Example Of My Strategy – Coca Cola Stock (KO)

This article was written on April 29 2010. I have developed my investing style over the past 35 years. It is important to remember that for me, I have a large chunk of cash sitting ready to jump into my stocks. For example, if Coca Cola Stock fell to $40.00 over the next few months, I would be writing puts all the way down and collecting stock when I was finally ready to be assigned. I only trade large caps and only a handful.

On the stocks I follow, I read everything I can. I know how much money I have available and how much I am ready to put to work and at what prices. KO Stock is a good example. I am presently holding puts at these levels: $57.50; $55.00; $52.50; $50.00

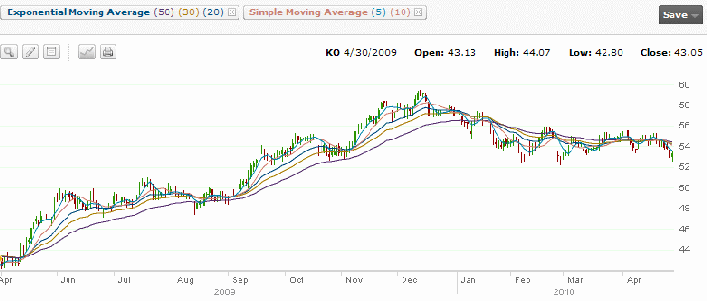

Coca Cola stock today (April 29 2010) is at $53.36. Look at the chart below for the past year. It has run up from $42.80 to above $59 around Dec 11 2009 and since then it appears to me to be in a trend down. It now appears range bound and has been for more than 3 months. I have $113,500 earmarked for all the naked put positions I am holding and I have another $50,000 earmarked for this stock if it should fall back to the upper $40’s.

But it will be months before I take assignment on any of my positions. I will continue to roll my puts, up, down, sideways, whatever until there is no premium left. Then I might just close and move lower or finally accept assignment on some shares.

Meanwhile since May 2009 I have earned about $13,000 to date in income. So far this year (2010) I have only earned about 2.5% on my capital, plus whatever I can get with the capital being held in a savings account – about 0.70% more. But my strategy is long term. I will be in Coca Cola Stock for years unless something fundamentally changes.

With $13,000 earned, I could decide to take assignment on some KO stock shares and use up the $13,000 I made (I am hoping for Coca Cola Stock to fall below $50). Then I move on and earn more – perhaps another $13,000 over time. Then maybe take assignment on some more Coca Cola Stock. All the while I am holding my capital in reserve and building up earned income which will eventually place me in KO Stock without requiring much of my own money.

I am a long term thinker. My day to day needs are not very much. I pick large caps and work them for income and eventually own a lot of shares which are often taken out with calls. I live in a moderate house and my expenses are easy to pay and I carry no credit card debt.

I think the most important aspect of my strategy is I maintain a large cash reserve and I am in for the long haul. The stocks I have naked puts, and covered calls on, I am not concerned about their downside.

If the market tanks, I am a happy camper. My puts skyrocket. I can usually buy and roll them for much better premiums, and when the stock collapses I am there with my broom of cash– to sweep up the pieces so to speak and take advantage of the fire sale prices.

Coca Cola Stock Example – Summary

This example of Coca Cola Stock is just a sampling. I suggest reviewing the various trades I have on my site for the past few years. As well review some of the current trades including the Coca Cola Stock trade to study my strategy further.

Remember that my strategy is one I have developed over many years and it suits my level of investing comfort and investing style. I am presenting it here not for others to duplicate, but for other investors to consider refining or including parts of it, to develop their own unique investing strategies.

Additional Reading:

2. The Author Of FullyInformed.com

3. How I Treat My Investing Like A Business

4. Stock Commission Rates Make A Difference

5. The Importance Of Having A Plan