Collar Strategy is a great way to buy into a stock during a bear market without worrying about the stock collapsing and taking your capital with it. But many investors hate using a Collar Strategy as they perceive it as being too expensive. Indeed to put a collar option in place on a stock will cost capital, but if the goal is to seek a capital gain and protect from capital losses then the Collar Strategy makes sense.

As well when a collar option is purchased an investor can use selling out of the money covered calls to help pay for the Collar Strategy. There are a number of methods to using a Collar Strategy. It is important for an investor to decide which collar option suits their style of investing and their goals and objectives. Remember that goals and objectives are of prime importance in any investing strategy, collar option or otherwise.

Collar Strategy – Quick Explanation

A Collar Strategy is a basic strategy that anyone can use. In its most basic form an investor buys stock and buys puts to protect the stock from falling and sells covered calls to defray the cost of the puts. In essence they have put a collar option around the stock. For example, an investor buys 500 shares of ABC stock for $30.00. The investor then puts in play a Collar Strategy by buying 5 PUT Contracts, perhaps 2 to 6 months out at the $30.00 strike. He then sells covered calls at 2 to 6 months or longer) perhaps at $40.o0 to help pay the price of the puts. Now if the stock falls lower he is protected from devastating losses because he has put a collar option on his stock. He has also limited his upside to $40.00. That’s the theory but there are lots of adjustments that can be made.

The Downside of the Collar Strategy

The problem with the Collar Strategy for most investors is the cost of the Collar Strategy which means the investor has bought ABC Stock for $30.00 and then bought a $30 put for possibly $3.00 to protect his stock.

Therefore if ABC stock falls to $27.00 dollars, he still has a $3.00 loss because the $30.00 put cost $3.00.

If ABC Stock rises to $33.00, he has made no money because he spent $3.00 to buy the put, for a total capital outlay of $33.00. $30.00 for the stock and $3.00 for the put to secure the position with the Collar Strategy.

Collar Strategy – Other Collar Options

The way around this is to think outside the box and consider the overall goals and objectives of why you bought the stock. If the stock is a dividend paying stock and you want to earn the dividend long-term and do not care to ever receive your original capital back, then do you really need a Collar Strategy?

For example an investor who buys Coca Cola Stock may never want to sell it, but just keep earning the dividend and hope that Coca Cola keeps increasing the dividend annually. If this is the case then do you want a Collar Strategy at all?

But if you bought the stock for a capital gain, and want to protect yourself against a loss then you can consider the Collar Strategy from a different perspective.

I will use Apple Stock for this Collar Strategy example as presently many investors believe that Apple Stock is a great play for a capital gain. It certainly seems like Apple is doing everything right, but it has already had a great move last year and again this year. Therefore an investor in Apple Stock may love the idea of getting into Apple Stock, but is worried about a possible downturn in the near future. This is the chance to use the Collar Strategy.

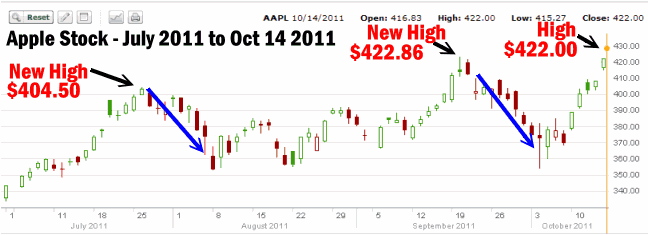

Below is Apple Stock chart since July 2011. On Friday Oct 14 2011 AAPL Stock closed almost at the most recent high. This is a very bullish sign and the candlestick was bullish as well.

But if you have read my articles about Learn From The Bear, the Royal Bank Stock article, Cat Stock article and JNJ Stock article, you know that when a stock makes a brand new high, it more often than not pulls back. In fact if you look at the AAPL Stock chart below you can see how Apple Stock has pulled back with the last two most recent highs, so there is probably a pretty good chance that Apple Stock will pull back from here. Perhaps not immediately but certainly within a couple of sessions.

If I want to buy it how should I protect myself? This is the perfect play for a Collar Strategy.

Collar Strategy – Collar Option 1

If I wanted to buy Apple Stock for a capital gain and protect myself at the same time, I have to decide how much loss I am willing to give up in the event the stock falls. To put in place a Collar Strategy I need to know what put strike I want to buy.

I can buy a put at the $420.00 strike, but it will be expensive despite offering me a lot of protection. I could go a lower but then if the stock falls I am going to have a larger loss on my trade. How do I decide what protective put to buy for my Collar Strategy?

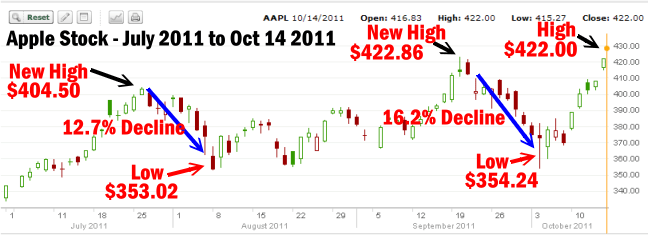

To set up my Collar Strategy, I look at the last few months to find the extents of the declines. In the case of Apple Stock, the first decline was 12.7% and the second was 16.2%. I then add then together and take the average. The average of the two declines works out to 14.45%.

I then take that loss and divide it in half. The total then is 7.22%.I would be willing to take a 7% loss in the stock. With the stock at $422.00 a 7% loss works out to $392.46. My Collar Strategy put strike then would be $392.00. As this is not available I would move to $390.00.

I then look to see how long did the two declines take. Both occurred over about two weeks. I know that I can buy a protective put 2 months out since I have a pretty good chance that any pullback shouldn’t last longer than that. If it does, then I would reassess my position in Apple Stock and if I still liked the stock, I would probably buy stock at a lower strike and again put in place a Collar Strategy.

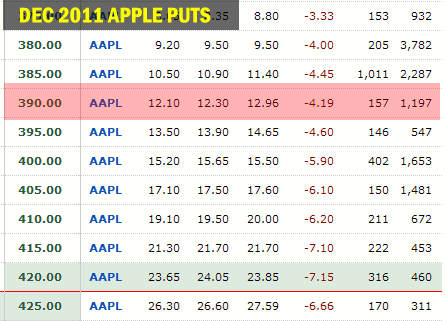

Above are the put options for Apple Stock for 17DEC11 expiry, a period of 61 days. The Collar Strategy parameters I established was for a put at $392.00. I therefore select the $390.00 for a cost of $12.30.

If I had bought the stock at the close on Friday Oct 14 2011 I would have paid 422.00. My new cost in the stock is $422 + 12.30 = $434.30. To break even on the trade the stock must get to 434.30 (all figures do not include commissions). On the downside since I paid $12.30, if the stock falls to $390.00 or lower, I will have a loss of $12.30 (cost for my put) plus $422.00 (paid for the Apple Stock share) minus $390.00 – my collar option put strike. Total loss would be $44.30 / 434.30 = 10.2% loss, if I decided to exercise and sell my stock at $390.00. Now I have in place my Collar Strategy. I cannot lose more than 10.2%.

But a 10.2% loss may be too great. To help defray the Collar Strategy cost and reduce any loss, I could consider selling a covered call.

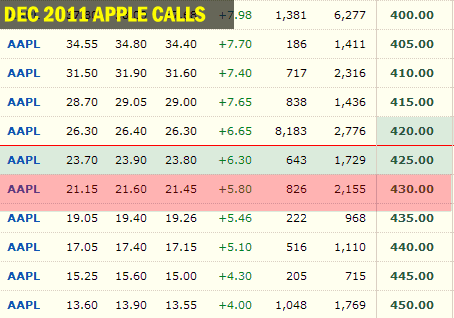

Below are the call options as of Oct 14 2011 for Dec 2011 Apple Stock. Which call option would you pick for your Collar Strategy? If you pick a strike that is fairly close to the present price, then you have locked in a small profit if the stock moves higher. If you pick a call option too high then you can’t cover the cost of the protective put for the Collar Strategy. Which is the best call strike to pick?

It comes down to your level of risk and outlook for the stock. Looking back above at the Apple Stock chart I can see that the latest run up in Apple stock was about 16%. For myself I would aim for 6% gain.

To do this the stock would have to climb from $422.00 to $447.32

The cost of my Collar Strategy put was $12.30. To cover the cost of the put and realize the 6% gain I could sell the $445.00 covered call strike for $15.25. My collar option put cost was $12.30, which leaves me with a credit of $2.95. If the stock reached $445.00 and I am exercised at $445.00, I will have made my 6% gain.

Collar Strategy Favorable Outcome:

Total cost of Apple shares: ($422.00)

Collar Option $390 put (12.30)

Covered Call $445.00 sold 15.25

Stock exercised at $445 445.00

Total Income Earned = $25.95 / $422 = 6.14% – Collar Strategy was successful.

If however the stock should sell off down to $390.00, here is the loss:

Collar Strategy Loss Outcome:

Total cost of Apple shares: ($422.00)

Collar Option $390 put (12.30)

Covered Call $445.00 sold 15.25

Stock exercised at $390 390.00

Total Income Earned = $29.05 / $422 = 6.9% – Collar Strategy held losses to 6.9%.

Select this collar strategy link to see the present options on Apple Stock.

Select this collar option link to see the present analysts outlook for Apple Stock.

Collar Strategy Summary of Collar Option 1

This is just a simple example of how an investor who is reasonably bullish on a stock but wants some protection could use the Collar Strategy to buy some fairly cheap insurance to protect himself against a large loss. For a stock such as Apple Stock, a loss of 6.9% is small considering the stock can easily move 3% in a day. Despite whatever stock an investor decides on, a Collar Strategy holds a lot of merit, especially in volatile markets like today’s.