete paid for from selling options.

7) At the same time a different approach could be a combination of 6 with 7. Income earned from the selling of covered calls could instead be used to sell cash secured puts which would eventually buy more shares in this AGQ ProShares ETF OR simply be used to cover any POSSIBLE assignment but if no shares are assigned then additional income has been earned which could be used to work toward retiring more shares already being held.

8) It is important to buy back sold options as soon as they reach a decent return. I always pick 80% or greater on any sold options to buy to close and wait for the next cycle to begin selling covered calls again. It is important to use the technical indicators to spot those periods when it is best to close and when it is time to buy to close.

9) It is important to NEVER sell covered calls when AGQ ProShares ETF or price of silver is in a pronounced decline.

10) It is always important to buy to close covered calls when AGQ ProShares ETF turns back up.

11) It is important to watch volatility to take advantage of it. While with an ETF like AGQ ProShares, using the Greeks is of limited value particularly on a 2X Commodity ETF, the Greeks can still be consulted to view volatility daily and watch for periods of higher volatility to assist in timing when to sell puts and when to sell covered calls.

To decide which of the above 11 key aspects to apply or combine into different strategies would depend on the investor, their goal, outlook, risk level, and investing style.

Dan has indicated he is long-term bullish on AGQ ProShares Ultra Silver ETF and in Part 2 and Part 3 of this article on AGQ ProShares I have laid out some of the strategies I have considered based on the 11 key aspects and Dan’s outlook.

Go To AGQ ProShares Ultra Silver Investing Strategies Part 2

Go To AGQ ProShares Ultra Silver Investing Strategies Part 3

You May Also Want To Read:

Read AGQ ProShares Ultra Silver Investing Strategies Part 1

Read AGQ ProShares Ultra Silver Investing Strategies Part 2

Read AGQ ProShares Ultra Silver Investing Strategies Part 3

Read AGQ ProShares Covered Calls Questions