Market timing technical indicators yesterday warned that if there was a bounce today, it should be ignored. Well no problem of that as the market sold off from the start and kept on falling.

Unfortunately I do not have a lot of time this evening for personal reasons so I just wanted to share the market timing technical indicators after the market close.

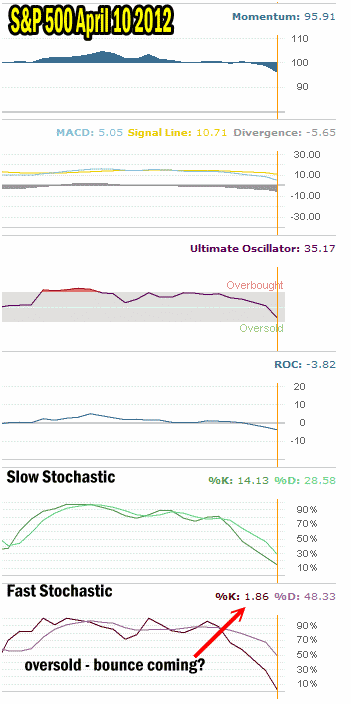

Market Timing / Market Direction Indicators For Apr 10 2012

The market timing technical indicators show that stocks are falling into deeply oversold territory. The Fast stochastic is at 1.86 which is incredibly low. This shows how bad the sentiment was today. Meanwhile the Slow stochastic is down to 14.13 and the ultimate oscillator is at 35.17.

Market Timing / Market Direction Technical Indicators For April 10 2012

All of this shows the market is oversold and a bounce could be imminent. The S&P bounced off the 1350 which if you recall from my previous market timing column is the mid-way point I expected. If the S&P holds here then we could see some sideways action. If the 1350 breaks decisively then look for the S&P to fall another 25 points.

I am betting on the 1350 area holding and a bounce in the works. After that it will depend on the mood of investors and their fear of European debt problems getting larger.

I will post more tomorrow including my spy put trade and I will try to answer all the questions I have received in a post tomorrow as well.

Market Timing / Market Direction Conclusion For April 10 2012

Take care and keep some cash ready for opportunities. Remember, I am looking for a bounce, then a retest of 1350 and then either it will hold or the S&P falls to 1325.