SPY PUT hedge is without doubt my favorite method of protecting my entire portfolio. Why more investors do not hedge with options, is a question I am often asked. I have no answer. Today is an excellent example. Yesterday the market shot up on unconfirmed news that a 2 trillion-dollar amount was being rumored as the size of a fund to try to turn the tide on the European Debt Crisis. Exactly how piling more debt on already unmanageable debt is going to help is obviously beyond the comprehension of a small investor such as myself. Nonetheless the rumors were just that, so far anyway.

I would think that most investors knew that the stock markets would fall today because it was just a rumor. Near the open I watched for signs of overbought conditions on the ultimate oscillator on the S&P 500 and sure enough, they appeared. I then put in place my SPY PUT by buying the Nov19 $121 puts for $3.31. To hedge with options is easier than investors realize. The SPY Put has to be the simplest of hedges. I believe the key is confidence, confidence in market direction and confidence in my purchase decision. If you are second guessing your trade then doing a hedge with options is not going to work in any scenario.

The last few days of the latest run-up has my email box full of questions asking me if the bear market is over and the bull has returned. Yet few investors could see that this latest run-up is exactly what a bear market does. Remember the sentence, bear markets have hair-raising rallies and spine-tingling plummets. In my opinion until the European Debt Crisis is pushed down the road, permanently for a few months or even 6 months to a year, the market is going to stay stuck. It is with this confidence that I am able to put in place my hedge with options through using the SPY PUT.

SPY PUT – Hedge With Options – OCT 19 2011

Below is today’s SPY PUT trade. After yesterday’s big run based on nothing more than the rumor of the 2 trillion fund to solve Europe’s debt crisis, I had confidence the market would pull back. I set the spy chart for 1 minute and I waited for the first overbought indicator from the Ultimate Oscillator and then bought the puts for my spy put hedge. Note how after buying the market continued to move higher. I bought 20 contracts because it is obvious to me that until something of substance comes out there is no way this market can reclaim the 200 day moving average.

Again to repeat, confidence in the market direction and confidence in my decision are key to putting in place a hedge with options, specifically my SPY PUT hedge.

Around 3:00 PM I sold my puts. There is no reason for me to hold the spy put hedge longer than today. All I want is to build up my cash cushion.

SPY PUT – Hedge With Options – Value Of The Cash Cushion

My SPY PUT cash cushion is something I have talked about for 3 years on my blog. The whole concept of my hedge with options is to buy and sell the SPY PUT hedge as often as daily and as long as a few days, but never longer than a few days. If you look at the past spy put trades below you can see the results of doing small trades repeatedly. In the spreadsheet below I have removed all the trades prior to Sept which takes out the trades from the biggest drop in August.

Looking through the SPY PUT chart you can see the value of using a hedge with options to build up a cash cushion to protect your overall portfolio. Many investors buy individual stock puts to protect their favorite stocks from a downturn. However the cost to protect more than a half-dozen different stocks is too costly and demands monitoring a number of positions and not just one.

By using a hedge with options such as the SPY PUT hedge, or possibly a contra ETF an investor can build some protection into their portfolio and watch just one trade.

5 KEY POINTS – SPY PUT – Hedge With Options – Trade Chart Sep 1 to Oct 19 2011

Glancing through the SPY PUT HEDGE CHART below, 5 key points stand out:

1) FREQUENT SMALL TRADES: The frequent smaller trades add up quickly to keep ballooning my cash cushion.

2) CONTROL LOSSES: Since the cash cushion grows, it also protects when my purchase of the SPY PUT hedge is wrong. A good case in point is the spy put trade of Sept 9 through to Sept 15 2011 which I have highlighted in red. That trade was one of the worst I have done in 3 years. The loss was $3688.00. While the amount lost may seem small, it is an overall loss of 17.7% in just 5 short trading sessions. However because of the constant ballooning effect of the cash cushion the loss is minimized as much as possible and within a few more SPY PUT trades the losses are covered.

It’s important to realize that no matter how long you have been investing you will still make mistakes. What you are trying to do is learn from the mistake and not repeat it often. In my loss I made several mistakes which I should have not made since I made them years earlier. I bought too many SPY PUT contracts to start, convinced the bear market would push a large collapse. I held too long when the market turned back up still convinced that my call for a downturn was correct. Instead I should have sold more than the 10 initial puts I closed as there would have been a profit. Instead I held the remaining puts rather than realize that in a bear market nothing is a sure thing.

3) SHORTER DURATION IS BEST: Holding the spy put hedge longer than a few days rarely works. This is because in a bear market, there are lots of whipsaws. The market gyrate from up to down and sideways which means that holding the spy put hedge for longer than a day can be very problematic. When the stock market day ends negative, there are absolutely no assurances the following day will continue that trend. Bear markets do not set reliable trends. They plummet, then recover only to possibly plummet again.

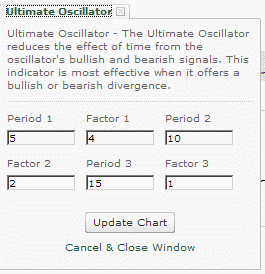

4) USE TECHNICAL TOOLS TO PINPOINT BUY AND SELL: Buy and selling the spy put hedge daily is easier when using such technical tools as the ultimate oscillator or 5 day simple moving average. While there is much debate about the merits of technical tools in stock market investing, my experience is that anything that can help should be used. There are many other technical tools available that work. Investors should study those tools to decide their value for their style of investing.

Below are my settings for the ultimate oscillator.

5) FORGET TRYING FOR THE TOP OR BOTTOM: When an investor uses a SPY PUT hedge or any hedge with options they do not need to catch the top or the bottom of a day’s movement. An investor only needs to be right some of the time. When there is a profit, it’s a profit, period. No matter how small or large, each profit keeps ballooning the cash cushion which provides that protection for the overall portfolio.

| Sep 6 11 | 115.59 | Bought 30 SPY Puts 22OCT11 $115 @ 5.37 | 32.00 | (10772.00) | ||

| Sep 6 11 | 114.75 | Sold 20 SPY Puts 22OCT11 $115 @ 5.87 | 32.00 | 11708.00 | 936.00 | 56533.00 |

| Sep 9 11 | 116.52 | Bought 40 SPY PUTS 22OCT11 $115 @ 5.19 | 57.00 | (20817.00) | ||

| Sep 12 11 | 114.25 | Sold 10 SPY PUTS 22OCT11 $115 @ 6.21 Comment: This leaves me with 30 SPY Puts still being held | 19.50 | 6190.50 | ||

| Sep 14 11 | 117.60 | Sold 10 SPY PUTS 22OCT11 $115 @ 4.45 Comment: I was stopped out at $4.45 – I have moved the remaining 20 stops higher | 19.50 | 4430.50 | ||

| Sep 15 11 | 119.67 | Sold 20 SPY PUTS 22OCT11 $115 @ 3.27 COMMENT: I was stopped out again ending the SPY Put trade. Obviously the market is moving higher at this stage. This is the great thing about the cash cushion I build throughout the year. When I am wrong, such as on this purchase of the SPY Puts, it protects me from the losses. To read an extensive article about this SPY PUT trade and the loss taken, click here. | 32.00 | 6508.00 | (3688.00) | 52845.00 |

| Sep 16 11 | 121.88 | Bought 10 SPY PUTS 22OCT11 $122 @ 4.37 | 19.50 | (4389.50) | ||

| Sep 16 11 | 120.66 | Sold 10 SPY PUTS 22OCT11 $122 @ 4.92 To review this trade you can read my comments and charts here: | 19.50 | 4900.50 | 511.00 | 53356.00 |

| Sep 16 11 | 121.60 | Bought 20 SPY PUT contracts 22OCT11 $122 @ 3.90 Comments: I plan to hold these over the weekend. You can read further here: | 32.00 | (7832.00) | ||

| Sep 19 11 | 118.91 | Sold 20 SPY PUT contracts 22OCT11 $122 @ 5.25 | 32.00 | 10468.00 | 2636.00 | 55992.00 |

| COMMENTS: Read the comments regarding the September 22 2011 trade here. | ||||||

| Sep 22 11 | 113.56 | Bought 20 SPY PUT contracts 22OCT11 $113 @ 4.42 | 32.00 | (8872.00) | ||

| Sep 22 11 | 113.12 | Sold 20 SPY PUT contracts 22OCT11 $113 @ 4.99 | 32.00 | 9948.00 | 1076.00 | |

| Sep 22 11 | 113.31 | Bought 20 SPY PUT contracts 22OCT11 $113 @ 4.69 | 32.00 | (9412.00) | ||

| Sep 22 11 | 112.86 | Sold 20 SPY PUT contracts 5.21 | 32.00 | 10388.00 | 976.00 | 58044.00 |

| Sep 30 11 | 115.15 | Bought 30 SPY PUTS 19NOV11 $115 for $6.05 | 44.50 | (18194.50) | ||

| Sep 30 11 | 114.19 | Sold 10 SPY PUTS 19NOV11 $115 for $7.05 | 19.50 | 7030.50 | ||

| Oct 3 11 | 112.13 | Sold 20 SPY PUTS 19NOV11 $115 for $7.30 | 32.00 | 14568.00 | 3404.00 | 61448.00 |

| Oct 3 11 | 113.48 | Bought 20 SPY PUTS 19NOV11 $113 for 5.92 | 32.00 | (11872.00) | ||

| Oct 3 11 | 111.01 | Sold 20 SPY PUTS 19NOV11 $113 for $7.15 | 32.00 | 14269.00 | 2396.00 | 63844.00 |

| Oct 3 11 | 110.97 | Bought 20 SPY PUTS 19NOV11 $111 for $6.27 | 32.00 | (12572.00) | ||

| Oct 3 11 | 110.37 | Sold 20 SPY PUTS 19NOV11 $111 for 6.89 | 32.00 | 13748.00 | 1176.00 | 65020.00 |

| Oct 19 11 | 122.60 | Bought 20 SPY PUT Contracts 19NOV11 $121 for $3.31 | 32.00 | (6652.00) | ||

| Oct 19 11 | 120.95 | Sold 20 SPY PUT Contracts 19NOV11 $121 for $4.21 | 32.00 | 8388.00 | 1836.00 | 66856.00 |

CONCLUSION – SPY PUT – Hedge With Options

The importance of the SPY PUT, or any hedge with options, cash cushion cannot be understated. My cash cushion is now at $66,850.00. My entire US Portfolio of stocks has a total capital committed of $609,400. I am now protected against a 10.9% loss in the entire portfolio. Coupled with my selling puts far out of the money and deep in the money calls, my entire portfolio has decent protection for downturns.

The present bear market offers a unique opportunity for investors to paper trade and learn how to hedge with options.

Additional Reading:

Other articles about using the Ultimate Oscillator

Understanding SPY PUT Hedge Strategy – Part 1

Understanding SPY PUT Hedge Strategy – Part 2

Understanding SPY PUT Hedge Strategy – Part 3

1 Year SPY PUT Chart

Other articles dealing with the SPY PUT hedge