Market timing today (Nov 2) was pretty straight forward. After two days of heavy selling, in particular yesterday, I would have expected a bounce today especially with the S&P so close to the 1200 level. This is exactly what happened. Sometimes market timing is easy and today was one of the easiest in a long time.

I received a number of emails wondering if I was selling puts today. It was yesterday during the plunge that was the time to be selling puts. When the market direction moves back up as it did today, it is best to wait for the next move down before considering selling more puts.

Today was just a relief rally in my opinion and there will be more opportunities ahead to sell puts on my favorite stocks. The chart for today is pretty easy to read technically.

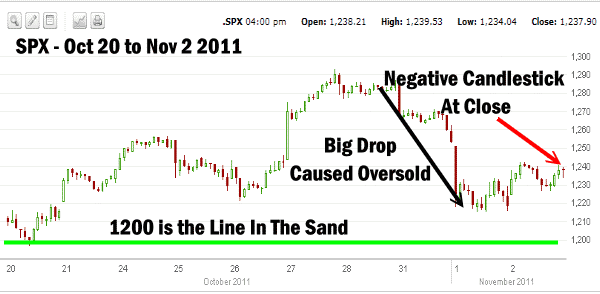

Market Timing / Market Direction Chart for November 2 2011

Today’s chart has lots of warning signs. Let’s review them.

The last two days has seen a big market direction drop in the markets. This created an oversold condition which resulted in today’s bounce. It’s a straight forward market timing analysis.

At the close the candlestick was negative warning that the market direction may change back to down. I have also marked on the chart the 1200 level which in my opinion in the line in the sand. If the market direction turns nasty and stocks break through, then the bear market is alive and kicking.

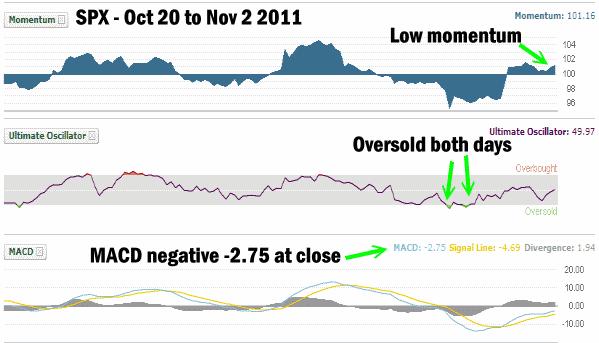

Market timing indicators abounded today with warnings signs that this latest rally should not be bought. Here are the easiest to spot:

1)Momentum was poor at best.

2) The ultimate oscillator is flashing two oversold days in a row which again advised that today could see a bounce.

3) MACD remained negative all day and even at the close it was a negative 2.75. MACD was not confirming the market direction back up. Select this market timing link to learn more about what is MACD.

Those who read my early warning tools article know that MACD can often point out market direction even when investors believe the market is heading in the opposite direction.

Market Timing / Market Direction – Summary for November 2 2011

It isn’t rocket science but it is surprising how often market timing has saved me from making a mistake. Today was not the day to be selling puts. Even if the market tries to climb tomorrow there does seem to be more downside risk ahead which means more opportunities to sell puts.

The market direction continues to point lower and market timing indicators are all confirming it.